France: Emmanuel Macron 2.0

After a difficult summer which saw his approval ratings plummet, President Macron is starting his second year in a weaker position. If the number of ambitious reforms on the agenda are as high as the last, the French economy will be less supportive. We forecast GDP growth of 1.8% this year, a notch below 2017’s 2.0%

Back to school

President Macron started his year by attending a class in a primary school which benefitted from one of his key first-year reforms, limiting the number of pupils per class for children aged five to six.

If past reforms have been slowly digested, President Macron now seems stuck in moving sands: isolated on the European scene while he made it a key reform area, affected in the polls by the judiciary troubles of one of his security guards, and losing two of his most popular ministers.

It seems that Mr Macron has slightly changed his ways, favouring a less “Jupiterian” approach to domestic politics and consulting more widely both with his ministers and social partners

His approval ratings have declined from 40% to 32% in the Ipsos political barometer between April and September. The departure of Nicolas Hulot, the French environment minister, could affect this approval rating further as the reason for his departure has to do with the very reason why Mr. Macron was elected, namely to prove that France can be reformed. If his most popular minister doesn't believe it anymore, it's hard to say that the second year of Macron's presidency has begun well.

Nevertheless, it'll be a busy year with several wide-ranging reforms scheduled, notably for unemployment benefits and pension regimes and the headcount cuts in the administration.

On the European side, he'll have to deal with the risk of a no-deal Brexit, with strong political opposition to his Eurozone reinforcement project and a potential political crisis with Italian populists in the European election campaign.

It seems that Mr Macron has slightly changed his ways, favouring a less “Jupiterian” approach to domestic politics and consulting more widely both with his ministers and social partners. This seems like an absolute minimum to regain approval and avoid a political meltdown at the European elections which are going to be a strong political test in May 2019 and for which the President’s party needs allies that have so far proven hard to find on the French political scene.

So far, the macroeconomic context of 2018 hasn't helped much. However, confidence and activity surveys show that there could be an uptick in the coming months and we think that the economic context should slowly be more supportive, before turning again at the end of 2019.

| 1.8% |

French GDP growth in 2018, lower than in 2017ING forecast |

Domestic demand has disappointed in the first half

In the first half of 2018, domestic demand was affected by higher oil prices (+35% year on year) and weeks of strikes in the transportation sector. In 2Q18, private consumption declined by 0.1% quarter on quarter for the first time since 3Q16.

Moreover, despite incredibly low-interest rates, consumers also refrained from buying more new houses as investment declined (by 0.1% QoQ) for the first time since mid-2015. This affected total investment growth, which wasn't supported much by businesses either. Indeed, corporate investment rebounded less than expected, by 1.1% QoQ after the dismal 0.1% registered in the first quarter, widening the gap with very high capacity utilisation rates (85.3% in the industry in 2Q18, the highest in ten years).

Even taking into account a rebound of activity in the second half of the year, the unexpectedly weak first half will drive GDP growth below 2% this year.

But several indicators remain supportive

Looking at business investment, most surveys continue to point to several quarters of growth. PMI data shows confidence remained broadly stable in both the manufacturing and service sector throughout the summer. In the industry, business confidence has been stable since February at 110, slightly below its level of the end of 2017 and capacity utilisation is at record highs. This should drive corporate investments up in the second half of the year. That said, we are not overly optimistic either.

We believe that after four good quarters, the outlook will be less supportive after mid-2019. We are not at the end of the cycle yet, but the countdown has begun

First, data from both July and August shows manufacturing companies are losing confidence in the general outlook (this component is at a 15- month low). This could be because order books, which had been filling up in the first half of the year, turned around in June while inventories, have been increasing since April and were in August at a two-year high. This is likely to continue leading to a stabilisation in industrial production in coming months, as already shown in industrial production figures since May: production growth has stabilised just below 2% YoY, far from its 4Q17 peak. Although the overall picture remains positive for investments, for the time being, it, therefore, seems that dark clouds are gathering overactivity in the manufacturing sector and that it is only a matter of time for confidence to decline again.

