Breaking below $1300/oz

Gold prices fell 1.5% on Tuesday 15 May, breaking below $1300 for the first time this year and ending what has been an incredible range bound for five months.

At times it seemed as if the yellow metal is prime to spring higher, but after several failed attempts to meaningfully consolidate above $1350 and attract decent inflows this year, it was the rebounding dollar and the step up in yields that set the only remaining path: down.

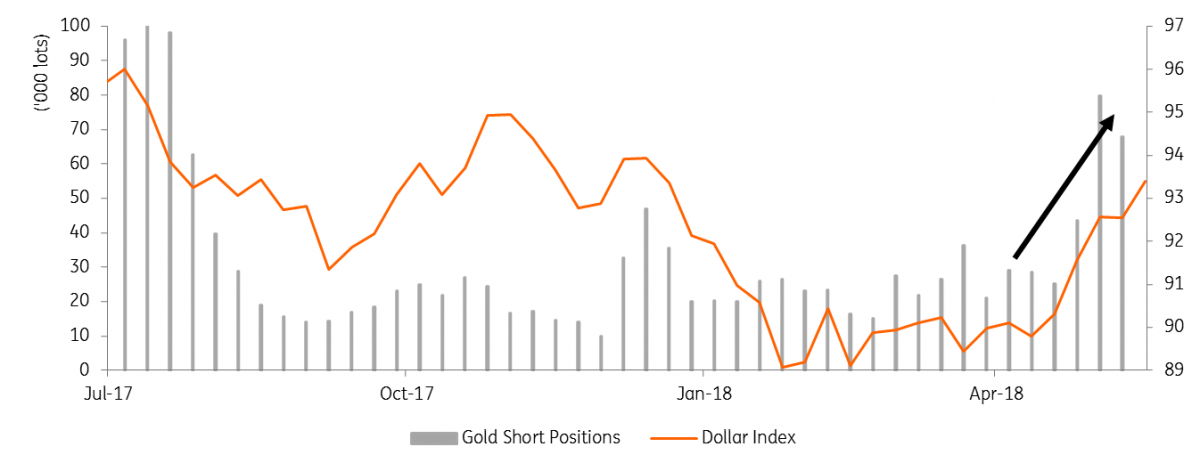

Gold's dull performance has indeed fatigued the long fund community for some time. Money manager longs were already reduced to just 109k lots by early May which is the lowest level since early 2016. We believe the USD rally from mid-April is symbiotic of a short squeeze rather than any change in fundamentals, but a surge of money managers that went short gold since the dollar turned suggests those funds saw things differently. The open interest had continued to rise after that which points to a continual short building right until the drop. Perhaps those speculative shorts were anticipating, like our rates team predicted, that as that dollar rally came off the boil, the US 10yr yield was free to break above the psychologically significant 3%.

We are under no illusion that rates and currencies direct gold above everything else, but the impact of a tightening physical market will play an increasing role to cushion these lows

As the 3% yield breach occurred on Tuesday, Gold’s non-yielding qualities were punished. Gold traders should expect more of the same headwinds for the next few months as ING strategists see yields on track to hit as high as 3.4%. But, with much of the fund longs already flushed out, growing inflation, geopolitical risk and a pick-up in physical demand should limit the downside. Things shouldn’t get much worse, but it will take time before we see improvement.

