3D printing set for post-pandemic rebound

The growth of 3D printing plunged in 2020 due to the Covid-19 recession, but the experienced vulnerability of supply chains and the economic recovery could be catalysts for a rebound. We expect growth to recover to 25-30%, slightly higher than in the years before Covid-19. We don't expect 3D printing to be applicable for mass production any time soon

3D printing back in the spotlight

3D printing caught quite some attention half a decade ago. In our 2017 report, we discussed the possibilities of the technology and its consequences for world trade. Now that 3D printing has come to the rescue in at least some markets where Covid- 19 has caused supply shortages, the technology is attracting attention once again.

The three articles in this follow up to our 2017 study look at the development of 3D printing in recent years. As for its future, specific attention is given to the short and longer-term effects of the pandemic on the outlook for the 3D printing business.

Short run pain of Covid 19: a setback in demand

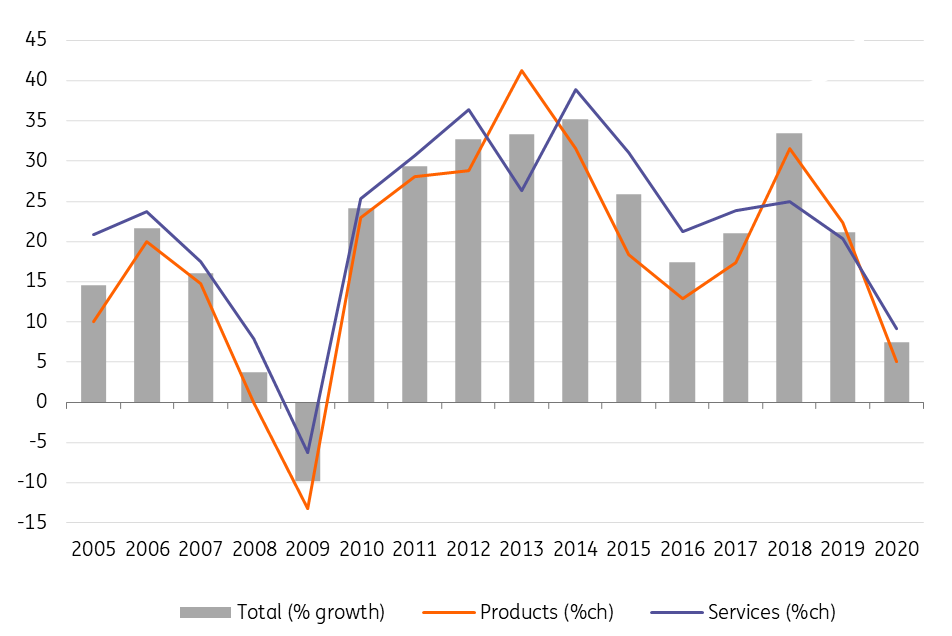

The Wohlers Report 2021 shows that the revenue growth of the 3D printing business dropped to 7.5% in 2020 and that this is substantially lower than the average growth rate of 25.2% in the previous three years. Quite a few 3D printing companies recorded significant losses. Nevertheless, a positive growth rate is relatively good given the worldwide recession last year. It also compares favourably to the financial crisis when, according to the Wohlers Report, 3D printing revenue dropped 3.7% and 9.8% in 2008 and 2009, respectively.

Click here for more information on the Wohlers report

Worldwide revenue growth 3D printing business, % change to previous year (2005-2020)

According to 3D printing consultants such as Wohlers Associates and Joris Peels, many manufacturing companies decided to postpone plans to invest in 3D printers last year due to their own financial problems caused by Covid-19 and because of the significant uncertainty about the near future.

Small desktop printers more in demand than larger industrial ones

The 7.5% revenue growth the industry nevertheless managed in 2020 originates in part from the large number of printed products sold by the service departments of 3D printer manufacturers and from specialised 3D printing service companies. Those who postponed buying a printer for ‘in house production’ turned to these companies to fulfil their needs for printed products. Together with maintenance and training activities, these activities make up 3D printing services. And those services grew by 9.2% in 2020, according to the Wohlers Report 2021.

Besides services growth, the 6.7% increase in sales of smaller 3D desktop printers to 753,000 units last year made an important contribution to the industry's overall 2020 revenue growth, the report says that due to the pandemic, revenue growth dropped to 7.5% but that compares favourably to the previous recession.