Second, in the service sector, confidence has been stable since April, and the August survey even brought some positive aspects: hiring intentions have rebounded, as well as the perceived pricing power. Recent investments have also been higher than expected. However, activity remains low in comparison with the end of 2017, so that investment intentions declined slightly in August. They remain high and consistent with an investment rebound in the second half of the year, but it could be short-lived.

Looking at housing investments, we noticed the drop in the second quarter. However, confidence surveys in the building sector show that the building sector remains the bright spot of confidence for the time being: capacity utilisation reached 90% for the first time this decade in June and hiring intentions remain elevated. Only the expected activity volume in new dwellings declined in August, despite very high order books. If there is a drop in demand, it cannot be seen in activity indicators yet. As interest rates remain low, we continue to believe in a strong rebound of households’ investments in 18Q3.

Activity in the service sector still points to above potential GDP growth

Private consumption will remain subdued

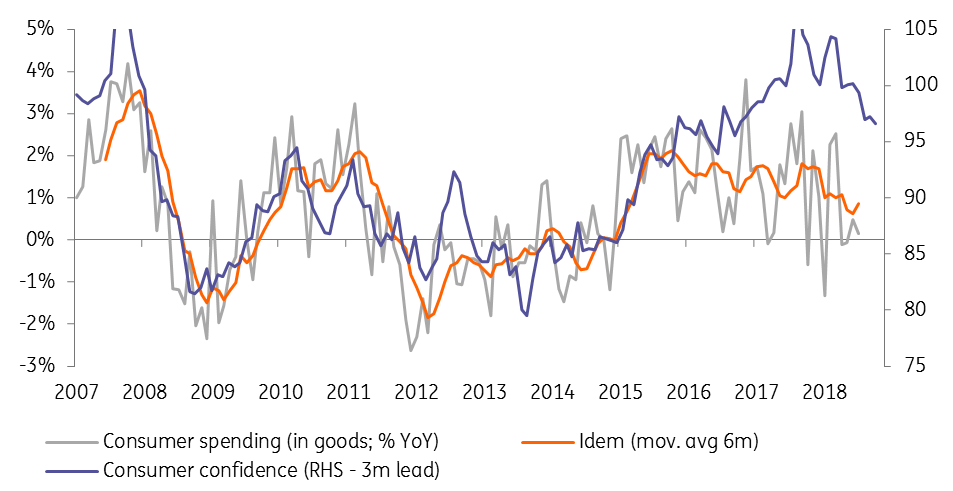

Investment growth should, therefore, reach 3.2% in 2018, lower than the 4.7% reached in 2017, but still on the recovery track. On the private consumption side, however, things are different. Household spending increased by a limited 0.2% MoM in July. Spending growth is still below 1% on the year. Looking at the long-term trend, it seems that spending growth has been declining slightly since mid-2015 despite improvements in consumer confidence. Indeed, consumer confidence was at 96.6 in August, which is consistent with a spending growth of almost 2% a year.

What the surveys are showing, however, is that the trend in consumer confidence is now down. If 96.6 remains at a higher level than in any month between 2015 and 2016, it is has been on a downward trend since December 2017 (104.3). Looking at the components, it appears that households are more positive about their savings now than in December, but this further improvement has been counterbalanced by a returning pessimism about the economic outlook and, since June, a return of unemployment fears.

The latter comes from the fact that the unemployed population has increased almost every month since March despite higher hiring intentions and a labour market reform (even the effect of ending subsidized contracts has abated since June). In the service sector, for example, the last PMI surveys showed that the improvements in the unemployment rate noticed in recent quarters could pause unless more demand is generated. Employment growth is weak by any measure. Even if this should allow the unemployment rate to fall below 9% in the second half of the year, we do not think that it will be sufficient to support strongly consumer confidence.

With the only improvements in confidence pointing to higher savings rather than spending, we think that the rebound expected in the third quarter in private consumption (+0.7% QoQ) will be short-lived, leaving private consumption growth a notch lower in 2018 than in 2017 (1.0% after 1.1% last year).

