Electric vehicle uptake exceeds expectations

The global share of electric cars in new deliveries surpassed expectations in 2021. Governments and corporates also made regulatory and strategic progress. Keeping up production remains a challenge and high raw material prices cloud the outlook. But the share of electric cars is expected to increase in 2022 and strong orders signal more progress in 2023

Global uptake of EVs beats expectations

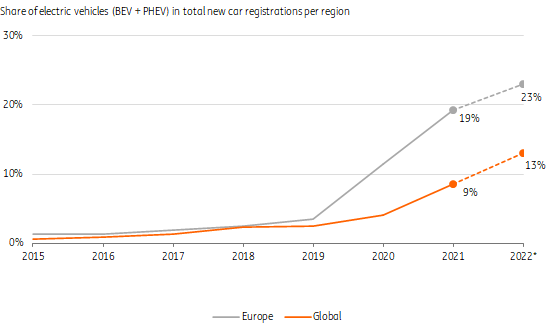

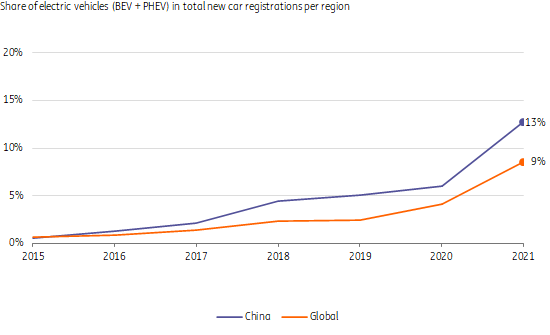

The global uptake of electric vehicles (EVs) (battery electric vehicles BEV + plug-in hybrid electric vehicles PHEV) is ahead of earlier expectations. The global share in new registrations hit 9% in 2021 (6.6 million) against earlier expectations of 6% (BNEF). The global figure was supported by an acceleration in Europe (with a 19% share) and China (14% share). The US lags in the electrification of new cars (total EV share was just 4.5% in 2021), but times are changing here. Ford – for instance – received 200,000 reservations for the new all-electric F150 light truck in a few months' time. With production kicking off, this will add to the EV share.

Global EV uptake gained momentum, Europe still in the lead

Largest European car markets gear up, lifting the continent

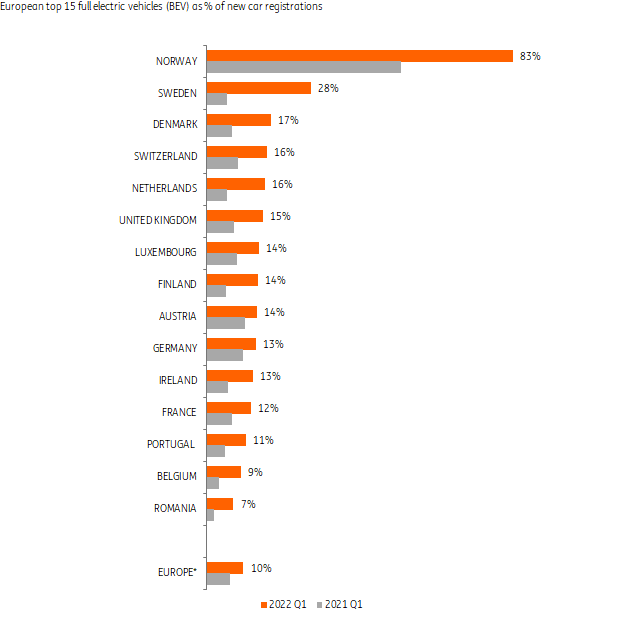

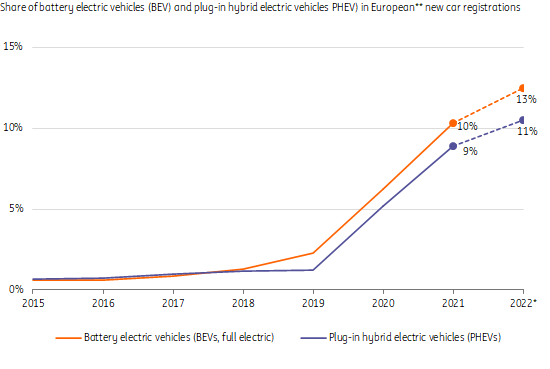

Looking at the breakdown of the EV share in Europe's new registrations over 2021, both fully electric vehicles (10%) and plug-in hybrids (9%) continued to rise, helped by new models entering the market. Within Europe, the largest car markets of Germany (14%), the UK (12%) and France (10%) have seen double-digit growth in BEV sales. A doubling of the fully electric share in Germany, the largest European car market, has pushed up the European average. A large car market which is still notably behind is Italy, at just 5% in 2021.

