Dollar bloc FX: Keep calm and carry off?

A concoction of negative seasonal trends, central bank currency jawboning and a global risk wobble could leave a sour taste for AUD, NZD and CAD in August

Talking points: Currency adversity, low-rate regimes and geopolitics

Small open economy central banks dealing with unwanted currency strength in different ways

Both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) have been quick out of the blocks to talk down their respective currencies, with concerns over the negative domestic macro implications met with some tentative - albeit non-credible - threats of FX intervention. Such rhetoric is understandable - and should have been largely expected - given that net speculative AUD and NZD longs were close to their five-year highs in late July. Unjustified currency strength - or one driven by a weaker USD and a "global risk bubble" - is like kryptonite for the Antipodean economies. On the flip side, we've heard nothing from the Bank of Canada (BoC) in response to the sharp CAD appreciation - it has seemingly shut up shop for the summer after hiking rates in July. We expect the BoC to play catch-up when it comes to taking heed of a strong currency - especially as the delayed disinflation and negative net export effects begin to manifest.

Structurally lower policy rates suggest limited scope for higher local yields

Updated central bank estimates of the neutral interest rate in Australia and New Zealand sparked some debate within markets over the past month. The RBA and RBNZ both now see the neutral nominal interest rate - the rate at which monetary policy is neither expansionary nor contractionary - at 3.5%. In Canada, the BoC sees the neutral nominal policy rate at 2.5-3.5%. While one can ineptly debate the timing of when these central banks will next hike, we prefer to take a step back and focus on the big picture: policy rates in these economies are set to remain structurally lower. If we take into account a significant degree of uncertainty around any neutral rate estimate, we could argue that the market implied policy rates of 2.5% (Australia), 3.25% (New Zealand) and 2.0% (Canada) in five years time aren't far off where they should be. Flatter rate curves rooted in markets, therefore, suggest little scope for monetary policy driven currency appreciation.

Tackling geopolitical risks

Rising geopolitical tensions present a new headwind for the traditionally risk-sensitive dollar bloc currencies. While Asian markets and economies are naturally in the spotlight given their proximity to North Korea, we believe it is too early to begin factoring in any negative economic shocks stemming from a regional flare-up. While the situation will require monitoring - especially for Australia and New Zealand - given their reliance on regional trade, the first-order effect may be an unwind of JPY-funded carry trades. In particular, we see the CAD at risk initially as rising geopolitical uncertainties sees the BoC hold pat on any further near-term tightening.

Dollar bloc FX forecast update

AUD: RBA stuck in neutral gear under a ‘lowflation’ economy

- A neutral policy tone at the August RBA meeting was met with strong concerns over what the recent AUD rally means for the economy. While it was clearly noted that a soft USD had been the root cause, policymakers were keen to stress the downside risks to their inflation and growth outlook as a result of a stronger currency. Moreover, we believe that the RBA's currency concerns may have been amplified by the trade-weighted AUD breaching the 67 level - the highest since January 2015. Short-term rates have subsequently drifted lower as markets questioned the RBA’s appetite for tightening. We suspect this trend may continue - noting that market expectations for a 3Q18 rate hike may get pushed out further.

- Iron ore prices have picked up a head of steam since June, with robust Chinese demand and lower supply providing support. But, at the same time, we note that AUD’s short-term correlation with iron ore has turned insignificant. We suspect the slightly more favourable terms of trade will play more of a supporting role for the AUD - as opposed to an active driving force.

- Geopolitical tensions, seasonality and market positioning present near-term headwinds, while the ‘lowflation’ domestic economy is unlikely to provide much uplift to local rates. A data-driven recovery in US yields and the USD also point to AUD/USD downside risks. We continue to look for a correction towards 0.75 in 3Q17.

NZD: Nobody wants a strong currency, not least the RBNZ

- The RBNZ has been saying no thanks to a strong NZD for some time now and ramped up its jawboning efforts in August by dropping the threat of FX intervention into the mix. Much like the RBA, the central bank acknowledged that a strong currency comes at an external disinflationary cost - which is particularly undesirable at a time when domestic price pressures have also slowed down.

- While the threat of FX intervention remains non-credible - especially as the costs of an RBNZ rate cut in terms of financial stability risks outweigh the benefits at this stage - we think it may be sufficient in containing NZD upside in the near-term. Speculative NZD longs were hovering around five-year highs prior to the RBNZ meeting and there's a good chance positioning will begin to neutralise.

