EUR/CHF: Swiss exporters want it at 0.98

When EUR/CHF was trading near 0.92 earlier this month, the Swiss export lobby group, Swissmem, called on the Swiss National Bank to curb Swiss franc strength. Swissmem thinks fair value for EUR/CHF is near 0.98. Lower global interest rates and higher volatility heading into the US elections suggest EUR/CHF will be trading lower than that

What's been driving EUR/CHF?

On 5 August, EUR/CHF fell as low as 0.9210. That's the lowest level since January 2015 – when the Swiss National Bank (SNB) pulled the plug on its floor in EUR/CHF at 1.20. The reasons for this month's EUR/CHF drop are plentiful. We explore a few of them below with a look at correlations between daily changes in EUR/CHF and changes in key financial variables since the start of July.

Some of the EUR/CHF highest correlations come with the carry trade unwind. For example, USD/JPY and also USD/MXN (the peso had been the world's favourite target currency under the carry trade) have some of the highest correlations. There are also decent correlations with a number of equity indices (Eurostoxx, Magnificant 7, etc) and also with the short-dated Euro swap rate. EUR/CHF tends to move up and down in a higher/lower euro interest rate world. We'll have more on that later.

While forthcoming rate cuts from central banks in September might be good news for equities, and while the majority of fast money has been forced out of the yen-funded carry trade, we do not, however, think EUR/CHF needs to trade a lot higher. Volatility could well rise into contested US elections in November and European sovereign bonds could also see some more volatility in September/October as governments under Excessive Deficit Procedure try to walk the fine line between Brussels and their voters.

But what about the macro side and what about the SNB which actively uses FX intervention and the exchange rate as part of its monetary policy?

EUR/CHF correlations with financial variables

Swiss exporters and the 0.98 level

When the Swiss export lobby group called for SNB action on 8 August, it cited 0.98 as the fair value for EUR/CHF. It used these terms:

If, owing to the inflation differential of 1%-2%, purchasing power parity is currently around 98 centimes, the industry is suffering from overvaluation of around 6% vis-à-vis the euro. Swissmem, August 8th 2024.

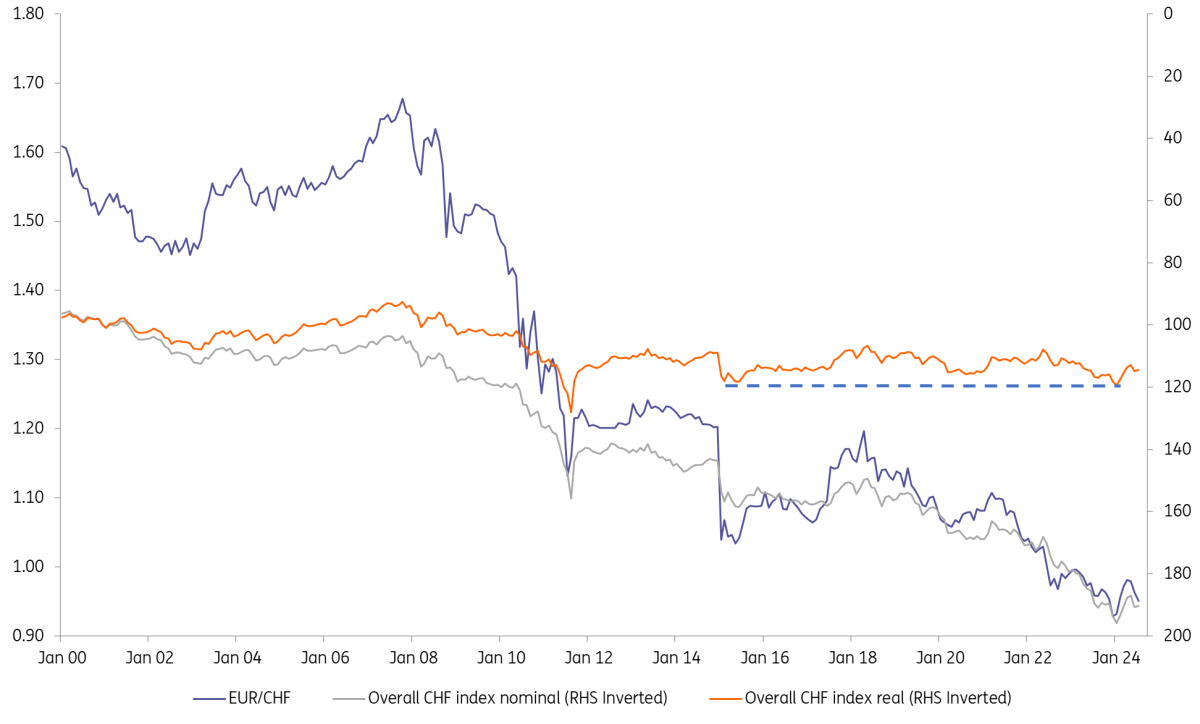

One hears a lot about inflation differentials when covering the Swiss franc and the SNB certainly focuses intently on them when managing the Swiss real exchange rate. We really started heavily focusing on this issue back in September 2022 when we forecast that the SNB would probably try to guide EUR/CHF some 5-7% lower per annum to offset its large inflation differential with the rest of the world. The Swiss franc was indeed the strongest G10 currency in 2023 as the SNB sold FX (see right-hand chart below) to ensure that nominal FX appreciation offset the cheapening of the exchange rate through lower Swiss inflation and kept the real exchange rate stable.

And that is what Swissmem seems to be saying now. Lower inflation in Switzerland than say in the eurozone can now justify 1-2% depreciation in EUR/CHF this year to 0.98, but not to the 0.92 level. We think the SNB probably feels the same way and the chart on the left-hand side below shows how the Swiss-eurozone inflation differential has narrowed substantially from the levels seen in 2022 and 2023. In short, the SNB will not be seeking the nominal CHF appreciation it did in 2022 and 2023. And having sold FX reserves between summer 2022 and end-2023, we suspect it will have reverted to buying FX in the second and third quarter of this year. For reference, the SNB turned a small buyer of FX in 1Q24 after seven quarters of selling.

Euro-Swiss inflation differentials and SNB FX intervention

What does the SNB think about EUR/CHF now?

We do not hear much from the SNB between their monetary policy meetings. But we do hear about them having a problem with the exchange rate. Having sought a stronger Swiss franc last year, the SNB complained about the real Swiss franc strength at the start of this year. Those comments helped reverse Swiss franc gains and softened the market up for the first SNB rate cut in March. According to the SNB's website, in January, the real trade-weighted CHF was at 119 – see graph below. In July, however, it was still only at 114 and suggests the same alarm bells may not be ringing now in Zurich as they were in January.

In addition, Switzerland actually delivered above consensus 0.5% quarter-on-quarter growth in the second quarter – perhaps weakening Swissmem's case for much more aggressive FX intervention or an inter-meeting SNB rate cut.

On the subject of SNB rate cuts, the market is expecting President Thomas Jordan (at his last meeting before he hands over to Martin Schlegel) to deliver another 25bp rate cut in September. This would take the policy rate down to 1.00%. But as we discuss below, it looks like the SNB is running out of track to cut rates. Lower rates around the world – including in the eurozone – will keep pressure on EUR/CHF.

EUR/CHF versus the nominal and real trade-weighted CHF exchange rate

EUR/CHF likely to trade in the lower half of a 0.92-0.98 range

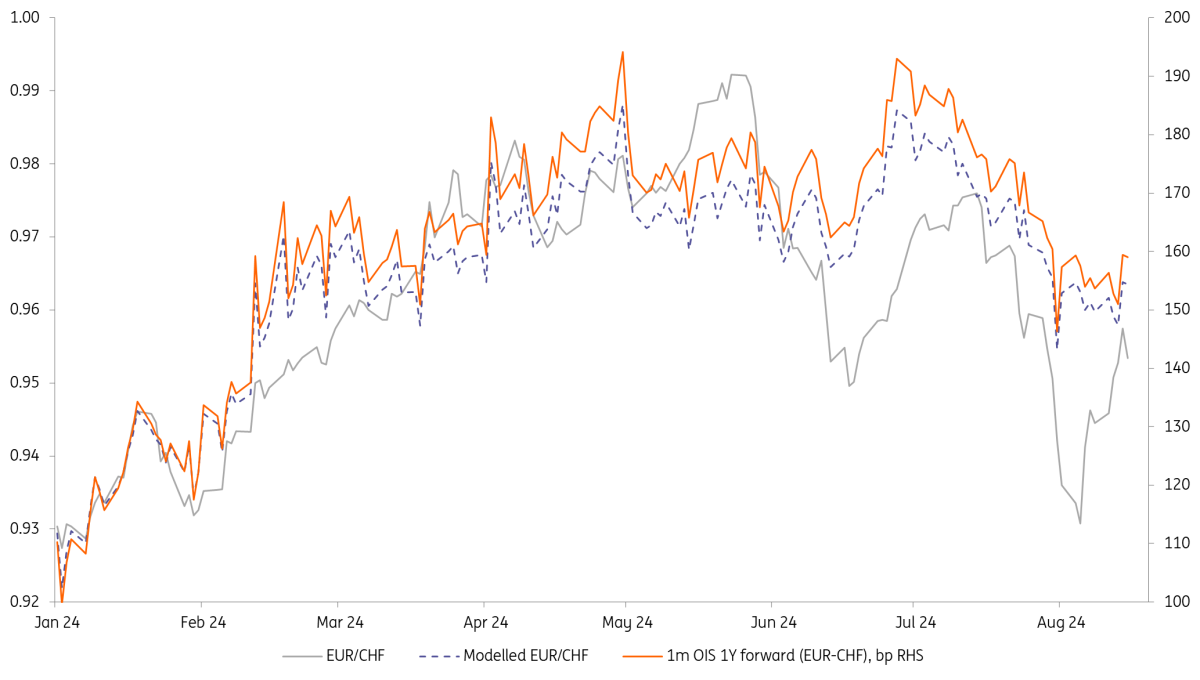

For the first half of this year, EUR/CHF was largely an interest rate spread story. Having traded as low at 0.93 last December when global interest rates fell sharply, sticky inflation and the US-led back-up in rates led EUR/CHF higher into May. In short, Swiss interest rates have a lower beta on global interest rates and rate spreads get dragged up and down with the global story.

This brings us to our final point in that there does seem to be a lower bound for the market pricing of the SNB policy rate. The market seems reluctant to price the rate below 0.50% and suggests the bar is extremely high for the SNB to consider negative rates again. In contrast for next year, the market is pricing the terminal rate for the European Central Bank easing cycle at around 2.00/2.25%. Were conditions to deteriorate, the market could price ECB rates sub 2.00%, rate spreads would contract further and EUR/CHF would trade lower.

We bring some of this together in our final chart below, which shows EUR/CHF versus the spread of ECB and SNB rate expectations. For these we use the 1m EUR and CHF OIS rate priced one year forward. We also show a crude, modelled rate, which looks at the (good) relationship between this spread and EUR/CHF in the first six months of this year and estimates where EUR/CHF could be trading were that 1H24 relationship still in place today. That sets EUR/CHF somewhere near 0.96 and suggests that three to four centime 'over-valuation' when EUR/CHF was trading at 0.92 embodied a risk premium from the carry trade unwind/volatility spike equity sell-off.

Given the prospects for lower rates around the world into 2025 (led by the Fed) and some uncertainty coming up in the form of US elections and eurozone budgetary acrobatics, we tend to think EUR/CHF will trade in the bottom half of a 0.92-0.98 range for the remainder of the year.

EUR/CHF will be weighed by rate spreads and probably by flight to safety too

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more