Europe's full electric share in new car sales started 2022 at 10%

Production constraints limit potential in 2022

The total production of new cars has been significantly hampered by semiconductor shortages over the past year. These shortages are not over yet and several European production sites including those of VW and BMW have faced new hiccups in supply chains due to interruptions at Ukrainian wire harnasses suppliers. Delays from lockdowns in China might trickle down as well later on this year. This means underproduction will remain throughout this year.

EVs require more chips but car makers also prioritise production

Full electric vehicles, which have more complex digital designs, require some 2,000 chips on average, roughly double the amount needed for conventional cars. Mature chips, which are still used in electric cars, have been in short supply as most of the capacity expansion has been focused on high-end chips. These supply issues have led car manufacturers to prioritise the types of cars they produce. But manufacturers are still trying to increase production of chip-consuming EVs (including E-SUVs) in order to keep up with competitors in the green transition and to comply with European CO2-reduction targets in average production.

Share of full electric cars in European new sales on its way to 15%

European BEV-share heading to next milestone of 15%

The share of battery electric vehicles got off to a slow start this year, standing at 10% in the first quarter, though this is still up from 6% in the same quarter a year earlier. The number of cars entering the market this year is fully directed by production capacity. Amid filled order books and ambitious plans, we expect a further step up from 10% this year, although the ability to accelerate is limited. Tesla has started production at its Berlin factory this year, which will gradually lead to more deliveries. Chip supply shows some signs of improvement, which could offer some flexibility and support production figures in the second half of 2022.

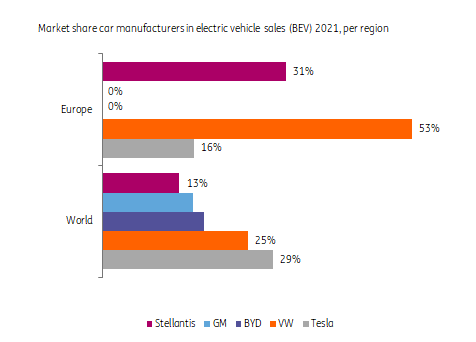

Tesla still leads the global EV market, VW dominates in Europe

Orders support short-term uptake – higher fuel prices help

Amid the headwinds on the supply side, the demand side is strong and order books for EVs are well filled, revealing growing consumer interest. Demand is fiscally supported and is clearly there. Europe's market leader in EVs, VW, indicated in April that it had an order book of 300,000 EVs for Western Europe alone (three times its global deliveries in 1Q), although new EV orders will only be delivered in 2023.

Higher fuel prices due to the war in Ukraine may also fuel consumer interest in BEVs. Although electricity prices have also soared, electric engines are more energy-efficient than combustion engines and in combination with cheaper charging options at home or work, this could be beneficial for demand.

Strategic push supports further electrification

Governments and corporates stepped up plans for electrification during the pandemic. In the run-up to the presentation of the European green deal strategy (‘Fit for 55’) and country and company pledges for 2040 at COP26, all large manufacturers announced plans to phase out internal combustion engine cars (ICE) in Europe before 2035. Several brands including Volvo aim to make the shift by 2030. These announcements came with large investment programmes and plans to introduce new models. Although an electric future is in little doubt, some manufacturers like Honda and Toyota are leaving multiple options open, pointing to constraints like required charging infrastructure and lagging supply of battery metals.

Large European plug-in hybrid countries start to shift to full electric vehicles

In most European countries, full EVs are already very prevalent. In Nordic countries such as Sweden, Denmark and Finland as well as in Belgium, the plug-in hybrid (PHEV) share was much higher than the European average (13%-26% of new sales). In Sweden and Denmark, in particular, new registrations have started to shift to full electric vehicles, boosting the BEV uptake in these countries. Average European plug-in hybrid sales continue to increase due to the hybridisation of existing models and electrification within the large middle class. Nordic countries have shown that these hybrids can provide an intermediate step to full electrification once the range of models is extended, and buying a fully electric car becomes attractive to a larger group of consumers.

China shifting faster towards EV sales than the global average

China helps the global uptake as largest global EV market

Although China is behind Europe in terms of its EV share, it is already (by far) the largest EV market by unit volume. Total EV registrations tripled to 3.35 million in 2021 (including 1.3 million fully electric cars). VW, as well as Chinese market leader BYD, both reported a surge in total EV demand in China at the start of 2022, which is promising as lockdowns continue to weigh on the car market. The total EV share ended up at 13% in 2021, which also implies the Chinese market is closing in on the European market in terms of the share of sales.

Higher battery metal prices and lagging supply could limit the medium-term pace of electrification

For the medium term, the story may be somewhat different. Soaring prices for battery metals could limit the pace of electrification by the end of the decade. Supply growth of battery metals like lithium lags demand and battery prices won't decline as they have before. This makes electric vehicles more expensive relative to traditional cars and could slow the shift to EVs, although fiscal policy also plays a role.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 May 2022

So many questions… we’ve got some answers This bundle contains 6 Articles