China’s residential property market is growing again

China's growing middle class continues to drive housing demand, but we believe restrictive policies are (still) working to avoid a bubble burst

Surprisingly strong growth in 1Q18

China's property development sector is well known to be under government's restrictive mortgage and administrative measures, especially the residential property market. By this logic, investment in the industry should remain controlled.

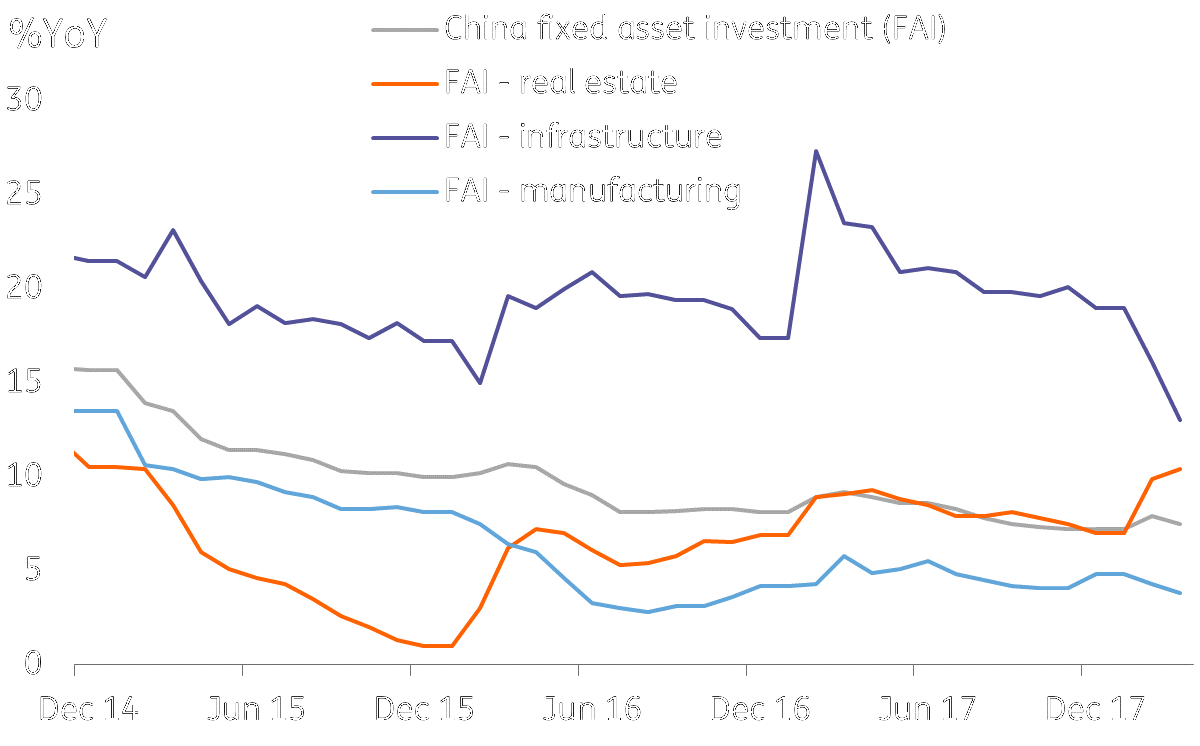

But 10.4% year on year growth of real estate investment in March is certainly a stronger than expected number for the market. The last time fixed asset investment in real estate grew at this speed was in February 2015. Growth in real estate investment was only 7.0% in 2017.

Interestingly, restrictive measures haven't deterred property developers experiencing good sales, which has driven them to invest more in the sector.

Fixed asset investment growth by industry

Residential property drives growth

Sales of private residential properties were 11.4%YoY in the first quarter of 2018, not only beating the overall sector's 10.4% but also contributing to more than 84% of all property sales, which include office and retail too.

We believe strong home sales have led to the 12.2% rise in new home construction, which was above the overall real estate sector's 9.7% growth. Land sales value grew more than 20% even land sales area grew only mildly by 0.5%YoY. All in all, these activities have pushed up fixed asset investment in the residential real estate by more than 13%.

Better home sales came from higher prices

Sales have been stronger than expected because house prices have continued to rise. Though the Statistic Bureau reported that out of the 15 major cities, seven of them suffered from falling new home prices on a monthly basis in March, the phenomenon did not apply to a larger picture of 70 cities.

Out of the 70 cities in China, 55 cities experienced rising home price on a monthly basis, and 60 cities had a higher home price on a year-on-year basis in March.

Home buyers moving to affordable cities

Our view is that restrictive policies are still working to avoid a bubble burst.

The responsibility of housing policies lies with the local government rather than the central government which is why different cities have different restrictive measures on down payment for mortgages, eligibility of potential buyers to buy their first home or additional homes; and home pricing policy on property developers. And, these measures change from time to time among cities.

So when buyers end up buying in cities, they have not lived in just because of lower house prices and slightly looser policies, this drives up the prices in lower-tier cities.

But so far this has not created a large crowd arbitraging different policies in different cities mainly because buyers are expected to have a job in the city that they would like to buy a home in. This is a big decision for most people. More, not many buyers are willing to invest in homes that are located in a remote location of the country because they risk a low resale value in cities that have a small population.

So the central government's delegation of housing policies to the local level is still effective to control housing bubble, and the objective of the government is not to suppress home price to a level that leads to bubble burst.

Investment in real estate will continue

We believe the growing middle class will continue to be the main driver of demand that supports the housing market as many are eager to own a home, and worried rising house prices will curb their affordability.

Home price would continue to rise when there are different tightness of home price measures among cities so that potential home buyers can take advantage of.

But on average, the speed of house price increase is moderate at the national level, which makes us believe that it is unlikely the government will apply stringent measures to squeeze the property bubble hard, which could yield an unexpected bursting effect.

As property developers expect better home sales to continue, their investments in real estate would also continue. We believe that the residential property market would enjoy a comeback.

Download

Download article

20 April 2018

Good MornING Asia - 20 April 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).