Copper goes back to a back

The LME Copper cash three-month spread has swung into backwardation for the first time since 2016. In a market where the curve takes precedence, nothing drives prices like a backwardation. However, we remain cautious that the tightness is more technical than structural, at least for now

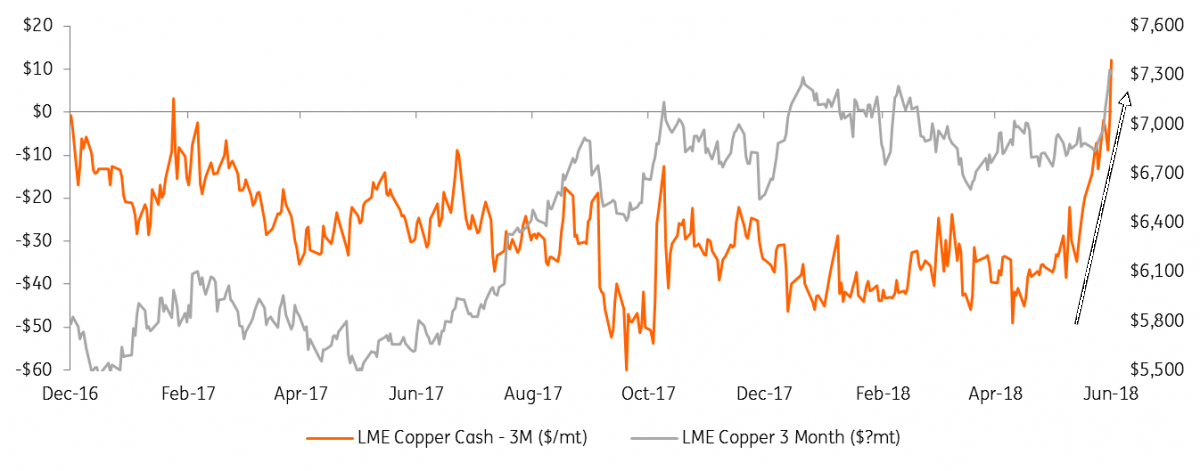

Prices rise as front spreads tighten ($/mt)

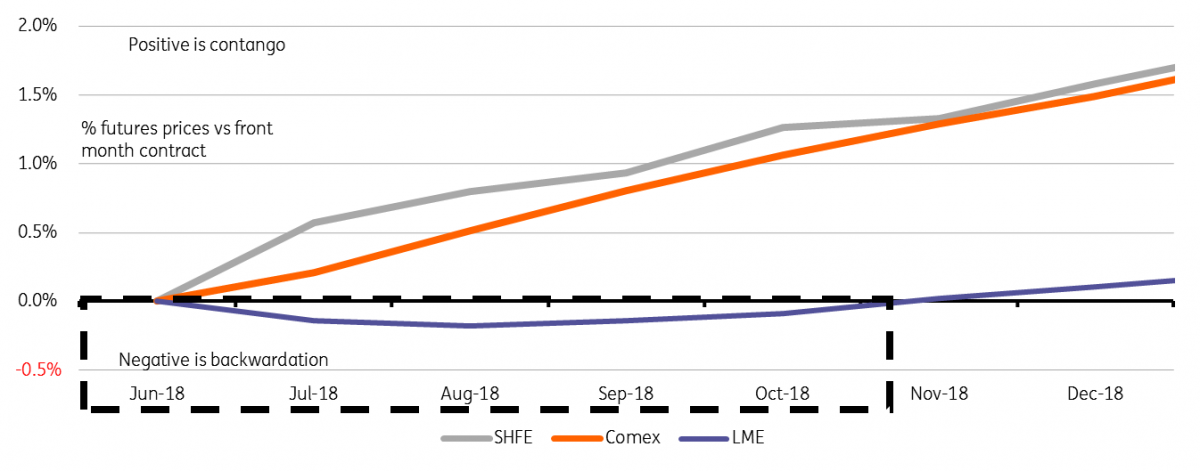

The pocket of backwardation is just in the front months ($/mt)

Back to a back

The LME Copper forward curve closed at $12/mt backwardation on Friday with futures discounted as far as November 2018 and deepest into August 2018. This is a sharp swing from a contango averaging almost from $40/mt January through to April 2018. Whilst those previously-wide levels discouraged traders from holding long positions (it costs to roll a long position through a contango) today's backwardation will be more attractive. Most funds though will prefer to hold positions beyond the three-month date. The contango remains in place here so the inflows may be more limited.

A backwardation at just the front of the curve is an odd phenomenon and most of the time indicates a technical tightness rather than being fixed in the fundamentals. As we have continually stressed, at least when it comes to the nearby spreads, it is the availability of stock to the market rather than total stock levels that matter most. In our last note, we highlighted how the tightening of the curve since mid-May has coincided with a building dominant position (now standing at 40-49% of LME copper warrants). LME lending rules ensure that the front prompt dates do not get squeezed in such a scenario (the dominant holder is obliged to lend the tomorrow/next, one-day roll at set rates) but looking a bit further out along the curve and that influence can clearly be felt.

