EUR/USD: Lowering the forecast profile

We have been bearish on EUR/USD this year, but not bearish enough. The war in Ukraine and what it has done to the eurozone’s terms of trade have damaged the euro’s equilibrium fair value. We are cutting our EUR/USD forecast by roughly 4-5% across our 2022-24 profile curve

Consensus has been too bullish

We have been pretty bearish on EUR/USD for most of this year, initially on the front-loaded Fed tightening cycle and then on the stagflationary shock generated by Russia’s invasion of Ukraine. And we had always felt that the dollar would probably peak this year given the house view that the Fed would probably end up cutting rates in 2023.

Yet with EUR/USD now at the lows of the year, our current end-year forecast of 1.08 paints us as bullish on the EUR/USD. This has been an uncomfortable view to present to customers and we now need to take action.

For reference, the chart below highlights how consensus has struggled to keep pace with this year’s sharp decline in EUR/USD.

Consensus struggles to keep pace with EUR/USD drop

Valuation: The euro is not cheap

We do understand that many corporate treasurers take sell-side FX forecasts with a large pinch of salt, but the war’s terms of trade shock and what it means to EUR/USD fair value has been a bearish development for the forecast profile. Back on 16 March, we said that EUR/USD, trading at 1.10, was 9% overvalued in real terms and was not cheap.

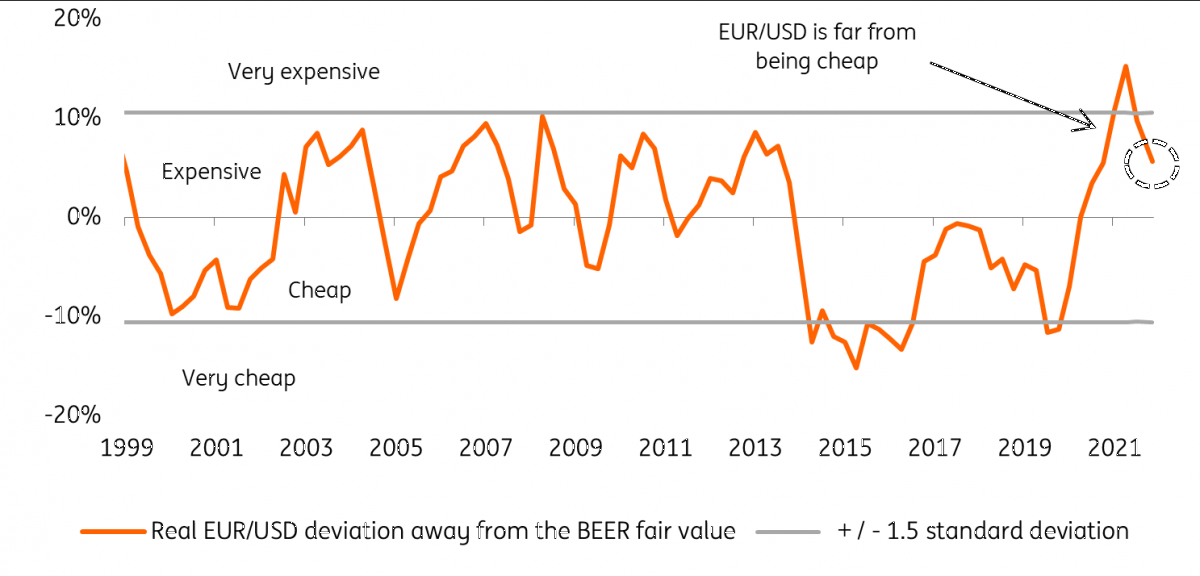

Returning to the issue of fair value now, a quick recap. In our Behavioural Equilibrium Exchange Rate (BEER) model, we estimate the fair value in real terms of currency pairs based on medium-term economic fundamentals: terms of trade (the price of exports divided by the price of imports), productivity, government consumption and current account. Given the frequency of these data, the BEER fair value is calculated on a quarterly basis.

One consistent observation that can be made across the majority of G10 currencies is that the terms of trade are on average the biggest determinant of medium-term swings in the exchange rate. This notion is particularly relevant in the current environment, where high volatility in commodity prices has generated significant shocks in most countries’ terms of trade positions.

Driving this terms of trade shock – especially for the euro – has of course been energy prices. Our US economist, James Knightley, provides the chart below showing the huge divergence between what the US and Europe are paying for natural gas prices. And our European macro and sector teams looked in detail in a recent article on the full impact of gas shortages on the European economy. US energy independence was always going to be good news for the dollar.

When it comes to our EUR/USD BEER model – which shows good explanatory power (R-squared of 0.70) – we can observe how the negative impact on the equilibrium exchange rate from the terms of trade shock in the eurozone (caused by high energy prices) has been sizeable. In the chart below, we show how much each factor has contributed to the moves in the EUR/USD real medium-term fair value in each quarter. The dampening effect of the eurozone’s terms of trade is very evident.

