Europe exits winter with record gas storage

European gas prices are likely to remain under pressure with the region having exited the 2023/24 heating season with record storage. Despite a comfortable US market, we expect the US natural gas balance to tighten with flat supply growth and stronger demand

European gas storage more comfortable than expected

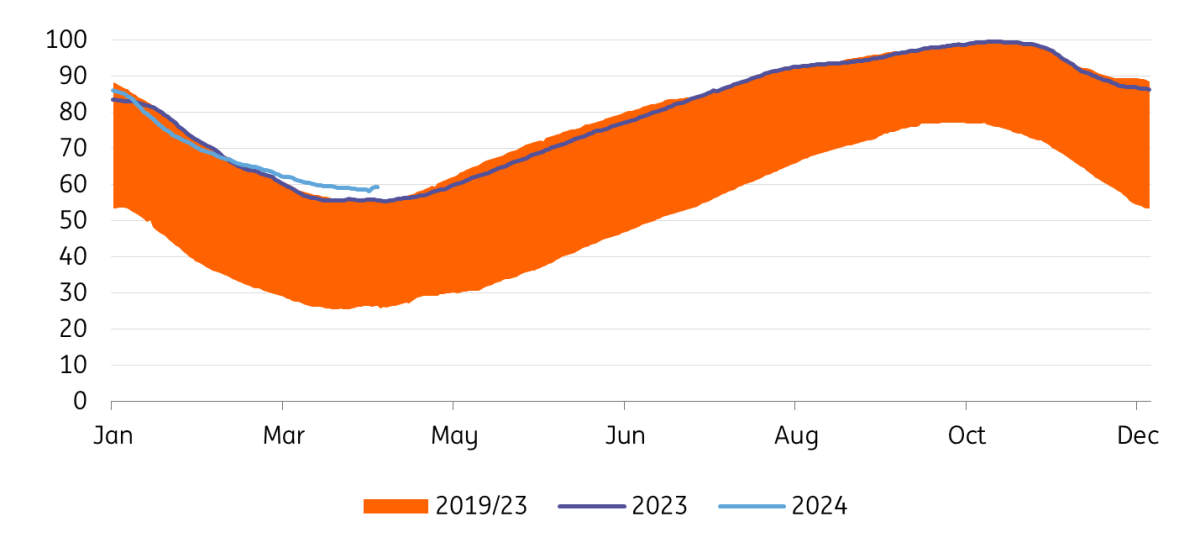

The 2023/24 northern hemisphere heating season has officially come to an end. Europe has managed to get through the winter months with very comfortable storage levels. In fact, with storage 58% full at the end of March, the region has exited the heating season with record high storage levels. Milder than usual weather through much of February and large parts of March has meant that the drawdown in storage has been somewhat less than expected.

While there is the potential for cold spells through April which could see some further storage draws, the forecast for the next two weeks in Northwest Europe is for milder than usual weather. In fact, storage has already started to edge higher in early April.

Therefore, the region is on a strong footing going into the injection season, which should make the job of refilling storage manageable. We once again expect European storage to be 100% full ahead of next winter.

Comfortable storage levels suggest that upside in prices through the year is likely capped (in the absence of any supply shocks, that is). Hitting full storage before the start of next winter mean that prices could come under further downward pressure over the course of the third quarter. As a result, we have left our TTF forecast unchanged at EUR25/MWh for both the second and third quarter of this year.

We believe that our fourth quarter forecast of EUR35/MWh is looking increasingly unlikely, with a more comfortable than expected market and improved LNG supply later this year. However, the potential for Russian pipeline flows through Ukraine being halted at the end of the year leaves us reluctant to revise this forecast lower at the moment. Fundamentally, Europe should be able to manage without this gas, although the market is still likely to react.

Europe exits winter with record storage (% full)

Steady gas flows to Europe

There has been little in the way of significant disruptions to pipeline gas flows to Europe through the winter, which would have helped ease concerns over the higher demand winter months.

Norwegian gas flows into the EU totalled around 23bcm in the first quarter of 2024, up from around 22.4bcm over the same period last year. While there have been some unplanned outages in Norway in the first quarter of this year, these have been relatively small in nature as well as short-lived.

Russian pipeline flows have been strong year-on-year, both via Ukraine as well as through TurkStream. Volumes via both routes totalled around 7.1bcm over the first quarter of 2024, up from around 4.1bcm for the same period last year. This is a continuation of a trend we have seen since the fourth quarter of 2023, with stronger flows via both routes.

However, Russian flows have still fallen significantly from pre-war levels, so the impact from a stoppage in remaining flows would be less significant. Although clearly, the market would still react to supply losses – just not anywhere near to the extent we saw during the peak of the energy crisis.

