The eurozone’s last hurrah before recession bites

The eurozone economy expanded in the third quarter, but most recent data suggests that the recession has already started. Double-digit inflation is keeping the ECB in tightening mode, though substantial progress has been made in withdrawing stimulus. That means we're unlikely to see any more rate hikes after February next year

Growth surprises positively in the third quarter

The eurozone registered an unexpected 0.2% Quarter-on-Quarter expansion in the third quarter. Not surprisingly Spain, Italy and France did see growth on the back of a good tourism season, but Germany also performed much better than expected with 0.3% QoQ growth. However, it is striking to see that economic data has started to deteriorate strongly after the summer holidays.

The eurozone composite PMI flash estimate fell to a lower-than-expected 47.1 in October. This is just a near 2-year low but also the fourth consecutive month that the PMI is hovering below the 50 boom-or-bust levels, clearly suggesting negative GDP growth. We get the same story from the European Commission’s economic sentiment indicator: it fell in October for the eighth month in a row to the lowest level since November 2020. The forward-looking components of the business surveys such as hiring intentions and new orders are heading south, a signal that the downturn is likely to intensify in the coming months.

Consumption is softening

Consumption is likely to cave in

Admittedly, consumer confidence improved slightly in October, but it remains close to the historical low reached in September. As households are expecting higher unemployment in the next 12 months, their intentions to make major purchases, renovate their homes or purchase a house, are all at very low levels. This strong cooling of consumption is also seen in high-frequency data such as hotel bookings, which are showing a post-summer dip.

To be sure, in most countries there is budgetary support to alleviate the energy bills, but we don’t expect this to be sufficient to generate positive consumption growth in the coming quarters. With the significant rise in interest rates, accompanied by tighter credit standards, the real estate market is starting to cool rapidly in several countries, putting downward pressure on house prices. This is likely to impact construction activity negatively over the coming year.

We're reiterating our forecast of a GDP contraction in the fourth quarter of this year and in the first of 2023. But there's more. The ECB's current tightening policies and the still difficult energy transition away from Russian gas will restrain the recovery thereafter. On the back of the better third-quarter numbers, we've revised our 2022 eurozone growth forecast up to 3.1%. For 2023 we are now pencilling in -0.7% growth and for 2024 1.3%.

Horror inflation

The October inflation data, published on Halloween, was another shocker: 10.7% headline inflation and 5.0% core inflation. The good news is that upstream in the supply chain there finally seems to be some moderation in price pressures. Supply chain delays eased to the lowest level for over two years, with shipping and material prices now clearly coming down.

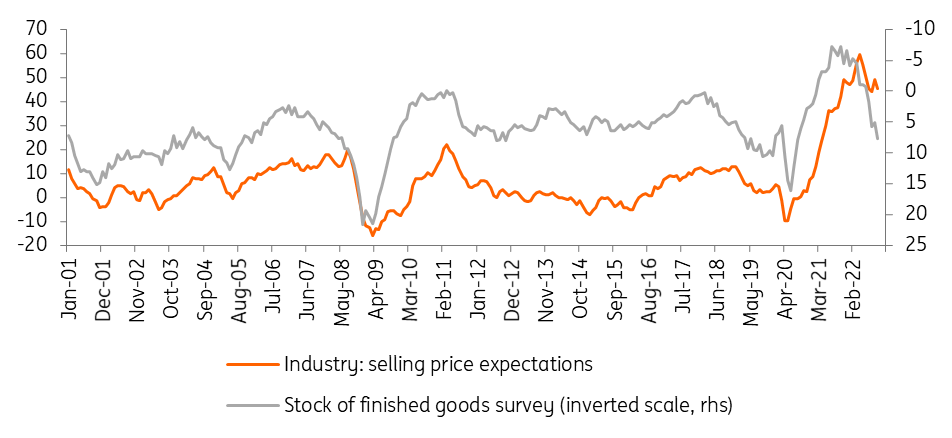

With inventories of finished products rising rapidly, pricing power is also likely to wane. On the back of the mild October weather, natural gas prices have also softened significantly, though we expect prices to rise again over the coming months when more normal winter temperatures set in. But even then, the contribution of energy to headline inflation is likely to diminish gradually. For 2022 we are now looking at 8.4% inflation and for next year, 5.6%.

High inventories are likely to depress pricing power

Substantial progress in withdrawing stimulus

The European Central Bank no longer dismisses the possibility of a recession, though we will have to wait for the December staff forecasts to know whether it will become the base case. For the time being the bank is still in tightening mode. But at the same time, it acknowledges that substantial progress has been made in withdrawing monetary stimulus. While the Bank's president, Christine Lagarde, didn’t want to put a figure on the neutral or the terminal interest rate during the press conference after the last rate hike, Banque de France President, Villeroy de Galhau, stated on several occasions that the neutral nominal interest rate is believed to be close to 2%.

We, therefore, maintain our forecast of a deposit rate of 2% in December and a final rate hike of 25bp in February. The ECB is also likely to announce the conditions that will trigger the start of Quantitative Tightening. We believe that it will begin in the second quarter of 2023 at the earliest, basically through no longer fully reinvesting the Asset Purchase Programme portfolio. This will only have a minor impact on excess liquidity and bond yields next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 November 2022

ING’s November Monthly: The long wait for the pivot This bundle contains 14 Articles