Eurozone exports to the rescue

Exports of goods have seen a surprisingly fast recovery over the course of 2020. A more challenging environment awaits for 2021 but we do expect the recovery to continue

The second wave of the coronavirus has had a much more limited effect on economic output than the first. This is related to several factors of which a very important one is that the rest of the world is much more open than in the first wave. That has boosted eurozone exports of goods significantly, to the point where they have almost reached pre-crisis levels again. As exports have become a key part of the manufacturing recovery and eurozone lockdowns have been extended well into the first quarter, a lot is riding on export strength to mitigate the service sector losses. In this note we focus on the drivers of the recovery and whether that can be maintained.

The global recovery is key for eurozone export growth

With restrictions on services still in place in many countries and savings running high, consumers globally have turned to spending on goods. The recovery in exports of goods has therefore been much quicker than in previous crises as the gap with pre-pandemic levels has almost been closed already. With demand in eurozone economies more limited by restrictions than outside the region, the intra-eurozone trade recovery has levelled off more during the second wave.

Eurozone exports continue to recover quickly, while intra-eurozone trade has levelled off

As the recovery of global demand plays a key role in export improvement, it should come as no surprise that China has been a stronghold for the eurozone's external demand. Chinese demand for eurozone goods recovered rapidly after last February's lockdown, returning to pre-crisis levels in June and currently around 15% higher. The UK has also been an important driver of recovering eurozone exports, although that recovery has been driven in part by frontloading exports ahead of the end of the transition period between the EU and UK, therefore driving up demand in 4Q that will be missing in 1Q.

China remains the stronghold for eurozone exports

The rest of the EU has also been important in the eurozone export recovery. Poland, Sweden and Denmark have already seen demand for eurozone goods recover fully, while the Czech Republic, Hungary and Romania are almost there. Among other large trading partners, the US is also an important one to watch. The recovery of US demand for eurozone products had been weak at the start of the recovery and has been trailing other large export partners. With income support likely to be substantial for 2021, there is room for improvement in terms of consumer goods exports, which would support a further recovery of eurozone exports moving forward.

What are they buying?

The recovery has been led by a few large export categories. The categories that have seen exports recover fully again are cars and processed industrial supplies, which are intermediate goods. The strong recovery of car sales shows that durable consumption has done well on the back of excess savings in the global economy. European car exporters are well positioned to profit from that. The strong improvement in processed industrial supplies results from production resuming quickly, which has caused strong demand for intermediate goods to return.

Food and non-durable consumer goods are already above pre-crisis export levels, which is remarkable as non-durable consumer goods exporters have been pessimistic about order books in recent months. Among the weaker performing exports are semi-durable goods and industrial transport equipment, both still well below pre-crisis levels in terms of export performance.

Medical supplies globally have risen substantially as a share of world trade, but in the eurozone, exports of Covid-19 related medical products have fallen back to normal levels after an initial surge during the first wave. While this supported exports during the largest drop over the course of the spring lockdowns, it is not currently playing much of a role in the recovery.

With the euro trending higher, could the recovery be derailed?

Now that we’re back on track, the euro has been appreciating against currencies of major trade partners. A significant strengthening of the currency since the summer has resulted in caution and concern at the European Central Bank, as this could slow inflation and weaken the competitive position of eurozone exporters, in turn slowing the recovery. So far, this has not thrown a spanner in the works. Of course, competitiveness is not only determined by currency strength or weakness and for now, the strong recovery of demand has been the dominant theme as demand has returned.

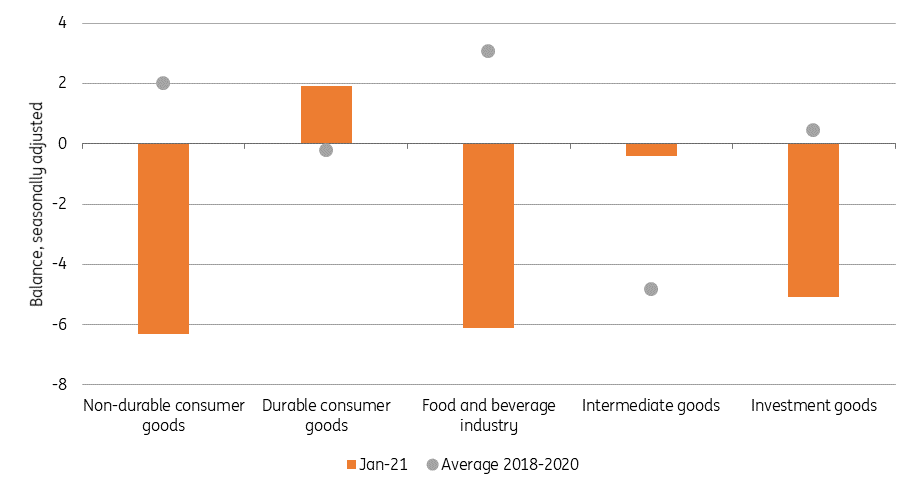

Stronger euro or not, eurozone businesses are already somewhat downbeat about their competitive position outside the EU. Compared to the pre-crisis situation, producers of non-durable consumer goods are particularly concerned. Only producers of intermediate goods and durable consumer goods have seen their competitive position really improve. That means that once initial pandemic recovery effects fade, the pace of growth in exports could slow given tougher global competition. In that environment, a stronger euro will not help.

The competitive position of eurozone companies outside the EU has deteriorated

For 1Q, expect a more subdued export environment, but order books remain strong

The fast recovery in the fourth quarter was inflated by UK hoarding, which we expect to reverse in 1Q, and the underlying pace of recovery has already weakened. With UK checks only starting in April and full border checks coming in July from both sides, there are still many hurdles to overcome for eurozone exports to the UK in 2021.

Other than the specific UK issues, other factors will also curb export growth moving forward. Supply chain problems have become more pressing in recent months, which could curb volumes somewhat. And businesses are reporting concerns about global competitiveness, not helped by a stronger euro. Also, once service sectors reopen, uncertainty remains about whether durable consumer goods will remain as attractive globally.

Don’t let that bring you down though. Export order books remain relatively full and businesses are optimistic about future production. Outside of China, we do expect many of the largest eurozone export partners to see domestic demand accelerate over the course of the year when economies can open up more sustainably. So while there are definitely concerns on the horizon for exporters, and 1Q is likely to see a more subdued export performance, expectations of a continued export recovery still stand for 2021.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more