EM Credit: Attacked from the core

All-in returns are being hammered by the rise in Treasury yields, but pure credit performance is proving more resilient. A weaker US dollar and synchronised global growth are positives for emerging markets, and an on-hold Fed helps too. The issue is that absolute returns remain quite tame versus risk, thus the route to returns is to add to selective risk. This remains a very tough year for fixed income, and we are not through the worst of it

A concession has built in emerging markets. The question is whether it is enough. The answer is, probably not. Synchronised global growth in the quarters ahead can and should prove supportive, as should resumed dollar weakness. However, the higher rates narrative is not over. We see the US 10yr heading to 2%, and likely above. That will maintain pressure on all-in credit exposures of all guises.

Some cushion is attainable in high yield, provided the risk environment remains relatively stable. That applies to both hard currency and local currency, but especially the latter where there is typically a tad more stretch in the spread, and room for some performance on the FX front.

A threat to the stable risk environment could come from a taper discussion from the Federal Reserve. We would not be surprised to see this coming from the June FOMC meeting. Risk assets might not take this badly if presented against an ebullient backdrop, but then again, it is also as good a catalyst as any for risk asset caution.

How we got to where we are

A point of vulnerability that was evident a year ago was the low all-in yield attainable across credit markets and into emerging markets, as tight spreads coincided with ultra-low core yield rates. The dominant influence on credit market performance so far in 2021 has come from the ratchet higher in core bonds yields. In fact, if we factor out the alpha from the beta effect, we find that pure credit performance has in fact been tolerably fair to good, and emerging markets generally have outperformed.

Emerging markets are still sitting on negative total returns year-to-date, but not as negative as the returns seen on US Treasuries for example, and emerging market have also outperformed versus investment grade corporates. The best performance out there so far this year has been in high yield, although it has to be said that even those returns are not fully compensatory for the risk being taken. A strongly rated investment grade corporate floater would almost match risky high yield performance so far in 2021.

It has not been a good year for fixed income generally. And given that the rise in inflation expectations has been at the heart of the bond market sell-off, there is an ongoing red flag in play for all types of product that pay fixed income that can be easily eroded away by inflation, and especially in longer tenors. But getting some spread on top helps to ease that pain, which is where the more yieldy emerging market product comes in. And emerging markets tend to like global uplifts – we are having one of those.

Synchronised growth and higher market rates

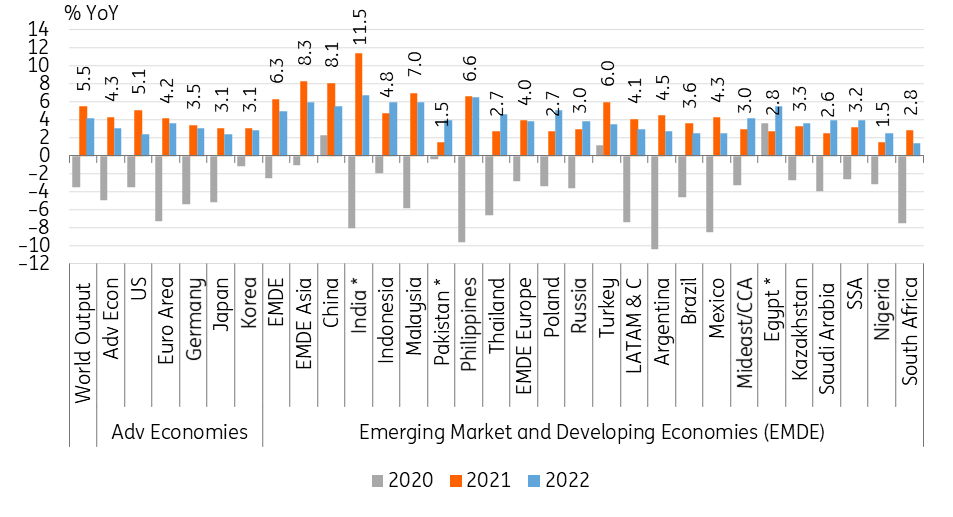

The growth outlook has clearly improved, with the IMF expecting global GDP growth to rise by 5.5% in 2021 and 4.2% in 2022 (vs -3.5% in 2020). Emerging markets and developing economies are set to grow by 6.3% this year, with EM Asia remaining the growth locomotive (+8.3%) while Latin America could also make up some ground (+4.1%) after annus horribilis 2020 (-7.4%).