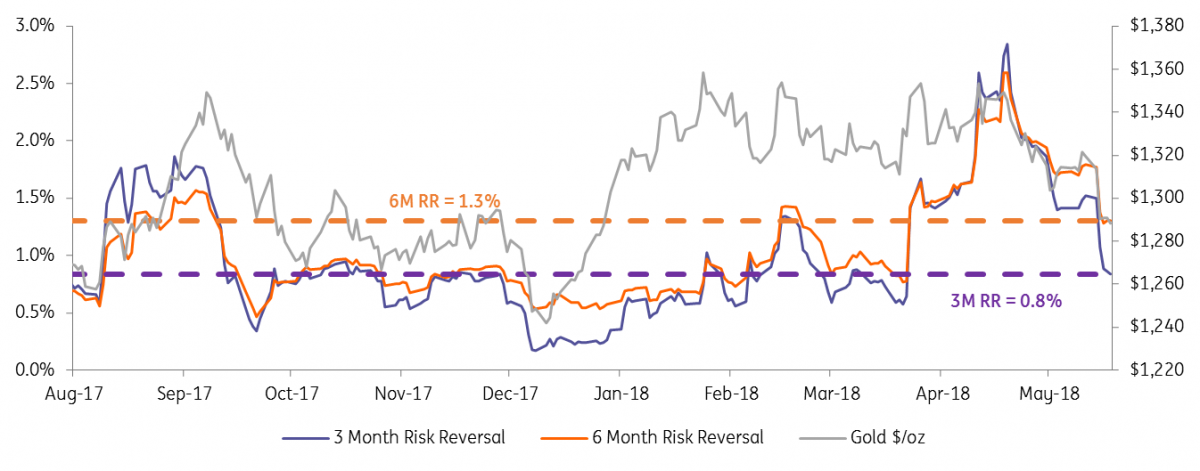

Looking at the options, it would seem the funds have the same dwindling near-term conviction but also hold out on further optimism. The 3-month premiums for calls over puts have collapsed even as prices fell but further forward the options markets are still pricing higher upside demand.

Dollar rebound spurred funds to go short gold

Options still skewed to upside further out but nearer term conviction has gone

25 Delta Risk Reversal's (RR)= 25 delta calls- 25 delta puts (i.e premiums paid for upside optionality vs downside)

Fundamental case for holding Gold remains intact

We expect longer-term holders/consumers to build a floor for the yellow metal even if it remains shunned by active money managers hunting for more attractive near-term returns. Indeed, ETF holdings have increased to highs not seen since 2013, with little sign of liquidation post the sell-off. We look to the flattening yield curve and burgeoning twin trade deficits against the looming catalyst of mid-year elections or nearer term trade spats that could highlight the US policy/political uncertainties and spell a reversal for the greenback.

As the dollar eases, it will be game back on for our bullish gold view, given our expectations for inflation to pick up substantially this year. Our economists expect US core inflation of 2.8% in Q3 with potential highs above 3% as higher oil prices feed through. Oil importing countries are looking more squeezed at the same time as facing higher US borrowing costs; a collapsing Turkish Lira could be bright spot for demand since the country is already the 5th largest for gold retail investment demand ( according to Metal Focus) and the sanctions on Iran are already reported to be driving a pick up in demand in what is the 4th largest country for gold jewellery consumption.

Overall, the first-quarter was awful for gold demand so even before considering the lower prices an improvement should be on the cards. The World Gold Council estimated a 7% YoY decline for Q1 demand which was a decade low and led very much by the 12% collapse in India. However, as the WGC point out, Q1 Indian demand was temporarily hit by the fewer auspicious days in the quarter (days deemed lucky for weddings). There were only seven such auspicious days in Q1 compared to 33 for the rest of the year.

The weakening Indian rupee might well prevent a stellar rebound, but rural farmers are also likely to gain jewellery purchasing power on improved crop yields and government subsidies. Chinese demand has been roaring for a while. Q1 jewellery spending was up 8% YoY but in RMB terms gold prices are now the lowest since early 2017 so we expect to see more ''bargain buying" take place.

We are under no illusion that rates and currencies direct gold above everything else, but the impact of a tightening physical market will play an increasing role to cushion these lows. With North Korea negotiations looking less likely and the EU-US trade standoff going down to the wire, it is possible near-term geopolitical inflows could create support, but it is more likely to see prices lull for the next few months until US political and policy instability comes back in focus.

Download

Download article18 May 2018

In Case You Missed It: Testing times This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).