High energy prices have dampened eurozone terms of trade and EUR/USD fair value

Despite the recent weakness in EUR/USD spot, the drop in its BEER fair value caused by terms of trade effects was so significant that we estimate the pair is still around 5% overvalued compared to its medium-term equilibrium level (chart below).

EUR/USD mis-valuation from BEER fair value

This is not to conclude that EUR/USD is bound to consistently trade below parity in the medium-term – as deviations from fair value within the 1.5 standard deviation band can last for many quarters – but simply to show how the euro is not looking cheap when medium-term economic factors are taken into account. In order to “unlock” some material upside potential for the pair, we’d probably need to see an improvement in the eurozone’s terms of trade, or in other words, an easing of energy prices.

Shifting the baseline scenario

As above, FX forecasts are not the be-all and end-all to corporate treasurers and here at ING, we find it useful to present a scenario approach. Back in June, we presented four such scenarios in which our baseline (Scenario 2) saw EUR/USD staying weak this summer, but gently rebounding to 1.08 by year-end as the market’s attention turned more fully to the 2023 Fed easing cycle.

Given the recent reduction in Russian gas supplies to Europe, and with our eurozone team very concerned by European growth prospects this winter, we now feel that Scenario 3 looks a more likely baseline scenario – and felt increasingly uncomfortable with a ‘bullish’ EUR/USD forecast for year-end.

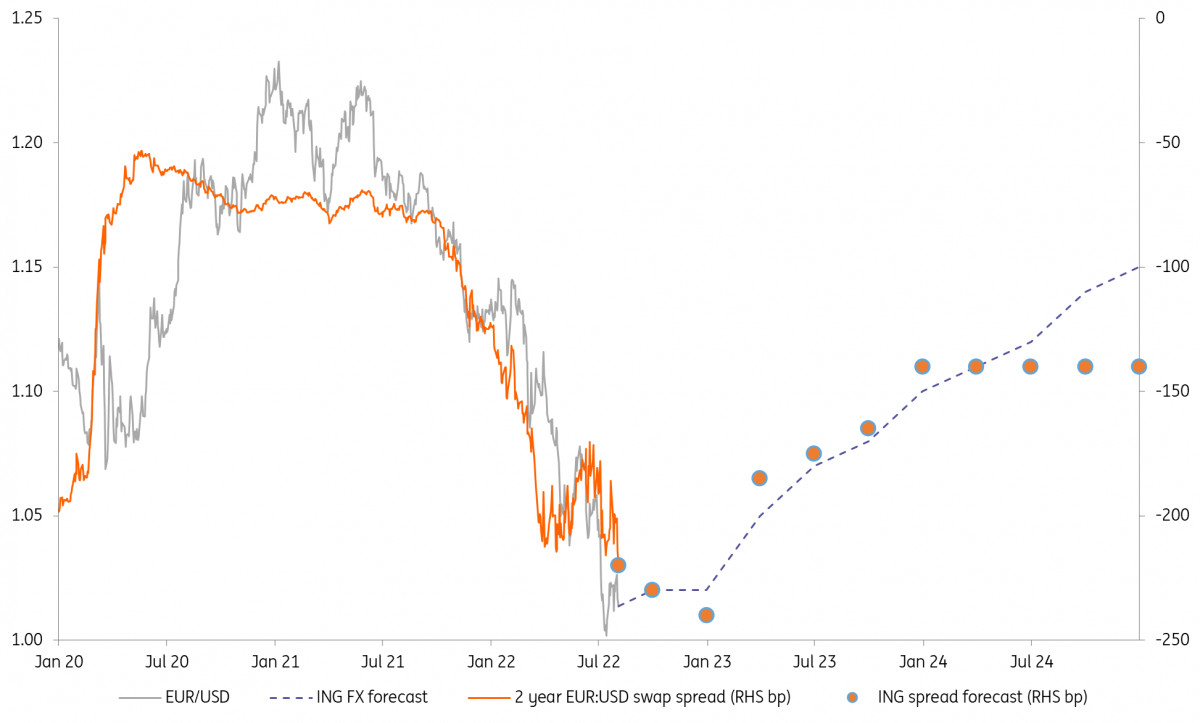

A cut in our EUR/USD forecast profile is now more consistent with our Rate Strategy Team’s view on the eurozone/US two-year swap spread divergence. It has this spread continuing to move against EUR/USD into year-end, with Fed easing expectations only starting to make their mark in 1Q23.

EUR/USD and two-year swap spreads: Actuals and ING forecasts

Combining macro, monetary policy, valuation and geopolitical views together, it now feels like the right time to take 4-5% off our EUR/USD forecast profile curve.

Please find our new set of EUR/USD forecasts in the table below.

Our EUR/USD forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article