Czech Republic: Slightly higher supply despite continued consolidation

Although the government continues to consolidate public finances, the supply of bonds will be slightly higher this year due to the unfavourable redemption schedule. The Ministry of Finance will also focus more on EUR-denominated issuance. However, the risk is lower supply due to the possibility of using supranational loans

Fiscal policy: The election year should not interrupt the consolidation

According to our estimates, the government ended last year with a deficit of 2.5% of GDP, the first year fully affected by the consolidation package introduced earlier, and also hit by the flood costs. For this year, the government approved the budget in December, and we maintain our usual positive bias on the Ministry of Finance's plan for the Czech public finances with a forecast of a 2.0% of GDP deficit. Although the September general election increases the risk of higher spending, historically any changes before elections have fit within approved budgets.

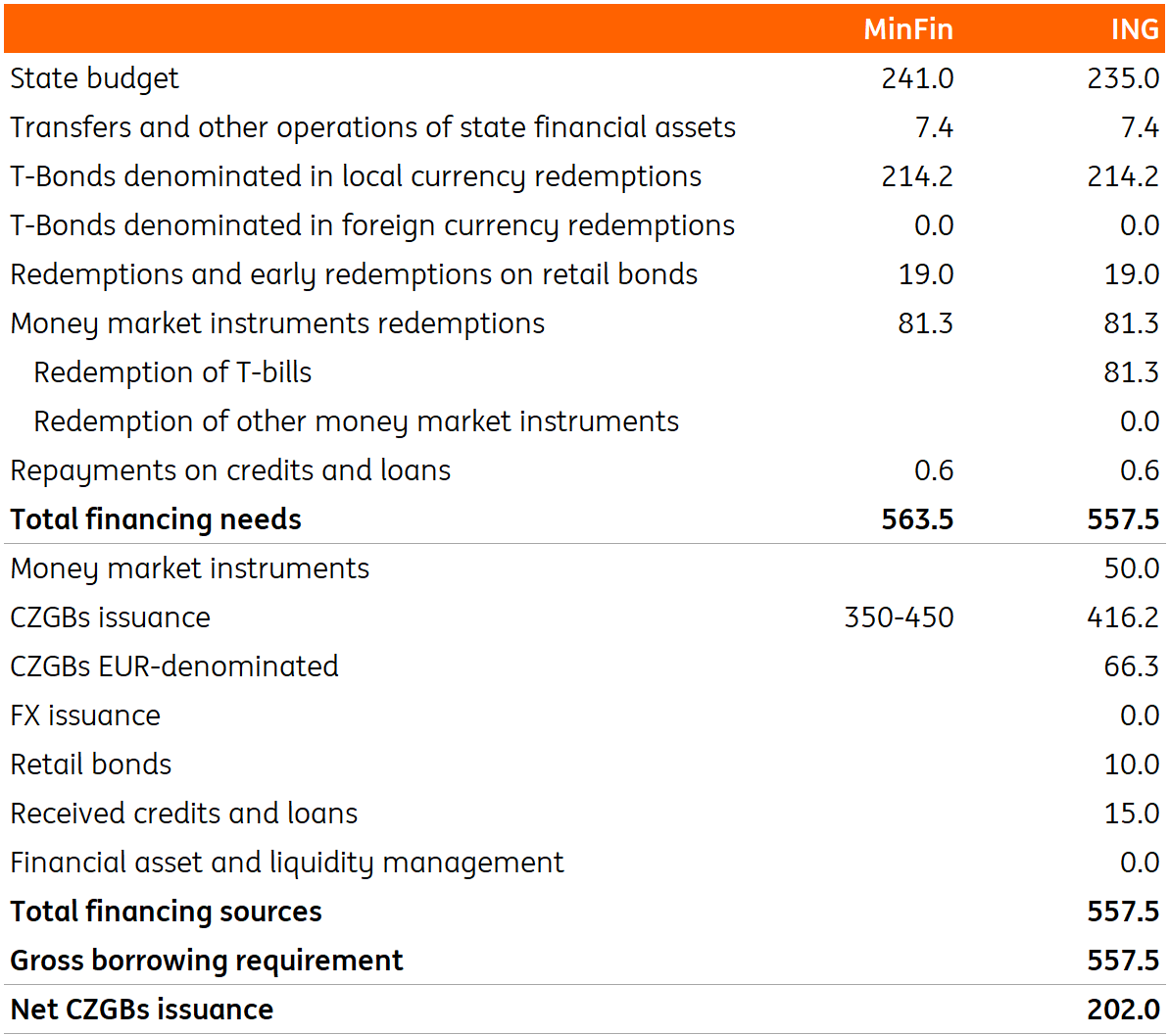

Gross financing needs and CZGBs issuance (CZKbn)

Local issuance: Slightly more government bonds but also EUR-issuance

Although the government continues its consolidation efforts this year and the deficit continues to narrow, higher redemptions will lift gross borrowing needs compared to last year. We expect an increase in borrowings from CZK530.7bn to CZK557.5bn (+5% YoY, 6.6% of GDP). Gross issuance of Czech government bonds (CZGBs) will rise slightly from CZK376.0bn to CZK416.2bn (+11%), but higher redemptions will keep net supply flat at CZK202.0bn. The Ministry of Finance is looking to develop the EUR-denominated CZGBs market under local law for future nuclear power expansion financing. Therefore, we are likely to see more issuance of these bonds this year, including a refinancing of EUR-denominated T-bills from last year. At the same time, the Ministry of Finance has the European Investment Bank's facilities, which could push down our estimate of the supply of CZGBs if the Ministry of Finance decides to use them fully, depending on market conditions.

Given the comfortable supply and high demand, the Ministry of Finance extended the average maturity last year with the average issuance maturity of 10 years (average maturity of 6.3 years by end-2024). This year we can expect a similar issuance pattern focusing on the long end of the curve in the 2034-35 and 2038-39 segments. The risk towards higher issuance of CZGBs is the possibility of prefinancing next year through switches in the secondary market, where the Ministry of Finance increased activity and sold about CZK41bn, mainly at the end of last year.

Financing needs for 2025 (CZKbn)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 January 2025

CEE Issuance Outlook 2025: Another year of heavy issuance This bundle contains 8 Articles