FXFX Talking

EMEA FX: Attention switches to Poland

After a year in which the Hungarian forint grabbed all the headlines for the wrong reasons, our EMEA team believe the market's attention will switch to Poland in 2023. Whether the central bank is right to close off its tightening cycle and whether Poland can negotiate access to all its EU funds in an election year will be a hot topic for FX markets

Shutterstock

Main ING Emerging Market FX forecasts

| EUR/CZK | EUR/PLN | EUR/HUF | ||||

| 1M | 24.50 | → | 4.78 | ↑ | 400.00 | ↑ |

| 3M | 24.50 | → | 4.80 | → | 390.00 | ↓ |

| 6M | 25.00 | ↓ | 4.70 | ↓ | 380.00 | ↓ |

| 12M | 24.50 | ↓ | 4.71 | ↓ | 390.00 | ↓ |

EUR/PLN: Politics and NBP expectations to prevent further PLN gains

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/PLN

4.693

|

Mildly Bullish | 4.78 | 4.80 | 4.70 | 4.71 |

- Near and medium-term prospects for the zloty are mildly negative. Not only there is very little hope for the National Bank of Poland (NBP) to restart its tightening cycle, but a collapse of household consumption in 3Q22 reanimated hopes for NBP monetary easing already next year. Still, the cost of financing positions against the zloty remains high, thus limiting the scope for zloty depreciation.

- General elections are scheduled for October 2023 with the risk of new spending a negative for Polish government bonds and the zloty. Also, investors seem optimistic about Poland accessing the Recovery Fund, but both the government and European Commission may not be all that willing to compromise prior to the elections in the autumn. On the other hand, opinion polls show rising support for the more EU-orientated opposition.

Refinitiv, ING

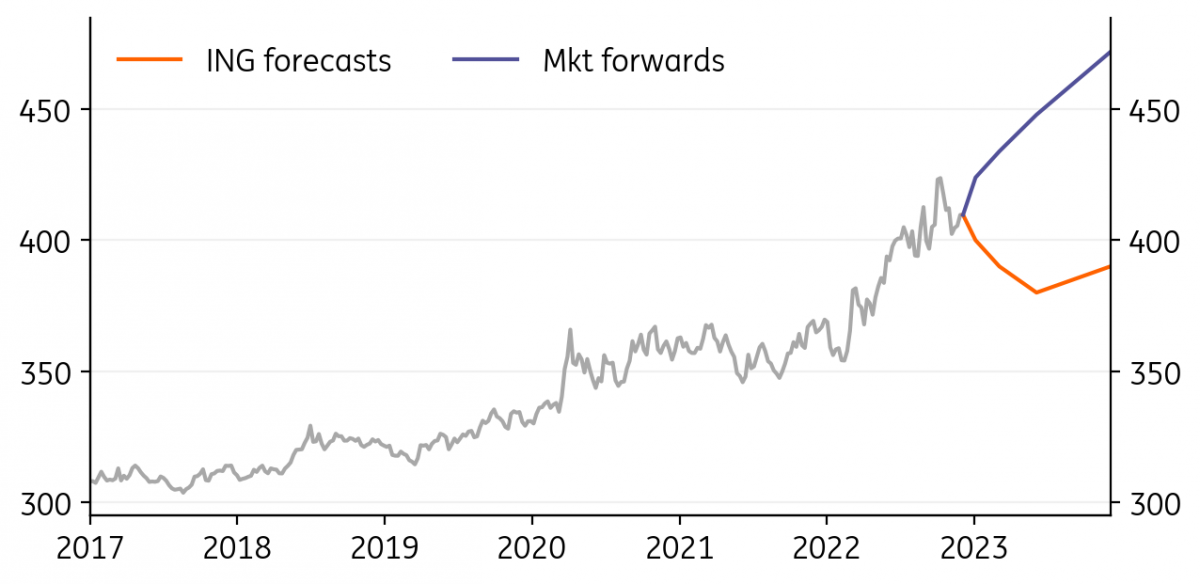

EUR/HUF: The forint is our currency of choice in the CEE4 space

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/HUF

410.00

|

Bearish | 400.00 | 390.00 | 380.00 | 390.00 |

- The forint is still more likely to be moved by non-monetary events and shocks in the short run. The recent complication over the Rule-of-Law decision and yet another warning signal from a rating agency caught up with HUF.

- We believe that the period of emergency National Bank of Hungary meetings is over, that the EU story is coming to a positive end, fiscal policy is pointing to tangible consolidation and that the current account deficit should come under control with a turnaround in CPI.

- Thus, we expect a gradual drift lower below 400 EUR/HUF in 2023. With Poland taking the baton of major market attention from Hungary next year, this makes the forint our currency of choice in the CEE4 space.

Refinitiv, ING

EUR/CZK: No rush to do anything

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/CZK

24.29

|

Neutral | 24.50 | 24.50 | 25.00 | 24.50 |

- According to official figures, the Czech National Bank (CNB) spent about €26bn (16% of FX reserves) on defending the koruna between May and October. According to our estimates, the central bank was not active in the market in November and December. Overall, the CNB remains in a very comfortable situation.

- Moreover, the artificial slowdown in inflation due to government measures in October, combined with data showing weakening domestic demand, is not pushing the CNB to make any move. Therefore, we do not expect any changes in interest rates or the FX regime anytime soon. We expect the first rate cut in 2Q23.

- Until then, we expect EUR/CZK to remain safely below the CNB's intervention level of 24.60-70 EUR/CZK.

