Eurozone: The underachiever

The sluggish pace of the vaccination campaign continues to jeopardise the eurozone recovery, though stronger manufacturing and construction activity are limiting the damage. Inflation is moving up and is likely to top 2% in the summer, albeit temporarily. Meanwhile, the European Central Bank is trying to prevent too much steepening of the yield curve

Sluggish vaccination campaign

At the risk of sounding like doomsdayers, we unfortunately have to repeat that the sluggish pace of vaccination continues to jeopardise the recovery in the eurozone. At the end of February, less than 5% of the population in the eurozone had received at least one dose of one of the vaccines. With Johnson & Johnson most probably able to step into the game from April onwards, supply constraints will ease, but the vaccination process also needs an urgent makeover in many countries if herd immunity is to be reached over the course of this year. This also explains why most eurozone countries have already announced that they will keep lockdown measures in place at least until the second half of March and probably even longer.

Industry and construction save the day

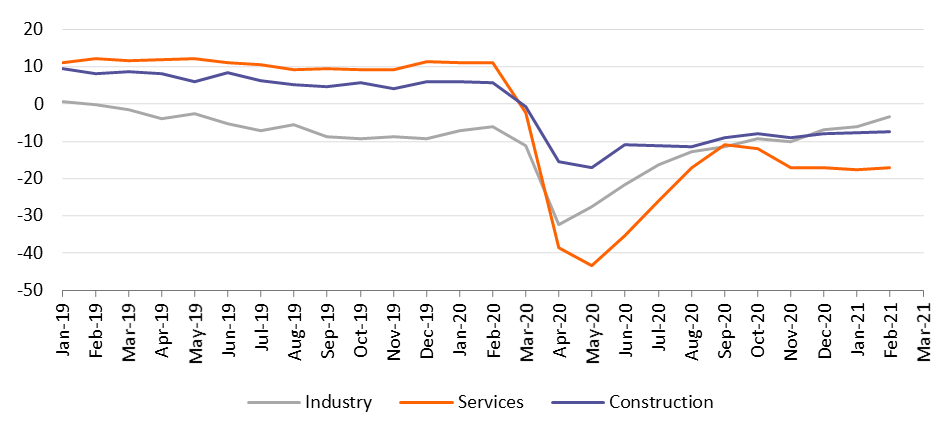

That said, eurozone companies are getting better at coping with the lockdown measures. While services are still heavily affected by the restrictions, both construction and industry are increasingly compensating for this. On the back of swelling order books, helped by the recovery in the rest of the world, confidence in industry rose in February to the highest level since May 2019. And while the first quarter is still likely to show a small contraction, a gradual reopening of the economy from the second quarter onwards should allow a recovery to take hold. Vaccinations probably won’t be advanced enough to see a normal tourism season this year, but we still think the eurozone should manage to grow by 3.8% in 2021, followed by 3.5% in 2022 on the back of some decline in the savings ratio. Bear in mind that even then, the pre-crisis GDP level will only be reached by the end of 2022, about one year later than in the US.

Stronger industry & construction, weak services

Inflation to top 2%

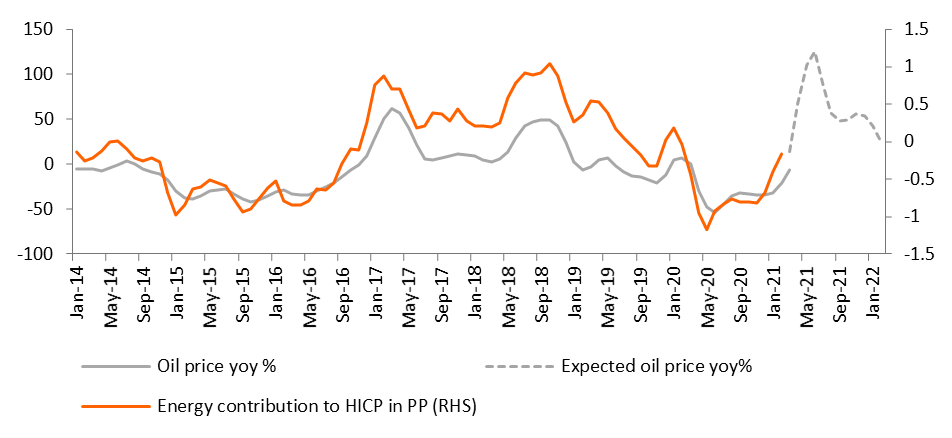

Meanwhile, inflation remained at 0.9% in February, with core inflation at 1.1%. Because of base effects in energy prices, combined with likely price increases in the services that reopen and the full swing of the German VAT reversal unfolding from July onwards, we now expect inflation to top 2% over the summer months. Though most of these effects will disappear in 2022 and for the time being there’s little reason to expect a wage-inflation spiral, underlying inflation might remain slightly above 1% beyond 2021. We expect an above consensus 1.8% inflation rate this year and 1.5% in 2022 (compared with an average inflation of 1.0% in 2016-2020). In other words, a little upward drift that the ECB is likely to welcome, but still at the low end of the ECB’s inflation objective.

Oil prices will push inflation higher

Yield curve steepening

Through different speeches, the ECB has given some colour on what it is looking at in order to maintain favourable financing conditions - though some might call it too colourful to fully distil the ECB’s reaction function. In our view, the GDP-weighted sovereign bond yield curve could be a key element in determining overall financing conditions. However, it would not be easy for the ECB to actually reshape this yield curve. For ECB Executive Board member Isabel Schnabel it is clear that “a rise in real long-term rates at the early stages of the recovery, even if reflecting improved growth prospects, may withdraw vital policy support too early and too abruptly given the still fragile state of the economy. Policy will then have to step up its level of support”. In other words, the ECB will continue to lean against the US-induced upward push in bond yields, through its Pandemic Emergency Purchase Programme. That said, we continue to expect the recovery to lead to some curve steepening, with the German 10yr bond yield likely to leave negative territory by the first quarter of 2022.

Download

Download article15 March 2021

Eurozone Quarterly: Still in lockdown blues This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more