Dut to the pandemic, revenue growth dropped to 7.5% but that compares favourably to the previous recession

The same report shows that a negative contribution in 2020 came from the larger industrial 3D systems (priced above $5,000). Sales dropped 8.4% in 2020 to 21,000 units. During the previous three years, the growth in unit sales of industrial systems had been 20.7% on average. The demand for large printers has, in part, been substituted by demand for 3D desktop printers which are continually declining in price.

The plunge in demand for those large, industrial printers has led to significant cost-cutting operations within 3D printing producers and, in some cases such as Voodoo Manufacturing, the end of the enterprise. The smaller production capacity that results from this means that supply constraints may curb the recovery in the near future.

In 2020, the revenue associated with materials that 3D printers' need increased by 9.9%, according to the Wohlers report. This indicates that the stagnation of investments in industrial 3D printers is not accompanied by a proportional decline in products made with 3D printers.

Long-run gain of Covid- 19: an impulse for adoption of 3D printing

The pandemic has shown how vulnerable international supply chains are to disruption. The unanticipated shortages in the supply of intermediate products have led to sudden unwanted cutbacks or the temporary standstill of production in various industries, not just in eye-catching markets such as automotive. According to a survey by Euler Hermes in the last quarter of 2020, sectors like Machinery & Equipment, IT, Tech, Telecoms, and Energy & Utility suffered even more severe disruption than the automotive sector. The US stands out here with most companies experiencing ‘severe’ disruption in 2020 (26%).

The pandemic has caused supply chain disruptions leading to shortages of various intermediate and final products. 3D printing has come to the rescue in some of these cases. The ease in which 3D printers can switch from producing one product to producing a totally different one makes it easy for them to resolve unserviced demand.

The interruption of supply has triggered discussions in boardrooms on how to increase the resilience of supply chains. Thoughts naturally turn to diversifying suppliers and increasing inventories, but that is easier said than done, as shown in this ING report for electronics, automotive and textiles industries.

Covid-19 could be the shock that many CEOs need to overcome their fear thresholds for new technologies

Covid-19 could be the shock that many CEOs need to overcome their fear thresholds for new technologies. People working in the 3D printing industry consider the fear threshold for new technologies one of the obstacles for the wider application of 3D printing, according to ING’s 2017 study. Of course, it remains to be seen how strong this effect will be in future years.

In his 3D printing consultancy work, Joris Peels notes clearly that the role 3D printing has been playing in solving the supply shortages during the Covid-19 crisis has changed the attitude of companies towards 3D printing: ”Before the pandemic, most companies would order a printer for experimenting and it would usually take a long time before 3D printing would subsequently be incorporated in the regular production process, if at all. Now that 3D printing has become much better known and trusted due to its success during the crisis, we are seeing a vast increase of companies that seriously consider integrating 3D printers in their production process. And they ask us how they can do it as soon as possible.”

Waning expectations

The share of 3D printing in worldwide manufacturing is still very small (0.1%) and since our 2017 report, the annual growth decreased from 29% to 21%. But the 7.5% turnover increase in 2020 in a shrinking global economy shows that 3D printing still has potential.

Supply disruptions due to Covid-19 have been an opportunity for the 3D printing business to show its value. 3D printers stepped in when traditional machines could not handle the exploding demand for face masks, nasal swabs and ventilator parts. The American 3D printing company Carbon, for example, produced a million nasal swabs per week in April 2020.

3D printing did not only step in to service extra demand for certain (pandemic-related) products. It also helped out in cases where supply chain disruption caused by the lockdowns led to more general shortages. For example, the Italian company Isinnova started to design and 3D print valves that were in short supply.

Expectations that 3D printers will become the dominant production method need to be tempered significantly

This experience is, according to consultants, contributing to a decrease in the 'threshold fear' in boardrooms for investing in 3D printing. The underlying growth of 3D printing is also being driven by rising demand for customised products; printing facilitates customisation because the marginal cost of making product variations is virtually zero. We expect the 3D printing business to grow 25- 30% per annum until 2040.

But industry experts are less optimistic than a few years ago that production with printers will any time soon be fast enough to make the printing of standardised products, such as binbags and bottles, economically viable. This means that the expectation that 3D printers will become the dominant production method in manufacturing needs to be tempered significantly.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 August 2021

3D printing’s post-pandemic potential This bundle contains 4 Articles