February US jobs report preview – was January a fluke?

Half a million jobs were added according the the January employment report, yet the raw data suggests it was more a case of warm weather reducing the ususal seasonal firings with favourable seasonal adjustments providing an additional boost. February is likely to revert to the 200k trend with downside risks for coming months as lay-offs rise

January jobs showed interest rates could stay higher for longer

The January jobs report was far stronger than expected and combined with the jump in retail sales and firm inflation data suggests that the economy is more resilient than thought. Comments from Fed officials became more hawkish in the wake of these reports and the market mindset firmly moved in the direction of interest rates needing to stay higher for longer.

We then shifted our view on the outlook for Federal Reserve monetary policy to be broadly in line with the market pricing of 25bp hikes at the March, May and June Federal Open Market Committee meetings. However, we continue to see the potential for interest rates cuts later in the year on the basis that the most aggressive series of interest rate increase for 40 years will increasingly weigh on activity and inflation. We also sense that that the data for January is not as strong as headlines suggest. This is particularly true of the jobs report.

Why was the jobs report so strong?

The blowout 517,000 jump in January payrolls caught everyone by surprise, coming in 200,000 higher than even the most optimistic forecasts out there. The unemployment was also better than predicted, falling to a 53-year low of 3.4%. The issue was it didn’t tally with any of the business surveys so to try to explain we looked at one-off factors that could have boosted the numbers.

The most obvious case is the 74,000 jump in government workers led by state and local government education workers. This was due to the ending of strike action by University of California Academics. This merely reverses job losses seen in November and December and means February will experience a return to much lower growth.

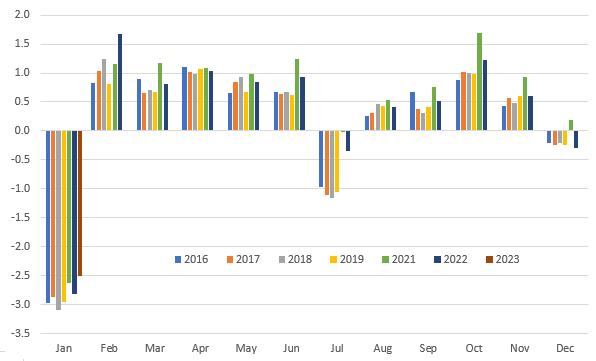

This does nothing to explain the strength in private payrolls though, which rose 443,000, so we looked at the raw data. The table below charts what has happened in each month for the past seven years (excluding 2020 where the pandemic disrupted the usual seasonal patterns).

Non-seasonally adjusted employment changes by months and year (millions of jobs)

This first thing to say is that the US economy certainly didn’t add 517,000 jobs in January. January is a month where millions of people lose their jobs. This is partly down to the end of the holiday season with people spending less on retail, leisure and hospitality with businesses typically laying off staff at this time. Then there is the weather impacting with winter temperatures and snow limiting the ability of people to work outside – so the likes of construction gets hit along with mining and oil and gas drilling.

Better weather and favourable seasonal adjustment factors

According to the National Oceanic and Atmospheric Administration, January 2023 was the sixth warmest on record and was the warmest on record for the most North Easterly states with fewer snow days than the average over the past 20 years. This meant construction, mining and drilling has been less disrupted and people were out and about more, spending money.

Typically, 2.7-3.1mn jobs are shed in January. This year there were only 2.5mn jobs lost in January, so fewer lay-offs, but not massively so. It is therefore likely that labour hoarding in the form of reduced seasonal layoffs post the holiday season was responsible for the strength, but 'generous' seasonal adjustment factors appear to have provided an additional boost to generate the seasonally adjusted 517,000 gain.

What about the February jobs report?

So far we have only had the ISM reports with the manufacturing index falling into contraction territory while the service index jumped four points to its highest level since December 2021. Nonetheless, the relationship month to month with payrolls has been poor. On Wednesday we will get the ADP private sector report, which the market expects to rise to 200,000, but remember that the 106,000 outcome for January gave very misleading signals. We will also get the job vacancy data from the JOLTS report for January, which is forecast to drop by more than 400k. This would still leave it pointing to far more job vacancies than there are Americans to fill them.