- External factors are also likely to be a limiting factor for the NZD; an uncertain global risk environment and US data-driven recovery in USD sentiment would fuel any NZD/USD correction towards 0.70.

CAD: Rally faces a fundamental reality check

- The CAD rally has run out of steam in the face of more realistic BoC tightening expectations and range-bound oil prices. On the former, the recent narrowing of two-year US-Canadian swap rates - the primary driver for USD/CAD's sharp adjustment lower - has been extreme. We look for a partial reversal as a 2H17 recovery in the US economy lifts December Fed rate hike prospects, while softer macro data in Canada questions the market's expectation for 50bp of BoC hikes by end-2018.

- Equally, we've yet to see the economic fallout from the recent CAD appreciation; the July MPR forecasts were based on USD/CAD remaining around 1.31-1.32 and any move below here can be seen as a drag on the BoC's policy reaction function.

- We believe the OECD PPP fair value of 1.27 will act as a near-term anchor point for USD/CAD. The risks are for a retrace towards 1.30 in 3Q17 as lower oil, geopolitics and softer Canadian data weigh on the CAD.

Bottom line: Time to take carry off?

While one may assume that the quiet summer period is a good opportunity to pick up some yield, we note that August is typically a strong month for the US dollar against high-yielding risky currencies – namely the AUD and NZD, which have on average in the month of August depreciated by 1.4% and 2.1% respectively since 2010. It has been a strange environment to see markets relatively calm despite the world's two biggest central banks – the Fed and the ECB – both on the verge of making significant changes to their respective balance sheet policies. With global tightening around the corner, one would have expected the carry trade to come under some pressure. Maybe August is the month where the “penny will drop”. Equally, with central banks stepping up their customary jawboning attempts, downside risks remain for the dollar bloc currencies.

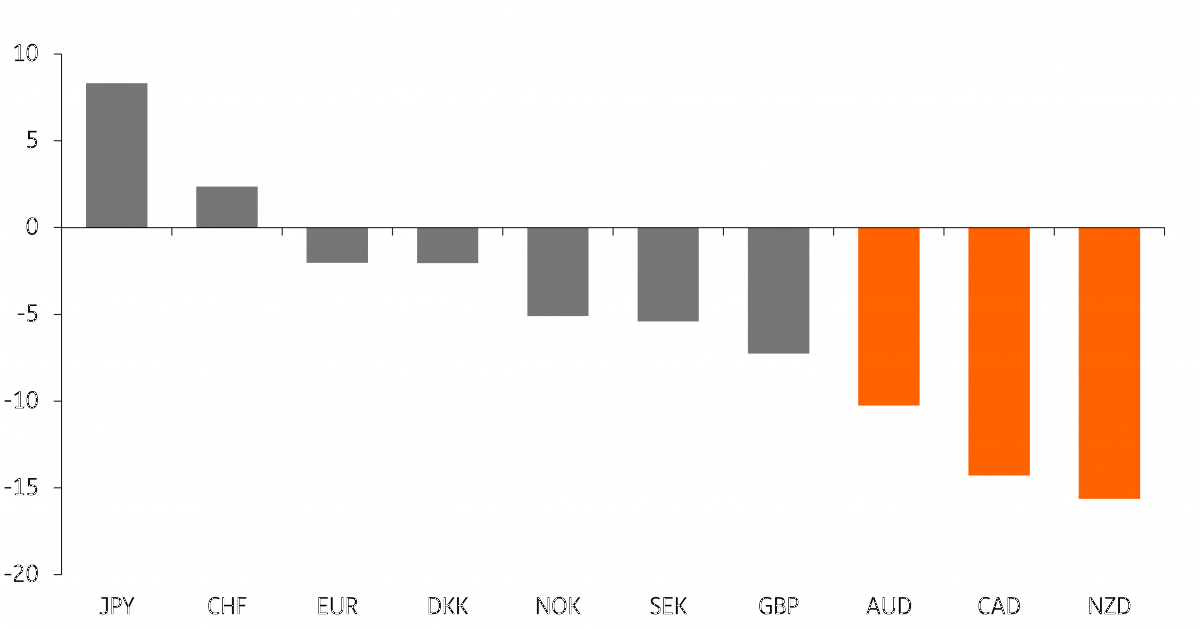

Risk-adjusted carry return since end-July

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).