Data centre growth to drive US energy policy and continued clean energy deployment

Exponential data centre growth is anticipated to drive US clean energy development under the new Trump administration, potentially unlocking a new wave of technological advances in electricity generation and grid infrastructure

Data centres to weigh on clean energy policymaking

The rapid expansion of data centres, fueled by digitalisation and the adoption of artificial intelligence, is poised to supercharge power demand growth, posing major energy challenges for the new administration. The US is home to about half of the world’s data centres, and various sources show that the share of total electricity consumption from these facilities can triple from around 4% in 2023 to up to 11.7% in 2030. The surge is forecast to be even more salient in certain hubs such as Virginia, jumping from 25% to potentially 46% over the same period.

Surging power demand from data centres

If this hockey stick trajectory is to be realised, power generation and grid infrastructure needs to be built at a similar pace, which is a lot higher than today. What adds to this challenge is the desire from the sustainability-conscious tech companies to power data centres with reliable clean power – but wind and solar today are not able to fulfill the need because of their intermittency characteristic.

This multi-pronged challenge was acknowledged at the recent Deploy24 conference on the deployment of critical energy and decarbonisation technologies in the US, organised by the Department of Energy (DOE) and attended by nearly 2,000 leaders across government, utilities, energy companies, financial institutions, and investors. Data centres and artificial intelligence were hotly discussed throughout the conference, with nuclear power and grid enhancement technologies highlighted as potential long- and near-term solutions to meet the growing demand. We foresee these two topics to be high on the Trump administration’s energy agenda as well.

Next generation nuclear power as a long-term solution

Nuclear has become a compelling low-carbon energy source to accommodate data centre-led load growth. Small modular reactors’ (SMRs’) promise to be smaller, cheaper, and faster to build than traditional plants is increasingly appealing and has seen significant progress in technological advancement; companies are also looking at re-powering currently idled facilities. The tech sector, in particular, has made big bets on nuclear with a flurry of partnership announcements in the past year.

Big tech’s backing of nuclear power (non-exhaustive)

There has been strong policy support for nuclear development throughout multiple administrations, and we expect the technology to assume an even more prominent role in the future. The DOE’s Advanced Reactor Demonstration Program (ARDP) aims to facilitate SMR technologies from concept to demonstration, with an initial funding of $230mn authorized in May 2020. The ARDP has been instrumental in enabling the advancement of current nuclear leaders Kairos Power, X-Energy, and TerraPower. The Energy Act of 2020 and the Infrastructure Investment and Jobs Act of 2021 together authorised over $5bn more in funding for ARDP projects. The Inflation Reduction Act of 2022 created tax credit support for nuclear, including the technology-neutral clean electricity production and investment tax credits (Sections 48E and 45Y) as well as the zero-emission nuclear power production tax credits (Section 45U). In September 2024, DOE’s Loan Programs Office (LPO) closed a new $1.52bn loan guarantee to help restart the 800MW Palisades Nuclear Plant in Convert Township, Michigan with plans for installing two SMR units in the future.

We expect future federal support for nuclear as well. This is reflected in Trump’s pick for the new Secretary of Energy, Chris Wright, who is on the board of an advanced nuclear developer and has already identified expanding nuclear capacity to be a key priority.

Grid enhancements need to be the near-term focus

Despite the mounting momentum in advanced nuclear technologies, new capacity is not expected to come online until late this decade at the earliest. To meet the imminent demand increase for 24/7 low carbon power, advanced grid solutions will be crucial in minimising current mismatches between power generation and demand and getting as much power delivered as possible using existing resources.

While battery energy storage system (BESS) is now under rapid development for frequency regulation, other distributed energy resources in the virtual power plant (VPP) ecosystem remain underutilised. VPPs, which are collectives of smaller generation resources such as smart appliances, rooftop solar, and electric vehicles, can provide an additional 80-160 GW of capacity (from today’s 30 GW) to fill in the renewable generation gap when the wind isn’t blowing or when the sun isn’t shining. In order to fully realise the potential of VPPs, federal policy support is needed to overcome some of the current bottlenecks, including standardisation of operations and integration into wholesale markets.

In addition to flexibility, reducing transmission line losses is also important for grid enhancement, which can be done through hardware and software upgrades and could potentially lead to a quadrupling of grid power flows. For hardware, advanced conductors made from innovative materials like carbon fiber and ceramics are both lighter and stronger than traditional steel-based materials. This results in greater carrying capacity and enhanced resilience under high temperatures. For software, dynamic line rating systems allow for real-time adjustments to transmission line capacity based on actual weather conditions, rather than relying on static ratings that use worst-case assumptions.

Developing and implementing these abovementioned solutions in generation, transmission, and grid operations will be critical over the coming year to address the energy bottlenecks for data centre growth and advance clean energy deployment in the US.

What is our broader view on the US clean energy policy outlook?