Given the mixed messaging we have pencilled in a 200,000 jobs gain for February but we have little confidence in that forecast given the seasonal adjustment factors and unusual weather patterns. The consensus remains tight with a range of 100,000-325,000 so there is the risk of another big miss, both to the upside and the downside.

Longer terms things are more challenging

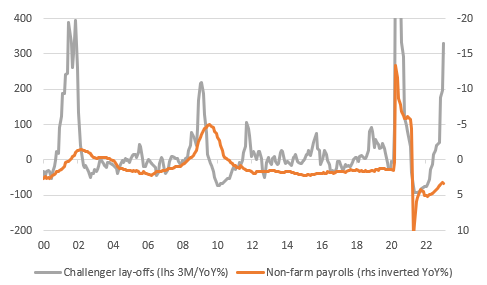

The outlook is deteriorating though. Job lay-off announcements are rising sharply with outplacement firm Challenger, Gray & Christmas reporting that lay-offs rose 440% YoY in January. The data is volatile, but if we take a 3M average of the annual rate we see that such big increases in lay-offs do typically result in employment growth eventually turning negative – the chart has employment on the right-hand scale inverted (orange line) so a movement higher implies weakening.

Challenger lay-offs and monthly changes in payrolls YoY%

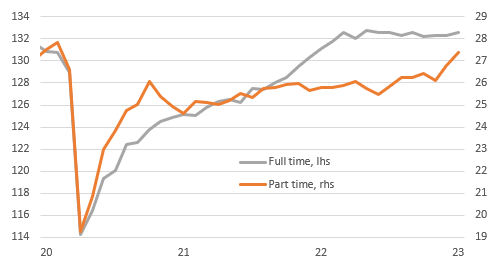

This tallies with the fact that full-time employment in America has flatlined since March 2022. All of the jobs created since then have been part-time, which does not paint the picture of a vibrant jobs market. Instead, when combined with the lay-off announcements it points to a jobs market that will increasingly lose higher paid, full-time positions only to replace them with lower paid less secure, part time work predominantly in the leisure and hospitality sector. We therefore need to be wary that while the headline jobs figure may look ok, the composition is likely to be deteriorating.

Full time versus part-time employment levels (mn)

Nonetheless, the headwinds for that sector are likely to intensify as well. The fact that interest rates have risen so far so fast is weighing on business sentiment. The Conference Board’s measure of CEO confidence is on a par with every recession over the past 40 years, which points to a more defensive mindset with a greater focus on cost control rather than business expansion.

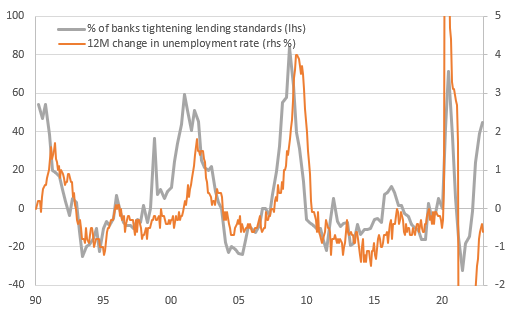

Lending conditions and higher borrowing costs will turn the screws on struggling companies

Compounding the problems is the fact we are also now seeing banks tighten their lending standards dramatically, meaning that not only is the cost of borrowing becoming more of an issue, but so too is access to borrowing. Companies and households that are already struggling will find themselves in an increasingly precarious position, especially with the Federal Reserve’s semi-annual monetary policy report emphasising that "a period of below trend growth and some softening of labor market conditions" is required to ensure inflation returns to 2%.

Banks tightening lending standards runs the risk of sharply higher unemployment

The chart above suggests that following such a sharp tightening of lending standards the unemployment rate has a tendency to climb around 9 months later. So, while for now there is optimism on the jobs market that is fueling expectations of interest rate increases, we see a clear risk that this environment changes over the summer months and our call for rate cuts before year-end starts to become more mainstream.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more