Eurozone: Waning confidence

While 2017 could be characterized as the year of “Europhoria”, 2018 has started on a somewhat more cautious footing

Confidence continues to slide in the Eurozone

Confidence has fallen for businesses in both manufacturing and services in March. Even though Trade Commissioner Malmstrom has arranged an exemption from the tariffs on steel and aluminium for the European Union for the moment, trade concerns seem to be an important driver of the moderating sentiment.

The question is how much this is going to impact activity in an economy that seems to be in stellar shape. While economic sentiment has been sliding in 1Q, output measures still indicate strong expansion. Even with lower confidence about future economic activity and moderating growth in new orders, economic growth has probably been strong in 1Q. We expect growth to have come in at 2.5% QoQ annualized.

But the outlook remains benign with strong 1Q growth

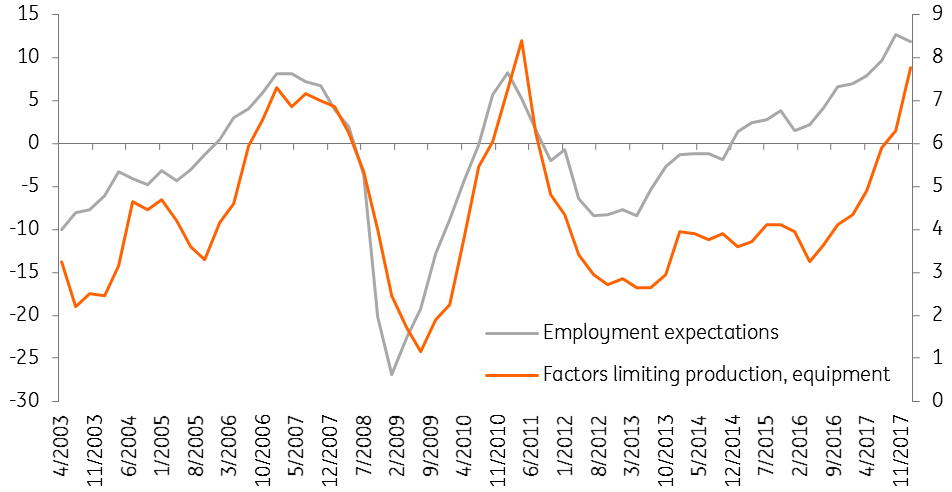

The outlook for domestic demand continues to be positive as the end of 2017 saw orders come in at such a fast pace that backlogs of work have become significant. Businesses indicate that almost four months of production are assured by current orders, which means that growth is set to remain above trend even if new orders are leveling off somewhat. And while employment expectations have been coming down, they continue to be near all-time highs. This supports consumption in the months ahead as household income improves.

Supply constraints also boost the investment outlook as capacity utilization is well above its long-term average and businesses are indicating that a lack of equipment hinders production. Still, as loan growth for non-financial corporates dropped from 3.4% to 3.1% YoY in February, investment growth could become somewhat more modest in the months ahead.

Capacity constraints support domestic demand…

Some growth moderation seems likely

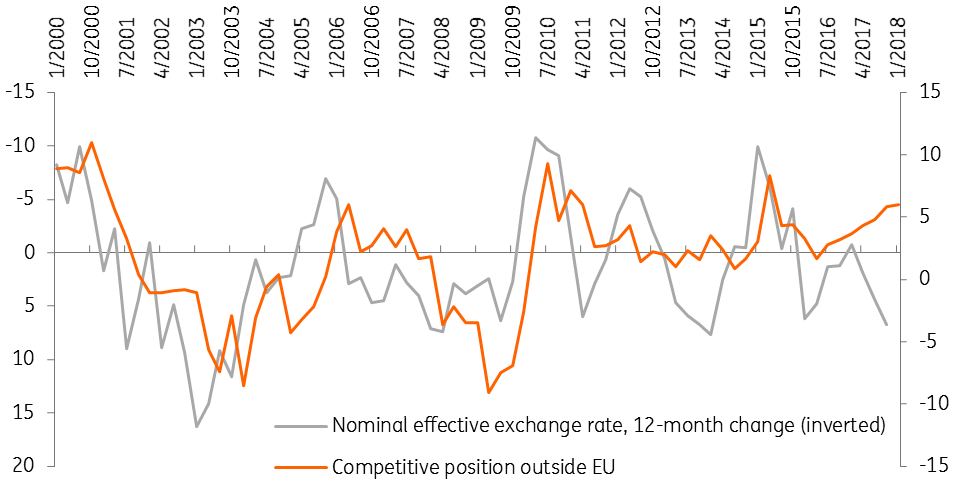

The big question mark is whether export growth can hold up. The continued euro strength has had little impact on export growth so far and businesses are not yet experiencing a decrease in global competitiveness. Even though exports dropped in January, annual growth of 9.1% outpaces import growth of 6.3% significantly. This January drop in orders New orders for exports are growing at just a slightly more modest pace, indicating that the trade environment has remained benign for now. Whether that remains the case if the EU becomes more involved in a global trade conflict is unlikely so uncertainty around the outlook for exports has increased.

All in all, the growth environment remains healthy, but with a few more ifs and butts attached to it. A slight slowdown in growth in the coming quarters therefore seems reasonable and we had already penciled this in. We therefore maintain our forecast of 2.4% GDP growth for the year.

…but can exports weather the storm?

Complacency about key reforms could also dampen confidence…

Some reservations about Europhoria might also stem from the political landscape. The German grand coalition will surely cause French president Macron to have a stable and willing partner towards more integration, but the question is whether that will also include reform of the monetary union which seems necessary in the long-run for Eurozone stability. Macron is currently focusing on structural reforms at home, pushing back the Eurozone topics on his political agenda. Given the sensitivity of the matter, agreement between European leaders could sooner be reached on matters like migration, defense and energy.

The stance of Italy in that will probably remain uncertain for a while to come. The elections have caused a scattered political landscape with a difficult and long formation ahead. With the populist Five Star movement and Lega as the biggest winners and no obvious coalition emerging, uncertainty about the Italian policy stance remain.

The ECB has taken out the easing bias But a lack of inflation leaves the governing council dovish

At the March meeting, the ECB again made a hawkish move while striking ever more dovish notes. The removal of the easing bias from the communication was downplayed by President Draghi, but was a significant change nonetheless and a clear preparation for the end of QE. The question remains when that is going to happen and even with the easing bias gone, the ECB does not seem to be in a hurry. They are more and more likely to extend QE further and even the toughest hawks seem to think so for the moment.

We maintain our call of an extension until the end of the year. Inflation data seems to support a more dovish stance for the moment, as core inflation failed to pick up in March despite an early Easter. This usually results in a calendar effect which boosts package holiday prices, but because of lower goods inflation that effect was undone. At 1%, core inflation has not increased since January.

An extension of QE therefore seems to be in the making

While pipeline pressures had been building over recent months, wage growth continues to be the missing link towards sustainably higher inflation. Even though we were already expecting just a modest pickup in core inflation, it looks like it could be even longer before price pressures start to materialize. This snail-pace improvement in inflation would be in line with a more dovish ECB as it moves towards normalization of its policy. With an extension of QE the most likely option now, that means that hawks are also pushing back expectations of the first rate hike. Bundesbank president Weidmann has expressed comfort with a hike in mid-2019, while Dutch Central Bank President Knot mentioned 2Q. If that is what the hawks think, we feel quite comfortable with the first deposit rate hike happening in June at the earliest.

This article is taken from ING's Monthly Economic Update, which you can find here.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more