Federal Reserve: Prudent patience

No change from the Federal Reserve as they emphasise they are in no hurry to raise interest rates. But if the data warrants it, and we think it will, they are prepared to tighten policy further later in the year

The Fed is in no hurry

The Federal Reserve has unanimously voted in favour of leaving the Fed funds target range at 2.25-2.5% and the clear message in the accompanying statement is that the Fed is on pause for some time to come. The key sentence was “the committee will be patient as it determines what future adjustments to the target rate” may be required. The statement also dropped the description that “some further gradual increases” in interest rates will be needed and have removed any reference to the balance of risks.

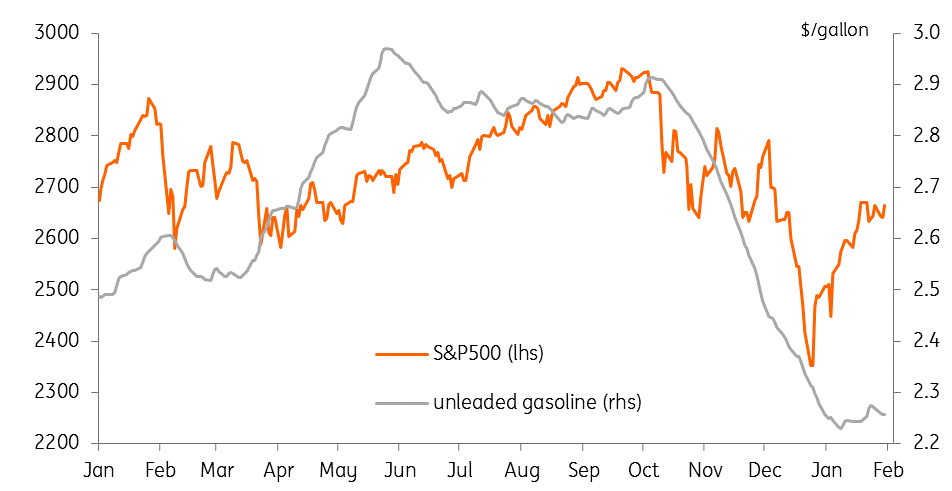

Certainly the unsettling effects of recent financial market volatility, trade uncertainty and the government shutdown give them clear reasons to adopt a wait-and-see stance. With inflation pressures described as “muted”, helped by the plunge in fuel costs, it looks as though it could be for quite a protracted period. Nonetheless, the economy is in decent shape with the jobs market described as “strong” and economic activity “solid”.

Back in December, the Federal Reserve indicated that it would slow the pace of rate hikes this year to probably two from the four 25bp moves seen in 2018. This still seems sensible to us, but the dovish tone in today’s FOMC statement hints at downside risks to this view. The US does face more economic headwinds this year: The lagged effects of higher interest rates, the strong dollar, the fading support from 2018’s fiscal stimulus and trade tensions at a time of weakening global activity all suggest that the US economy will experience slower growth in 2019.

But, there are clear positives too with a strong jobs market, rising pay, plunging energy costs boosting real incomes and a recovery in equities supporting sentiment. We also expect core inflation to continue grinding higher, rising above 2.5% by the early summer. As Jerome Powell stated in the press conference, they are data dependent and if the data warrants it, they will hike again.

The perfect combination - equities up, gasoline prices down...

A bias to hikes

In terms of the timing of the policy moves the government shutdown argues for caution in the near-term. It has been economically disruptive with the latest “polar vortex” potentially adding to the downside risks for 1Q GDP. There will also be questions over the quality of the data released for December and January given significant numbers of statisticians were furloughed. As such the Federal Reserve is unlikely to feel confident responding either way to these data, which offers further support to a wait-and-see stance

Taking it all together we are unlikely to see an interest rate rise in the first quarter, but we still think there is a decent chance of a move in June. If the strength of the US jobs market persists and wages keep rising the consumer side should help support growth and generate a little more inflation. Furthermore, if we can get some progress on US/China/EU trade relations that could help lift spirits, boosting business optimism, investment spending and the outlook for trade. So while the Fed is right to be patient for now, we still think they have more work to do.

Alternative options

We have to acknowledge the Federal Reserve does have other tools that it could use to adjust the monetary policy stance. Fed Governor Lael Brainard has suggested that raising countercyclical buffers is one way that could be used to tighten monetary conditions whilst also shoring up financial risks. However, this seems to have little broad support at this time, especially with the Fed in wait-and-see mode.

However, the more likely alternative appears to be that the Fed could accelerate (or decelerate) sales of its longer-dated Treasury holdings with the Fed commenting in a separate note that it is "prepared to adjust" balance sheet normalisation (both in size and composition) after agreeing to maintain the $50bn roll off per month. A potential inverted yield curve in the US is a challenge for the banking system since banks have long-dated assets and short-term liabilities and this environment would deter lending. Selling longer-dated Treasuries would re-steepen the curve, thereby putting up borrowing costs but taking some of the pressure off the financial system. However, with Fed Chair Jerome Powell saying it won't be used as an "active" tool, the Fed funds target rate will remain the main driver of policy.

Download

Download article

1 February 2019

In case you missed it: Goldilocks returns This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more