Dutch staffing industry outlook: Temp hiring slows down

Due to a softening economy, the number of temporary agency hours in the Netherlands is likely to decrease in both 2023 and 2024. New regulations and a structurally tight labour market are putting pressure on the earnings models of many staffing agencies. They need to make clear strategic choices in order to remain relevant in the near future

Weaker demand for temp workers

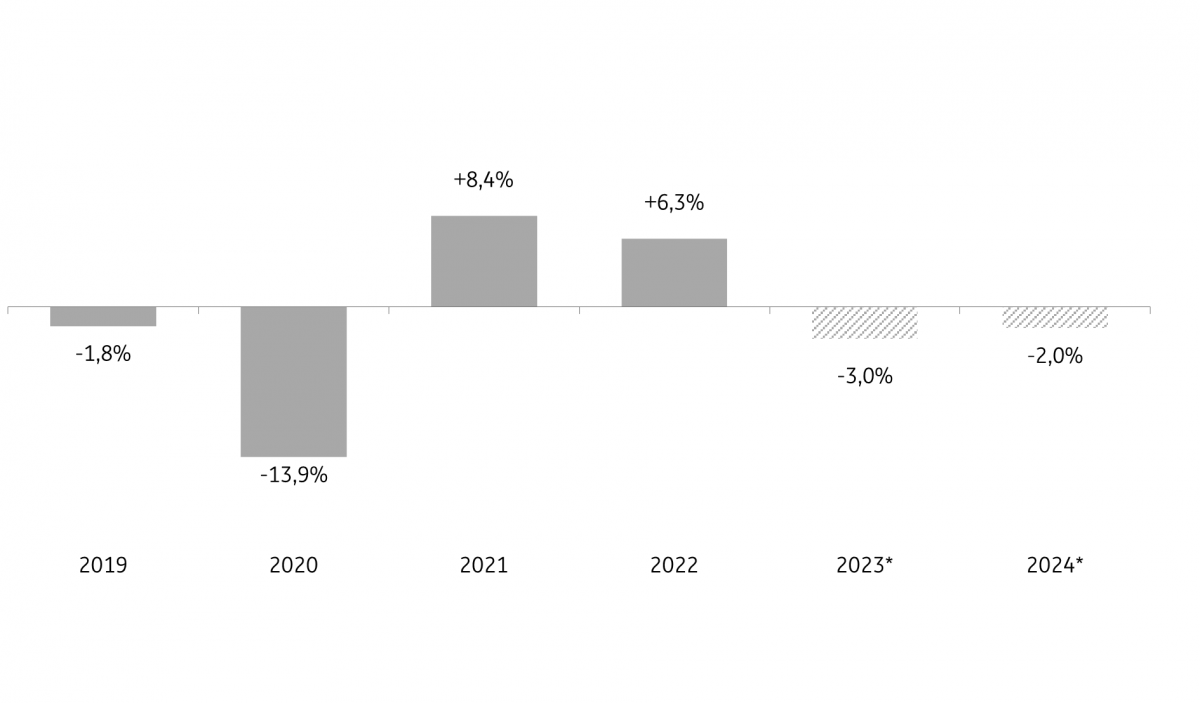

The number of temporary agency hours in the staffing industry - consisting of temporary employment agencies, recruitment firms and payrollers – is set to contract by around 3% in 2023. With economic growth expected to fall sharply this year compared to last, demand for flexible workers is also declining. The drop in temporary agency hours is tempered somewhat because of continued demand for recruitment and selection services from the government and the semi-public sector, partly due to a shortage of personnel. For 2024, we also expect a volume contraction (-2%), mainly due to continued relatively low economic growth.

Contraction in the staffing industry in 2023, after two years of strong growth

Volume growth in the Dutch staffing industry, output basic prices, year-on-year

Cutbacks in temporary agency jobs

Nearly one in five temporary employment firms experienced declining demand for temporary agency workers at the beginning of the second quarter of 2023. This is also evident in the number of temp jobs. In the first quarter of 2023, the number of temporary agency jobs contracted by 45,000 (-6%) compared to the same period a year earlier, the first drop in two years. The decrease in temporary jobs has also been caused by the fact that temporary workers are often offered a permanent contract more quickly in the current tight labour market. In addition, under current legislation and regulations, it is more attractive to work as a self-employed person than as a temp worker in certain sectors – such as health, hospitality and construction.

Strong cutbacks in temporary agency jobs in the first quarter of 2023

Growth in the number of temporary agency jobs in the first quarter, year-on-year

Self-employment is an attractive alternative

New regulations make temporary agency work more expensive and less flexible in the long term. This is leading to a shift to other flexible forms of work, such as self-employment, which is an attractive alternative for both companies and workers, thanks partly to tax benefits. The shift to self-employment is also reflected in the increase in the share of self-employed persons in the labour force, from 11% in 2019 to 13% in 2023. At the same time, the proportion of flexible workers has fallen.

More self-employed persons, less flexible employment

Share of labour position in the labour force, first quarter

Gen Z wants more flexibility

According to the trade association ABU, it is mainly students (generation Z), formerly accounting for approximately 20% of temporary agency workers, who are opting more often for self-employment in the current market. Above all, they seek work that offers more flexibility and supports their well-being. They do this by, for example, working as self-employed through online work platforms such as Temper and YoungOnes, where they can determine their assignments, working hours and rates.

Strategic reorientation

It is clear that the Dutch staffing industry, in its current form, is no longer functioning properly. Staffing firms will have to make strategic choices in order to maintain their relevance in the near future. The structurally tight labour market offers new opportunities. For example, temporary work agencies may need to invest in good employment in order to retain temporary workers for a longer time by offering them a permanent contract directly. Staffing firms can also play a more significant role in the field of labour mobility between shrinking and growing sectors through training and career guidance, for example, by targeting people over the age of 50 or by retraining blue-collar workers. Finally, because of their knowledge and experience, they can relieve other companies and advise them on HR issues. Ultimately, a broadening of services will lead to a more long-lasting customer relationship and higher added value.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more