Disruptions to remaining Russian pipeline flows is a very real risk. Gazprom’s transit deal expires at the end of this year and Ukraine has made it clear it has no plans to extend the deal. This puts around 50% of remaining Russian pipeline flows at risk. Although, Russia may try push larger volumes through TurkStream. Either way, we expect any potential losses from Russia to be manageable for Europe, given the ramping up of new LNG export capacity later this year and into 2025.

North African pipeline flows have been relatively stable on a year-on-year basis with flows in the first quarter of this year totalling 7.3bcm, down just 1% year-on-year.

Azerbaijan flows have also been steady through this period, totalling 2.8bcm over the quarter compared to 2.7bcm for the same period last year. We do not expect to see any significant changes in these flows through the year.

Given the comfortable storage situation in Europe, there has not been a strong pull on LNG in recent months. According to Refinitiv data, LNG imports into the EU over 2024's first quarter totalled just over 31bcm, down from a little over 32bcm for the same period last year. It shouldn’t be too surprising that the US makes up the bulk of these imports, with 50% of flows originating from the US. The US share in EU imports has grown from around 42% for the same period last year.

Meanwhile, the EU’s dependence on Russian LNG has also grown. Russia made up around 20% of total EU LNG imports in the first quarter, up from around 17% for the same period in 2023. Pressure is growing from within the European Commission towards players to reduce Russian LNG imports, and it would appear it is only a matter of time before the EU bans Russian LNG. Global LNG supply in 2025 is set to increase with the ramping up of new export capacity, which could make the European Commission feel more comfortable about possibly banning Russian LNG.

European gas demand starting to recover

European gas demand is still struggling to make a strong recovery despite the broader weakness seen in European gas prices. EU gas demand in 2023 totalled a little over 330bcm, down 7% YoY and 20% lower than 2021 (pre-war) levels. More recently, demand over January-February was up 1% YoY (January was up 9% YoY, while milder weather in February saw demand 8% lower YoY), so we are seeing signs of demand finally starting to recover. In fact, since October, three out of five months have seen YoY growth in gas demand – although the region is still obviously well below its five-year average. We expect weaker prices and lower volatility to continue to drive a recovery in industrial demand through the year. We also expect the power sector to be less of a drag on gas demand this year.

Demand destruction is still needed in Europe to ensure a balanced market. However, we do not need to see the degree of destruction we are seeing now. We believe that demand could grow by around 9% YoY in 2024 and still allow the EU to hit its target storage level of 90% by 1 November, and in doing so, leaving the market in a comfortable position for the 2024/25 winter.

EU gas demand showing signs of recovery (bcm)

Strong Asian LNG demand

Asia has seen strong LNG demand so far this year. LNG imports in Asia over the first quarter totalled almost 99bcm, up around 9% YoY. The weaker price environment has seen more price sensitive buyers in South Asia and Southeast Asia returning to the market. Imports into these regions (excluding India) grew 20% YoY in the first quarter of the year.

Except for Japan and South Korea, almost all other key markets saw growth year-on-year. Indian LNG imports in the first quarter grew by 45% YoY, while China’s continued recovery saw its imports grow by 25% YoY to almost 28bcm.

Stronger buying appetite from Asia and a comfortable European storage environment suggests that spot Asian LNG will continue to trade at a premium to European prices.

US natural gas market set to tighten

The US natural gas market has come under significant pressure this year, with front month Henry Hub trading down to its lowest levels since 2020.

US gas storage continues to look very comfortable, with smaller than usual draws through much of the 2023/24 winter. US natural gas storage is 23% above levels seen at the same stage last year, and almost 39% above the five-year average.

Milder weather has played a key role in smaller draws over the winter months. We have also seen some disruptions to operations at Freeport LNG, which would have reduced feed gas demand and increased supply in the domestic market.

With US domestic prices trading below US$2/MMBtu, it is no surprise that the natural gas rig count has come under pressure. According to Baker Hughes, the gas rig count in the US has fallen by 7% this year to its lowest levels since January 2022. As a result, no growth is expected in US natural gas supply this year, after growing by 4.2bcf/day in 2023. We will need to keep an eye on oil drilling activity, though. If this increases, we could see more associated gas production (gas produced from oil wells).

However, with the view that output will be largely flat this year, the potential for strong demand from the power sector (due to the low-price environment) and stronger demand from LNG plants, along with new export capacity (Plaquemines phase 1 and Corpus Christi) set to start up later this year, we believe that Henry Hub should trend higher through the year.

In terms of regional spreads, the US market is set to tighten while Europe is looking increasingly comfortable, and we would also expect to see a narrowing in the TTF-Henry Hub spread.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more