Divergent copper curves: The tightness is only on the LME

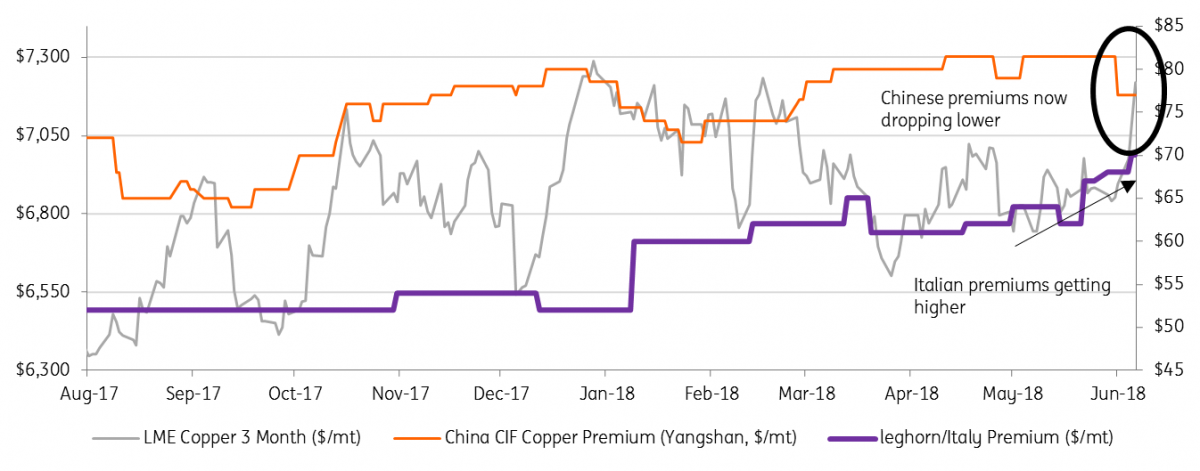

Outside of Europe physical looks softer, but the timing will be everything

The tightness of the spreads appears then to be largely limited to the LME and should stockholdings become more freely distributed, the tightness could unwind, taking the steam out of the recent rally. Indeed, Comex remains in a wide contango as US stockpiles continue to swell, as on Shanghai. With the copper import arb into China at a widening loss and spot premiums dropping through June, the lack of tightness from the largest consuming country is certainly at odds with the swings in the curve.

The only place we currently see a genuine pick up in tightness is in Europe. LME stocks here have drawn by 40kt since March and have tended to be more fundamentally reflective than Asian/US stocks these last two years. Premiums in Italy (leghorn) have surged 35% year-to-date with the wider Rotterdam benchmark now also rising 7% since mid-May in step with the premiums.

The fundamental question for how prices settle as we see it, therefore, is how long do stocks remain unavailable to the LME market and if this continues, can the emerging physical tightness in Europe be sufficient to drive a change in global conditions?

The most significant position in the LME futures banding report shows a dominant short position (20-29% of August open interest), which is sufficient to hedge up to 50% of current live stock levels. If this does indeed show the dominant stock is hedged out to late August, this would more than cover a crucial period where many of the Europeans who are currently caught short will have to source additional spot units that will likely drive at least EU premia further. The now permanent closure of Vedanta's Tuticorin (400ktpa) may also require more cathodes to be sent to Asia. The confluence of these features could well support a stronger 3Q for copper than we anticipated.

Watching moves in spreads/LME stocks/dominant holder and premiums will be key for copper traders over the next few weeks/months. When spreads normally tighten amid lower premiums, deliveries to the exchange are usually prone to upset the party. The availability of copper cathodes off-warrant will surely then be put to the test. The degree of flows from scrap yards at the higher prices- and as backwardations prevent profitable financing- are another known unknown.

Chinese premiums dip but Europe is getting tighter ($/mt)

Escondida: Just a coincidence?

While media has focused on the nervousness surrounding labour talks at Escondida, the world’s largest copper mine, we don’t think this adds up as an explanation for the rally, rather we think it’s the swings of the curve that's paramount. We would highlight just a few reasons why the Escondida news doesn’t fit the cause:

- No new news- The negotiations have been known for well over a year now so why should copper rally as talks begin? A strike has always been possible and the fact that negotiations appear to be ongoing without any immediate disruptive actions is, if anything, positive. The time for an “Escondida rally” if any would have been when early talks broke down.

- Where were the funds?- Moves in open interest suggest most flows followed rather than led the rally. LME open interest jumped almost 7% last week but talks began on 4 June and even by the close of the 5th those positions were only up by 1.7%. It wasn’t until the 6th with again no additional news flow that the bulk of new positions were built. SHFE is the same trend and actually the gains in O.I are much milder than previous surges in 2017. Lastly, Comex net speculative positions were still only mildly bullish the day after talks started (5 June) with most of the recent net increase from a dip in shorts rather than fresh longs.

- A strike would need to be big- As was the focus of last week’s note, given the smooth start to negotiations at other mines, our models suggest a balanced market given the historically-ample 5% disruption allowance. A 44-day outage last year was extreme and BHP is unlikely to tolerate a repeat of this.

- Plenty of time – The current labour contract expires 31 July, which means that the earliest a strike could legally occur would be mid-August (following mandatory government mediations). Negotiations at two mines went down to the wire this year (Codelco Norte, Los Pelambres) so funds betting on strike risk are likely to wait.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).