Commodities are buoyant but supply concerns are still a worry

Metals prices are flirting with record levels, agricultural markets are trading at multi-year highs, and oil has staged an impressive recovery. The post-Covid-19 recovery is clearly bullish for commodities. However, what is less clear is whether we can call this a super-cycle. We remain more comfortable calling it a cyclical uplift

Pedal to the metal

Copper prices are in striking distance of their all-time highs made in 2011, whilst iron ore prices have hit record levels and edging ever closer towards $200/t. China has been key to the broad-based rally we have seen across the metals complex, with its post-Covid stimulus boosting infrastructure projects, and in turn boosting demand for metals. However, it’s not just China where we are seeing a recovery, global demand is making a return as more economies reopen, and downstream sectors restock following the pandemic-induced lockdowns. US plans for a large infrastructure spend have only provided further support to markets, with investment planned to go towards electric vehicle infrastructure, power grids, as well as roads and bridges.

Fundamentals for the bulk of metals are constructive, with recovering demand helping to tighten balance sheets. Visible inventories have generally trended lower, including in China, where we have entered a period of usually stronger demand. However, most metal markets have entered this period of seasonal demand strength with below-average domestic inventories, which has helped to underpin prices.

Supply issues have also become more of a concern for certain metal markets. There were worries over supply risks around copper from Chile, given the latest Covid-19 related restrictions, along with port strikes, although this does not appear to have had much impact on supply. However, it is the steel and aluminium market where there has been a lot more noise around supply. Regional government restrictions within China for the aluminium and steel industry have raised worries over tighter domestic supply, and obviously with China a key consumer of metals, tightness or even perceived tightness has ramifications for the global market.

The greening of the global economy expected to benefit metals' demand

In addition to the constructive short-term fundamentals, the longer-term narrative is also quite bullish, with the greening of the global economy expected to benefit metals' demand. However, it is in the medium term where we believe we should see a downward correction for most metal prices. If we use copper as an example, the supply picture does start to improve as we move into the second half of this year, which should help to alleviate the tightness we are seeing in the market at the moment, and in fact we see the copper market returning to surplus in 2022.

In addition, the Chinese government has voiced concerns over rising commodity prices, and so the market should not rule out the potential for government intervention in a bid to cool down markets. This could include releasing metals from state reserves or tightening credit conditions.

Supply worries push agri markets higher

Agricultural markets have tightened considerably over the year, and the initial catalyst for this move was strong import demand from China. Having drawn down domestic inventories in recent years, we are seeing China restock, along with increased feed demand as the country’s pig herd recovers following the African Swine Fever outbreak. As a result, China is estimated to import a record 28mt of corn in 2020/21, up from almost 7.6mt last season.

Agricultural commodities have also benefited from stronger Chinese demand

Other agricultural commodities have also benefited from stronger Chinese demand, including soybeans, wheat, and sugar. Whether this demand from China is sustainable moving forward is the big question. Domestic corn production in 2021/22 is expected to increase due to higher domestic prices and government policy. Higher corn prices will also see the ratio of corn used in animal feed drop. The USDA forecasts that Chinese corn imports in 2021/22 will fall to 15mt, still high on a historical basis, but quite a drop from the current marketing year estimate.

Supply concerns have coincided with this stronger Chinese demand. If we look to South America, drought conditions have weighed on the outlook for several crops. Brazil’s second corn crop this season is facing downgrades because of dry conditions. Brazil is also set to see a decline in sugar output from the Centre South region, with weather weighing on yields, and this follows poor sugar crops from Thailand and the EU in the 2020/21 season.

However, we are in the US planting season, and given the strong price environment for corn and soybeans, we are likely to see farmers increase acreage significantly for the 2021/22 marketing year. This should help relieve some of the tightness we are seeing in the market later this year (assuming we have normal weather conditions over the summer), which should see prices trend lower from these elevated levels.

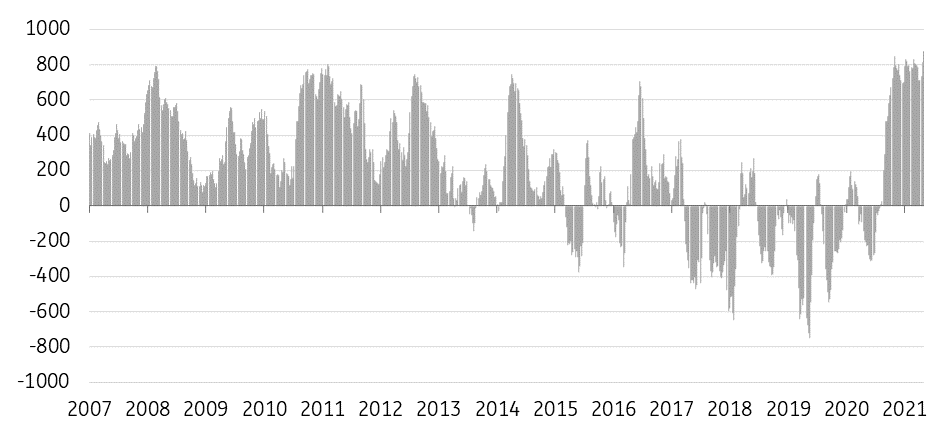

Positioning data, particularly for corn shows that the market is very long at the moment, and so the risk is that if we do see a bearish catalyst in the coming months, such as much larger corn acreage in the US, we could see a fair amount of speculative money liquidating.

Speculative net long in agricultural commodities at historical highs (000 lots)

Oil likely to play little role in a potential super-cycle

Oil markets have been mostly rangebound over the last month, with ICE Brent struggling to break above US$70/bbl. There are several factors which appear to be holding the market back for the moment. OPEC+ is set to increase output by 2.1MMbbls/d over the next three months. Iran has been increasing output for much of this year, despite US sanctions, and this is a trend which is likely to continue for the remainder of the year, regardless of whether we see a quick lifting of sanctions or not. Then, the latest Covid-19 wave across India is a big worry for the oil market, given it is the third-largest oil consumer in the world. Therefore there are concerns that if the situation deteriorates further, we may see a significant hit to global demand.

The biggest downside risk is if oil demand does not recover quickly

However, we continue to believe that prices will edge higher as we move through the year, and still expect that ICE Brent will average US$70/bbl over the 2H21. Despite rising OPEC+ output, and also accounting for larger Iranian supply, the market is still set to draw down inventories throughout the year. Obviously, during these uncertain times, the biggest downside risk for the market is if oil demand does not recover as quickly as many in the market are anticipating.

We believe that oil will play little role in any potential super-cycle, firstly OPEC+ is still holding off almost 5.8MMbbls/d of supply from the market, even after accounting for the production increases we should see over the next three months, and so if the market rallies too much, we would likely see OPEC+ ease cuts at a quicker pace. In addition, and more of a medium- to long-term cap for the oil market, is that stronger prices will only see increased drilling activity from the US. So, if we are going to see a super-cycle, the commodities complex will have to rely on metals and agriculture.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 May 2021

Someone left the cake out in the rain… This bundle contains 12 Articles