ECB projections for credit

European Central Bank President Christine Lagarde said the next meeting on 22 July may be an eventful one with “some interesting variations and changes”. Interestingly, she also mentioned that the Pandemic Emergency Purchase Programme may “transition into a new format”

Change in messaging

We hadn’t expected all that much from the July European Central Bank (ECB) meeting, however we are now gearing up for an eventful gathering after Lagarde hinted at a change in messaging, along with “some interesting variations and changes”.

Lagarde repeated that she expects the PEPP to run until at least March 2022, but said there may be a transition into a new format after that. Of course, the messaging from the ECB in terms of the end of PEPP is centred around keeping the support in place as long as needed. However, it must come to an end at some point. One potential option that we have mentioned before is for the ECB to smooth the transition by increasing purchases under its Asset Purchase Programme.

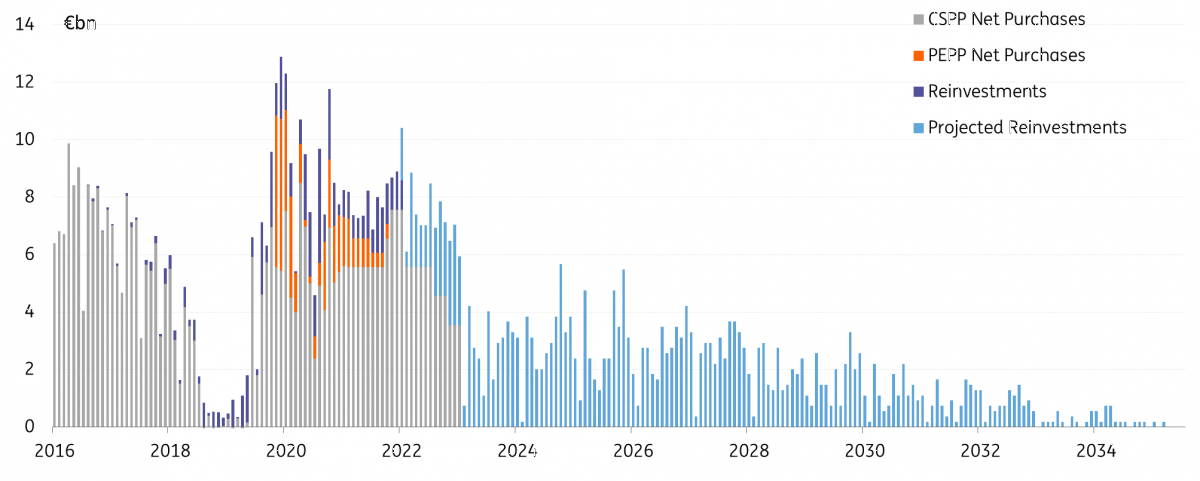

This could be as significant as €40-50bn per month, up from the current €20bn per month. While most of this will target public assets under the Public Sector Purchase Programme, we feel that the ever-popular Corporate Sector Purchase Programme will also benefit. Indeed, we wouldn’t be surprised if the net result is zero; in other words, purchases of corporate credit could fully compensate for the end of the PEPP. The central bank has been buying €5.5bn of corporate bonds per month, on average, under its CSPP but could raise this to about €7bn per month. Currently, the CSPP runs at 25% of the APP, so even a slight decline would still mean a net rise.

Looking further ahead, the CSPP may well remain active until mid-2023. The messaging from the ECB is that this programme will remain in place until shortly before the Bank starts to raise interest rates. Our economists are looking for the first rake hike to take place in late 2023.

What's more, the reinvestment of redemptions by the CSPP is increasing such that by late 2023 and into 2024, we expect reinvestment flows alone to support credit by some €2.5-3bn a month on average.

Actuals & Projections of CSPP, PEPP and reinvestments

Monthly net purchases and reinvestments of CSPP and corporate purchases under PEPP, alongside reinvestments

Regardless of the specifics of next week’s meeting, the ECB is looking to continue its substantial support whilst maintaining the flexibility to do so. Whatever happens, the ECB will remain supportive for credit markets.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more