Eurozone lending to businesses dips in April: not bad news

The lending dip probably does not reflect increased economic weakness. Rather, the contraction follows a surge in March. It is hard not to see a link with the TLTRO benchmark period that ended in March

April lending dip first and foremost a monetary phenomenon

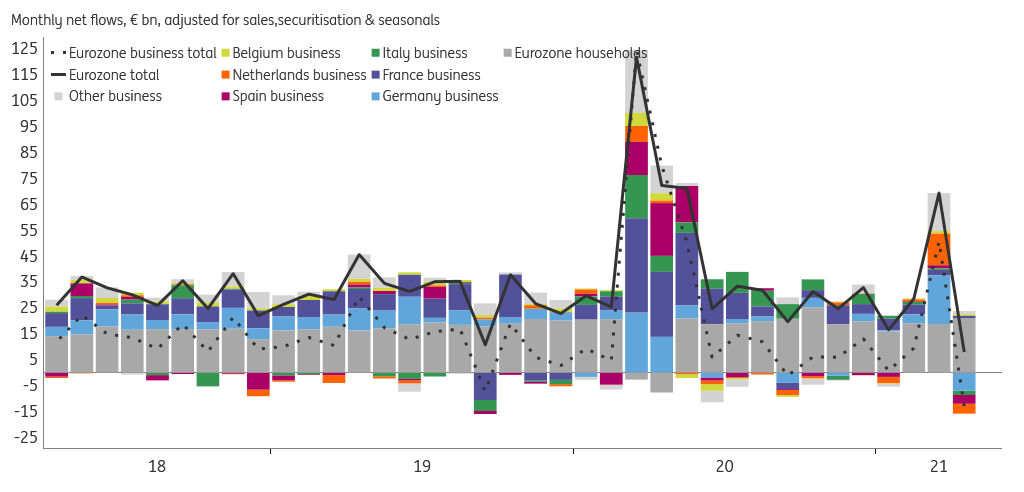

Eurozone bank lending to businesses contracted by €12.9bn in April (seasonally adjusted), after a March surge of €50.5bn. It is hard to explain this contraction by a changed economic dynamic in April. Rather, we consider the March surge as an effort by banks to clear the benchmark lending hurdle posed by the ECB's Targeted Longer-term Refinancing Operations (TLTRO). Doing so entitles banks to a better rate on their TLTRO borrowing in the June 2020-June 2021 period. The March lending surge likely represents lending that would otherwise have taken place in April and beyond, thus explaining the April dip, and suggesting that May could be weak as well.

Corroborating the idea that this was mostly about TLTRO, is the fact that April lending to business was especially weak in countries where it was strong in March: Germany and the Netherlands, and to a lesser extent also Spain and Italy. French bank lending managed to stay positive, though by a much smaller number than what we've seen in recent months. Meanwhile, lending to Eurozone households remains stable, with mortgage lending as the reliable engine of growth.

Eurozone bank lending to households and non-financial businesses

ECB bond buying continues to drive deposit inflows

Meanwhile, bank deposit inflows remain slightly elevated compared to the pre-pandemic period. Bank lending has retreated as a source of deposit inflows (bank deposits are created simultaneously when a bank lends, and destroyed when a bank is repaid). Yet ongoing government support to locked down economies, financed indirectly by ECB government bond buying, continues to generate deposit inflows – see our "Money Trumpet" for an explanation of this mechanism.

Eurozone bank deposits by households and non-financial businesses

Ignore the weakening of year-on-year monetary growth figures

By the way, don't be fooled by the decline in annual money growth figures as reported e.g. by the ECB monetary developments press release (from 12.3% in February to 9.2% in April). That decline is purely a "base effect": high-growth figures in March-May last year are currently dropping out of the year-on-year calculation, causing a mechanical decline in the growth figure reported. This decline means exactly nothing for current money growth or any inflation pressures generated by them. Similarly the sharp drop in loans to business from 7.0% year-on-year in February to 3.3% in April, is driven mostly by base effects. In reality, both lending and deposit growth have been fairly stable since June last year, with the lending peak-through movement in March-April related to TLTRO, as discussed above.

Cumulative TLTRO-eligible bank net lending growth since October 2020 (%)

Spain faces the biggest challenge meeting the TLTRO lending benchmark

While March marked the end of the "special reference" TLTRO benchmark period, we are already well underway in the "additional special reference" benchmark period, running from October 2020 until December this year. Lending performance in this "additional" period determines the rate banks will be getting on their TLTRO borrowing from June this year until June 2022. The April lending dip means a setback in lending performance against the benchmark for most countries, although most countries remain above the benchmark (see chart above). Spanish banks continue to have the biggest challenge meeting their lending benchmark. Yet December is some time off, and in the meantime we will most likely see the lifting of lockdowns, which should support credit demand.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).