ECB: More EUR strength to kick in next year

Draghi successfully made today's ECB meeting a non-event, taming any EUR upside. But its own forecast on Eurozone activity suggests a rosy outlook for the euro in 2018. We target EUR/USD 1.30 next year

Draghi successfully taming short-term EUR upside

Overall, today’s ECB meeting was one big non-event in terms of the spill-overs to the EUR. While the ECB staff revised both its GDP and CPI forecasts higher, one can argue that the change to the CPI forecast is somewhat conservative versus market expectations. For example, our economists are looking at CPI projections at 1.5%YoY vs 1.4% presented by the ECB for 2018. Hence, the knee-jerk reaction in EUR/USD lower.

But long-term EUR/USD strength on cards

Going beyond the near-term EUR price action, the rather positive upward revision to ECB’s own Eurozone GDP forecast and “greater confidence” that inflation will converge towards the central bank’s aim, also makes us more confident in our bullish EUR/USD view. We target 1.30 next year.

We expect ECB QE to end next year (though our economists think the ECB may extend it by one more quarter to 4Q18, by EUR 15bn). However, as we approach the end of QE (which is now in great part priced into the euro), we expect the market to start focusing on the ECB deposit rate normalisation. Although the latter is a story for 2019, we look for the FX market to front run the event (in the same way the FX market front ran the ECB QE tapering which was priced into the EUR well ahead of it actually starting). This should provide a boost to EUR/USD in 2H18, which is why our target of 1.30 next year.

EUR/USD still undervalued, despite its rise this year

As per our 2018 FX Outlook, we still deem EUR/USD to be undervalued both on the medium and long-term basis. Based on our medium-term BEER model, EUR/USD is undervalued by 4%, while the long-term OECD PPP model points to a fair value of 1.33 (Fig 1).

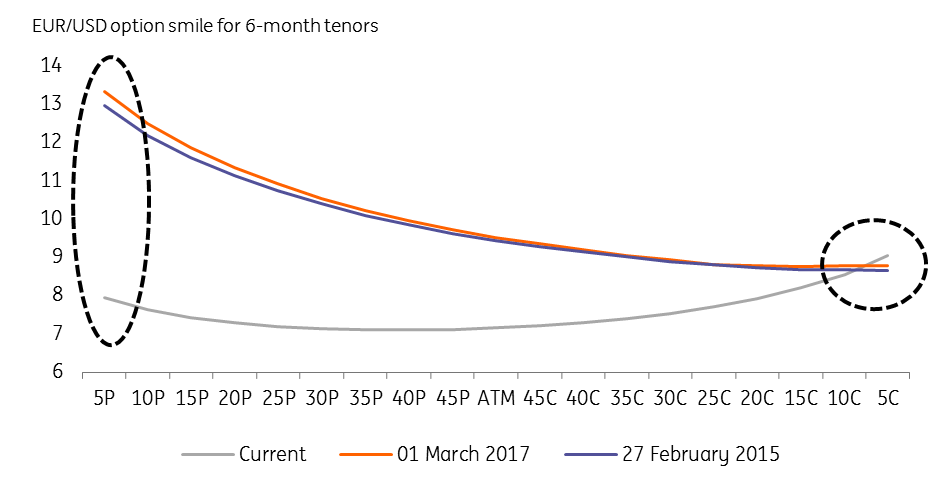

Hence, we see plenty of upside to EUR/USD particularly when the perception of the EUR has changed, with the currency no longer being perceived as a tail risk asset (as evident in the current shape of the EUR/USD option smile – Fig 2).

EUR/USD is cheap on long term basis

European FX block to benefit from higher EUR/USD

We expect the EUR/USD strength to positively spill over into the European FX space, making the European currencies the outperformers in the G10 FX space (vs the dollar block).

In the emerging markets FX space, this points to CEE FX outperformance as this is the only emerging markets region that neatly and directly benefits from higher EUR/USD. We expect short USD/CZK position to do well next year, with the cross likely declining by 10%.

EUR is no longer seen as a tail risk currency

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).