The eurozone’s flying on one engine

The eurozone expansion is now solely being fuelled by a strong services sector, but tighter monetary policy is likely to bring the economy to a standstill in the second half of the year. While inflation is trending downwards and bank credit standards are tightening, the European Central Bank is likely to hike interest rates at least one more time

A disappointing first quarter

First estimates show that the eurozone grew by 0.1% in the first quarter. A disappointing stagnation in Germany and another freak figure for Ireland (which is prone to revision) offset decent growth figures in most other member states. However, many countervailing factors continue to muddle the growth outlook.

The tailwind created by the significant drop in natural gas prices is likely to be countered by diminishing fiscal support and tighter monetary policy. And while supply-side issues in industry have now been resolved, an inventory overhang and weak new orders are putting a lid on output growth.

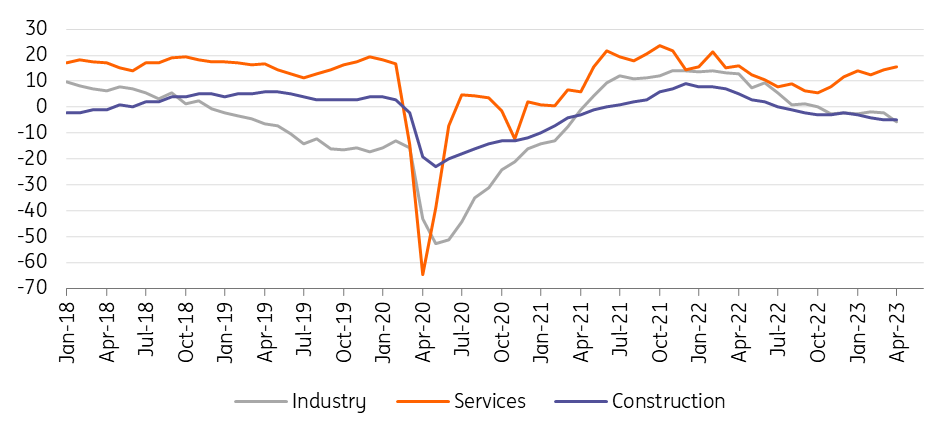

Recovering growth in China could be a boon for European exports, though the fear is that this will be offset by the looming recession in the US. The strong decline in German industrial production in March is a warning sign, and sentiment indicators for April show that the eurozone industry weakened further in the first month of the second quarter. Both order books and export orders softened in April, which doesn’t bode well for the months ahead. Meanwhile, order books in the interest rate-sensitive construction sector also deteriorated in April, for the fourth month in a row.

Order book or future demand assessment

Services save the day

If it weren’t for services, we would probably already have to start thinking about a recession. To some extent, consumers are still in a post-Covid mood, spending essentially on services rather than on goods. Retail sales turned out to be very weak in March. But the assessment of demand in the services sector is significantly above its long-term average. And expected services demand for the months ahead rose for the second month in a row in April. So, for the time being, growth hinges essentially on the consumer.

Purchasing power is improving on the back of higher wages and falling energy prices. But at the same time, cracks are starting to show in the labour market. Unemployment is still very low and with the structural tightness of the labour market, a strong increase in unemployment looks unlikely. At the same time, hiring intentions are weakening. This might ultimately lead the consumer to become a bit more cautious in spending, halting the decline in the savings ratio. This will probably weigh on activity in the second half of the year. For the year, 0.8% GDP growth should still be feasible, but starting from a lower base, we now only pencil in 0.6% growth for 2023, way below official forecasts.

Expected selling prices

Inflation is stubborn, but will come down

According to the flash estimate, headline inflation rose to 7% year-on-year in April, though core inflation fell to 5.6%. However, the underlying trend in core inflation (3M on 3M change, annualised) accelerated to 6.1%. These are not figures that will convince the ECB that inflation is under control. That said, disinflationary forces in manufacturing will get stronger – expectations for selling prices fell back in April to the lowest level since the start of 2021. And while they are still high in the services sector, they have also been coming down for three consecutive months. That said, it might take until the second half of the year before service price inflation starts to drop significantly. The bottom line is that we expect the downward trend in inflation to continue, although core inflation is still likely to hover around 5% in the second quarter.

Monetary transmission in full force

As the dynamics of core inflation is one of the three factors that will drive monetary policy, according to ECB President Christine Lagarde, the ECB cannot rest on its laurels just yet. The ECB still projects inflation to remain “too high for too long”. On the other hand, it is also clear that the monetary transmission mechanism is now working in full force.

Banks tightened credit standards the most since the financial crisis and in the first quarter credit demand was much weaker than anticipated, according to the Bank Lending Survey. M1 growth, which has been a good leading indicator in the past, fell 4.2% year-on-year in March. Another 25bp rate hike in June looks like a done deal. It remains a close call, but we cannot exclude a last 25bp rate hike in July too. In any case, a long pause is likely to follow from the second half of the year onwards. Given the likelihood of significant US monetary easing before the end of the year, we now anticipate the first ECB rate cut in the second quarter of 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 May 2023

ING Monthly: We’re in a polycrisis – and this is what it means This bundle contains 16 Articles