History shows that emerging markets tend to perform well during generic spurts in global growth, especially in the early phases where core rates are kept at bay. This is very much the set-up as we progress through 2021. An offsetting negative, however, comes from the ongoing rise in longer tenor rates. This is especially painful for longer duration emerging market sovereign issuers, and generically poses challenges for longer tenor re-financing costs.

IMF growth projections for 2020-22 across country groups and region (% YoY)

Dollar weakness to resume

A significant impulse comes from the foreign exchange markets, and especially the US dollar. The broad theme since the start of 2021 has been one of resumed US dollar strength; not dramatic, but the trend has been in that direction. We doubt that will be sustained. A broadening in global recoveries tends to take the bid away from the US dollar, and we expect the same here.

The US dollar tends to do better during more stressed times. Here, we are de-stressing. Moreover, we are reflating, and higher US inflation as a stand-alone is a negative for the US dollar, as implied purchasing power is eaten into. On top of that, the front end of the US curve continues to trade with super deep negative real rates. This all points to resumed US dollar weakness as we progress through 2021, and a weaker US dollar tends to take pressure off emerging market currencies, and by extension, EM itself.

Cost of recession issuance, and flow trends morph weaker

We have seen receding primary market activity so far in 2021, with for example only US$9.9bn of hard-currency sovereign debt issued in February (vs US$41.4bn a month earlier).

Sovereign debt issuance by rating and region (US$ equivalent)

This is mostly reflective of relatively mild re-financing needs. In fact, in the months ahead we would expect to see issuance pick up, partly to finance cyclically elevated deficits, and also to finance additional Covid-19-induced incremental costs to exchequers right across emerging markets.

These bills are much larger in the developed markets space, but are also a growing element in emerging markets, albeit less so, thankfully, in frontier markets. The hit to Asia too is less. But Latam has a heavier bill to pay.

As we ended 2020 and morphed into 2021, it was striking how resilient the inflows into emerging markets were, and especially into local currency funds.

In recent months, we have seen portfolio flows into EM risk assets slowing down to US$31.2bn in February, split into US$22.8bn for debt and US$8.4bn for equity. This compares to around US$50bn in the preceding two months. The increasingly challenging backdrop is also likely to weigh on inflows in March.

Monthly portfolio flows into EM debt and equities

Returns have grown in negativity in the past month

This, however, is reflective of a wider stress being brought to bear on all-in credit performance generally, as fixed income has struggled in 2021 to date. It is a year that is shaping up to be one of aggregate negative total returns for fixed income, reminiscent of 2013, the year of the taper tantrum. In hard-currency credit, the JPM EMBI Global Diversified has delivered a negative 4.3% return year-to-date, not far from the 5.3% drop for full year 2013.

This negative emerging markets performance has primarily been driven by the rise in UST yields (with a c.70bp year-to-date rise in UST 10yr yields, and dedicated long end Treasury funds running on negative returns in excess of 10%) but lately this has also weighed on risk appetite and caused modest outflows (led by ETFs), with the JPM EMBI Global Diversified spread widening to levels beyond 370bp in early March (from the lows of 339bp in early February and vs 352bp in end-2020).

The prognosis ahead is mixed

Synchronised global growth in the quarters ahead can and should prove supportive, as should resumed dollar weakness. However, the higher rates narrative is not over. That will maintain pressure on all-in credit exposures of all guises. The cushion is in high yield, provided the risk environment is relatively stable. That applies to both hard currency and local currency, but especially the latter where there is typically a tad more stretch in the spread, and room for some performance on the FX front.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article