Refinitiv, ING

EUR/RON: Well supported offer side

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/RON

4.93

|

Neutral | 4.94 | 4.95 | 5.10 | 5.10 |

- As usual into the year-end, the accelerated Treasury spending has led to a much-improved liquidity situation. Thus, the banking system turned to a surplus of approximately RON5.4bn in November, from a deficit of more than RON4bn in October.

- Better liquidity prompted high carry rates to tank throughout November and likely December as well. In response to the surplus liquidity conditions, the National Bank of Romania seems to prefer FX interventions to deposit auctions for mopping up the excess liquidity.

- Given that commercial flows in December might be richer on the offer side, a year-end EUR/RON closer to 4.90 rather than 4.95 looks rather likely.

Refinitiv, ING

EUR/RSD: A new trading range setting-in close to 117.30

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/RSD

117.30

|

Neutral | 117.30 | 117.30 | 117.40 | 117.40 |

- The recently-decided Stand-By Arrangement with the International Monetary Fund (IMF) will undoubtedly influence the monetary policy decision in the short to medium term.

- Reading through the lines of the official communication, we believe that the IMF is comfortable with the National Bank of Serbia (NBS) maintaining the current quasi-pegged dinar FX rate, but interest rates might need to be increased beyond what the NBS had in mind.

- We have already changed our terminal key rate estimation to 5.75% (to be reached in 1Q23). We maintain our year-end EUR/RSD forecast at 117.30 for 2022 and revise 2023 mildly to the upside, at 117.4.

Refinitiv, ING

USD/UAH: Massive external imbalance puts hryvnia at risk

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/UAH

36.84

|

Bullish | 38.50 | 40.00 | 40.00 | 38.00 |

- Ukraine continues to face a very high external imbalance. Central bank FX operations have decreased by around half since the July peak (US$2bn in October). Should the conflict escalate after the winter, FX operations may rise again. Hence maintaining US$/UAH at the current level seems untenable, despite significant foreign aid, given the central bank’s FX reserves are at around US$25bn.

- Long-term prospects for the hryvnia are hard to predict. Even after the war with Russia finally ends, policymakers will have to decide whether to convert foreign aid via the market to help to stabilise inflation or for the central bank to support exports. Still, given the massive damage to the Ukrainian economy, US$ returning anywhere close to pre-war levels seems highly unlikely.

Refinitiv, ING

USD/KZT: Downside appears limited thanks to domestic factors

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KZT

469.20

|

Mildly Bullish | 480.00 | 480.00 | 470.00 | 470.00 |

- Having touched 460 vs the US dollar in mid-November during the tax period, USD/KZT is now back above 470, in line with expectations, on weaker oil prices and very modest FX sales of just $0.3bn out of the sovereign fund for the budget spending purposes.

- With President Kassym-Jomart Kemeluly Tokayev winning the snap elections, local sentiment should be supported. However, the tenge remains vulnerable to external factors, such as oil prices and risk appetite.

- Assuming mild dollar appreciation expected by ING for the coming months amid stable oil prices, the tenge may remain under moderate pressure in the near term, but the downside for the longer run appears limited thanks to local fundamentals.

Refinitiv, ING

USD/TRY: Risks to the TRY outlook under focus

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TRY

18.64

|

Mildly Bullish | 18.90 | 19.30 | 20.30 | 24.00 |

- FX reserves that have been quite volatile this year have shown a rapid recovery since the end of July despite rate cuts since August. Another boost to reserves in the near term is also likely if Turkey and Saudi Arabia finalise the US$5bn deposit deal.

- TRY has been stable lately because of inflows under net errors and omissions, the FX-protected deposit scheme diverting FX demand from residents, and implicit Central Bank of Turkey intervention. In this environment, the real effective exchange rate increased by more than 15%, implying significant real appreciation since the end of 2021.

- We think TRY will remain on a gradual depreciation path on a nominal basis in the near term, assuming that additional credit and fiscal stimulus measures are kept limited. However, risks to the TRY are on the downside if we see a larger-than-expected deficit in the current account due to higher energy or commodity prices and less interest in the FX-protected deposit scheme.

Refinitiv, ING

USD/ZAR: The presidential premium

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/ZAR

17.70

|

Mildly Bearish | 17.50 | 17.50 | 17.25 | 16.50 |

- The rand is failing to fully take advantage of the weak dollar environment, where one would think it should be trading under 17.00 by now. Apart from the weaker dollar, South Africa has seen its terms of trade pick up sharply, saw a very narrow -0.3% of GDP current account deficit in Q3 as well as 1.4% quarter-on-quarter GDP growth.

- Instead, potential impeachment proceedings against President Cyril Ramaphosa seem to be holding the rand back. We should find out shortly whether parliament wants to support an independent panel’s findings that he may have violated the constitution.

- A tough growth/risk environment in 2023 leaves us ZAR negative.

Refinitiv, ING

USD/ILS: ILS looks well positioned

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/ILS

3.43

|

Neutral | 3.45 | 3.40 | 3.25 | 3.00 |

- USD/ILS continues to consolidate in the 3.40/45 area in a soft dollar environment. The shekel remains one of our preferred currencies for when the big dollar trend fully turns lower – something which may not happen until next spring/summer.

- Strong growth, low unemployment and a large current account surplus underpin the shekel, as does a policy rate now at 3.25%. Into 2023, the market prices the policy rate staying at 3.25/3.50%.

- The big turn lower in USD/ILS also probably requires a more durable rally in equity markets – again something which may not be seen until spring/summer 2023. Expect good demand for the shekel now should we see a correction to the 3.50 area.

Refinitiv, ING

Download

Download articleThis article is part of the following bundle

13 December 2022

FX Talking: Winter wonderland This bundle contains {bundle_entries}{/bundle_entries} articles

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast