Dutch manufacturing outlook: Struggling with weak demand

With supply constraints diminishing, declining demand is limiting industrial activity in the Netherlands. The picture differs strongly between industries. The large growth gap between energy-intensive and technological industries will narrow now that energy prices are sharply lower and demand has softened across the board

Dutch manufacturing in a slump

Dutch manufacturing has seen production declining steadily since May last year. In recent months the outlook seemed to improve, partly due to the mild winter and declining gas prices, the reopening of the Chinese economy, and governments offsetting spikes in energy prices. However, both the Dutch economy and that of the key trading partners remain fragile.

Looking ahead, the demand for goods is not expected to increase significantly in the near future. Consumers are spending more on services instead of goods, and the remaining post-Covid catch-up demand is drying up. Additionally, higher interest rates will have an increasingly larger economic impact throughout 2023. Some recovery in the industry may occur in the second half of this year and in 2024, but the path to recovery will be less steep. We expect the sector to return to moderate year-on-year growth only in 2024.

A small contraction in 2023, moderate growth in 2024

Volume growth of Dutch manufacturing

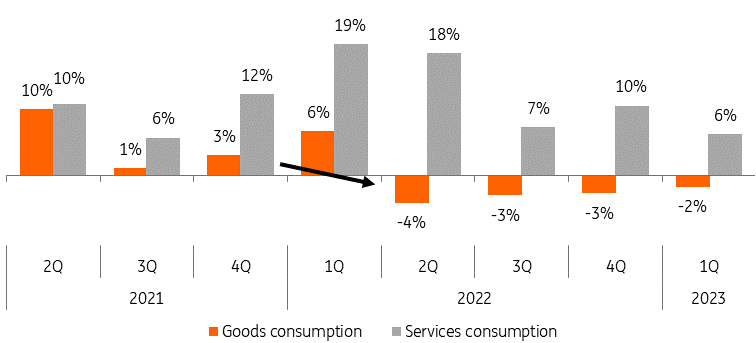

Services more popular than goods

During 2022, household consumption of goods declined due to rising inflation. Dutch consumers shifted a portion of their expenditures to services, which became fully accessible again after the pandemic. For example, the number of overnight stays, air travel, and visits to entertainment and recreational facilities increased significantly. This came at the expense of goods consumption, which has not grown since the second quarter of 2022. Durable goods such as cars, home furnishings, and also food are being purchased less. Domestic household consumption is expected to grow at a slow pace in the coming quarters, with demand for goods remaining under pressure.

Consumption services continued to grow, fewer goods purchased

Domestic private consumption, YoY volume change

Limited growth in foreign demand

After a weak first quarter, Dutch exports are expected to pick up over the rest of 2023 and 2024, in line with a recovery in global merchandise trade, which recently experienced a setback. Conditions have improved as supply chain disruptions are hardly hampering trade anymore, global destocking is gradually decreasing, and China is no longer having lockdowns. This expectation is also in line with the increased outlook of producers regarding foreign turnover in the next three months. However, goods exports are likely to grow only at a slow pace. The economies of the eurozone, the US, and the UK remain weak, and the shift from goods to services consumption continues.

Inventory reduction will gradually decrease

Producers are still relying on their inventories due to reduced demand and significantly diminished supply chain issues. The historically large stock of materials and finished products is increasingly seen as a cost item since financing has become more expensive due to higher interest rates.

With the long-lasting disrupted supply chains fresh in memory and considering the current geopolitical unrest, producers won’t deplete their buffer stocks completely. However, a majority of Dutch producers still consider their finished product inventory to be too large. Therefore, traders and final producers are aligning their inventories with expected sales. Suppliers are also reducing their inventories. This bullwhip effect has led to significant production declines at the beginning of value chains, such as in basic chemistry, basic metal, and plastic industries, but it will gradually decrease.

Bottom for energy-intensive industry in sight

On the other hand, new orders in the chemical and plastics industries are picking up again. Energy prices are also significantly lower than the average of the past year. Therefore, some recovery in the energy-intensive industry is possible from the second quarter onwards. As a result, the energy-driven growth gap between manufacturing sectors is gradually disappearing. However, due to economic headwinds and energy prices expected to remain structurally higher than in 2021, the energy-intensive industry does not anticipate a quick return to previous production levels.

Higher interest rates dampen prospects for investment goods

Higher interest rates and moderate sales expectations are inhibiting the need for expansion investments. This applies to both the manufacturing sector itself and the demand from sectors such as construction, which is experiencing a decline in investments in homes and commercial buildings. Financial surveys also indicate a decrease in investment demand.

In the first quarter of this year, investments in ICT equipment and machinery and other equipment in the Netherlands decreased by 6.2% and 0.6%, respectively. Overall, investments are under pressure this year and next, negatively affecting the demand for industrial investment goods such as machinery and equipment. However, investment expectations in the industrial sector itself are still relatively high due to sustainability requirements, capacity constraints – especially in the technological industry – and the need for expanding digitisation, automation, and robotics to mitigate the impact of labour shortages.

Many industries are still working overtime, while energy-intensive production is on the backburner

Deviation of current occupancy rate from long-term average, in percentage points

Energy gap is closing, but growth remains subdued

The energy-driven growth gap between industry sectors is gradually disappearing. Nevertheless, we do not expect energy-intensive production to return to previous levels in the near future. Growth is being held back by economic headwinds and energy prices are expected to remain structurally higher than before. All in all, a slight contraction (-1.0%) in 2023, followed by moderate growth (1.5%) in 2024 seems the most likely scenario for Dutch manufacturing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more