Confidence on a downward trend again, but still high compared to actual spending

External demand has improved

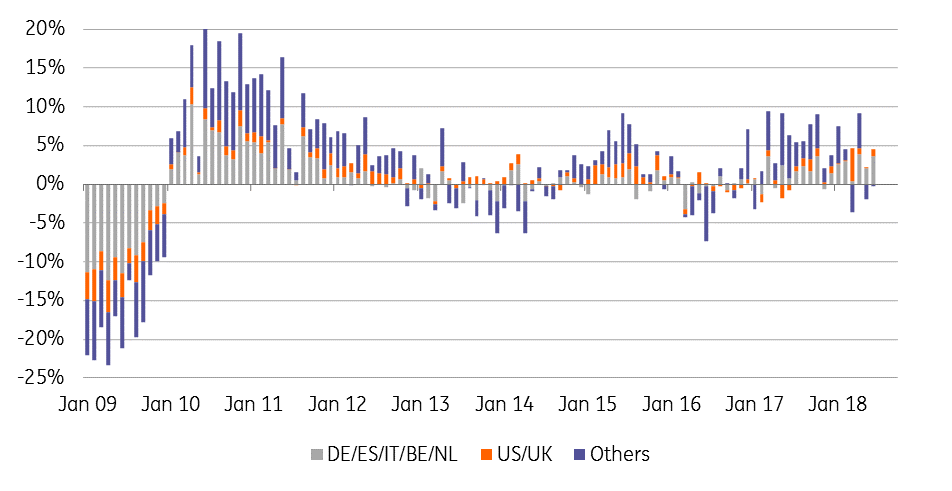

Net exports are usually not the brightest spot in French growth reports. However, it could add 0.2pp to growth this year.

Despite the fear of trade wars and the slowdown of Eurozone demand, exports rebounded by 0.6% in the second quarter. In 2018, export growth should be above 4% (after 4.7% in 2017) while a weak private consumption should dampen imports. We expect the weak euro to continue supporting this dynamic in the second half of the year while next year will mostly depend on the Brexit situation. Finally, let’s note that the French automotive sector is less exposed to the risk of trade tariffs from the Trump administration as only 1.6% of the automobile sector value added is linked to car exports to the US (versus 8.6% for Germany).

France: export growth contributions per geographic zone

We expect growth to reach 1.8% in 2018

The second half of the year should be more supportive of President Macron’s reforms. But a number of external risks remain including a somewhat weaker Eurozone demand, Brexit turbulence which could impact exports to the UK (6.5% of total exports) and, finally, a stronger euro stemming from a tightening monetary policy in 2019.

This is why we believe that after four good quarters, the outlook will be less supportive after mid-2019. We are not at the end of the cycle yet, but the countdown has begun.

And this won't allow the French deficit to fully comply with Brussels

With 1.8% of GDP growth expected in both 2018 and 2019 and still a lot of uncertainties around how the President intends to lower public expenditures from 57% to 54% of GDP by 2020, doubts subsist in Brussels around France’s capacity to get its public debt in order.

Especially, the railway reform implies that the French railway network debt has been included in gross public debt computations (the 35 billion euros amounted to a 1.3pp increase to 98.5%, recently made public by INSEE). With the government projection now down to 1.7% in 2018, the deficit to GDP forecast has been revised upwards, from 2.3% to 2.6%. The railway reform will not directly affect the budget deficit this year but will nevertheless add at least 0.1pp to budget deficits after 2019, until the railway network decreases its own financing needs. Moreover, the 2019 deficit will again be closer to the 3% limit in terms of GDP as some temporary corporate tax credits will become permanent expenditures.

If President Macron wants to gather more consensus around his ambitious Eurozone plans, he has to show more clarity on how France is doing its homework. The 2019 budget that will be presented in Brussels next month will show a budget deficit below the 3% of GDP threshold and a stabilising gross debt (just below 100%), but we expect the European Commission to point to the weak progress made in terms of the structural deficit. France is out of the excessive deficit procedure, but for how long?

French economy in a nutshell (% YoY)

Download

Download article17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).