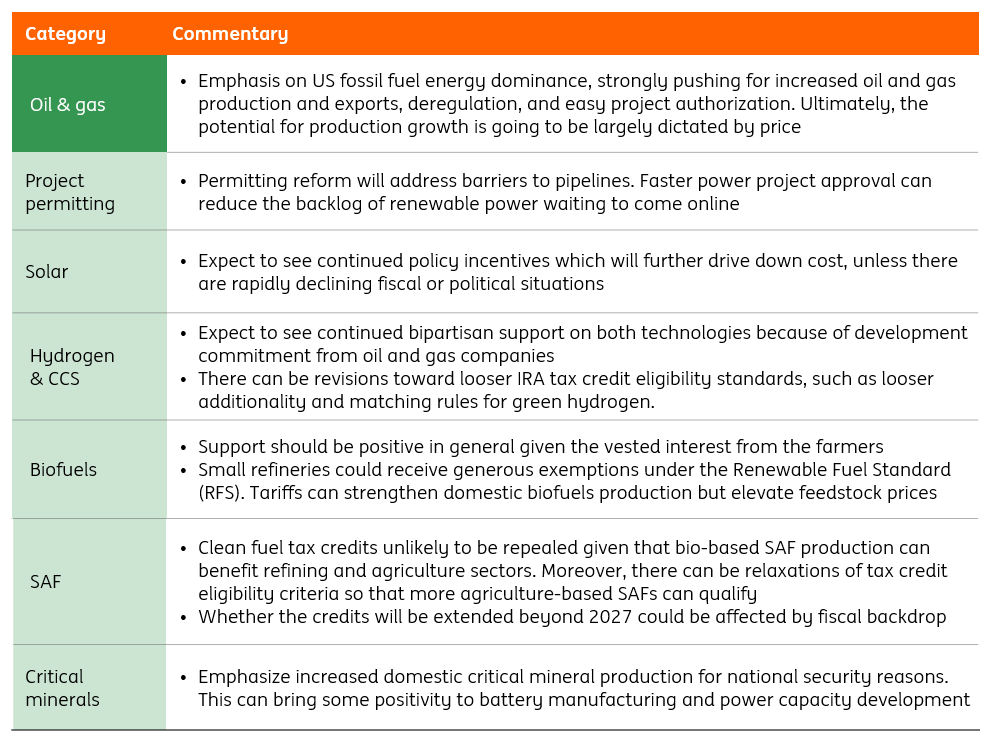

We expect a milder ‘carrots’, almost no ‘sticks’ where substantial regulation swipe-outs and a focus on fossil fuel production can add speed bumps to the US’s green agenda. But many clean energy incentives under the IRA may find a lifeline, and we still see potentials of turning challenges into opportunities.

Supportive/moderately supportive policy

Neutral policy

Unsupportive/moderately unsupportive policy

What is the investor and government sentiment about the energy transition in the future?

The private sector and the government have crucial roles to play in meeting US power demand and accelerating the energy transition and cannot replace one another. Public-private partnerships and blended finance, where achieved, can be key in bringing a clean technology to mass adoption. On top of that, the tax credits under the IRA can further enhance a project’s revenue streams.

From the private side, investors remain committed to investing in clean energy – to leverage on opportunities that can create value in the long term. Nevertheless, with expectations of weakened policy support in certain clean energy areas, we see more caution from investors on company and project selection.

That said, even more so than before, investors are looking for companies and projects with compelling business models. A compelling case can be achieved via designing superior products, connecting to critical infrastructure, as well as securing permitting, procurement, and offtake. All these can lead to long-term predictability and hence investor confidence. It is true that these aspects would become harder to realise absent an enabling policy ecosystem, which can lead to delayed final investment decisions (FIDs), canceled projects, or longer technology development periods. But as mentioned before, many technologies can still get continued – albeit modified or reduced – policy support. It will then be important for developers to identify the certainty from the uncertainty, the positive from the negative, which can yield a more effective strategy and communication (re)positioning.

As for the government, the current DOE thinks of the US energy transition and manufacturing transformation as ‘private sector-led, government-enabled’. It highlights the importance of the government in filling some financing gaps – or the missing middle – to help promising emerging technologies to go beyond the pilot phase that is largely funded by venture capitalists and be scaled up to attract more institutional investors. And the DOE is persistent on maintaining a high bar in project selection for funding. We expect the new administration to support AI-related and cutting-edge carbon-free technologies, meanwhile facilitating competitive emerging technologies toward true commercialisation.

Conclusion

The US clean energy industry is set to create new norms of doing business in 2025 and beyond. The pressing need to meet the energy demand of data centres presents the single most important opportunity to develop clean firm energy and upgrade the grid. This will then provide a more enabling environment for companies outside the data centre/AI industry that are looking to decarbonise.

Moreover, innovation-fueled technological advancement can retain attractiveness to public funding they can appeal to security and competitiveness. The development of these technologies will then need upgraded and expanded infrastructure, making a case for more investment in the space. The US energy transition model, which has been different from the EU’s, will continue its uniqueness.

Download

Download articleAuthor

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more