China: Trade war and geopolitics

Trade war and geopolitical tensions continue to escalate between the US and China, but increasing concerns around Taiwan could risk intensifying the situation

The US administration has threatened China that if there is no constructive outcome from the Xi-Trump meeting in the upcoming G20 gathering, then the US would expand tariffs on Chinese imports to a total of $505 billion, though it has not mentioned the tariffs rate yet.

In terms of what we already know on future tariffs, from 2019, the tariff rates on $200 billion of Chinese imported goods is set to increase to 25% from 10%. We expect China to reciprocate on imports from the US, (i.e., to 25% as announced earlier in August). See our trade teams piece on the impact the US-China trade conflict could have on world trade next year.

Xi-Trump meeting is likely to be a stalemate

It seems that the US would like to get some concessions from China during the Xi-Trump meeting. But this will be primarily be determined if the two sides insist on their points on trade such as:

If the US continues to emphasise that Chinese imports are the driver of the US trade deficit, but China reckons narrowing the deficit won't really help. Or if the US continues to express displeasure at how it doesn't like how China gets its technology from business partners but China insists that is just business. And finally, if the US continues to send military vessels around Taiwan, then China is bound to lose its patience after a while.

Trade war has damaged the Chinese economy

Using the Taiwan card could prove to be foolhardy

As we have emphasised, the trade war doesn’t end with just tariffs and is now increasingly tied to geopolitical tension.

The US is increasing hurdles for its trade allies including Mexico and Canada to sign trade agreements with China. Moreover, two US warships sailed through the Taiwan Strait providing military arms sales to Taiwan.

According to the Chinese media, Xi has ordered the military to be prepared for war and we think this should be considered with caution. The One China principle means Taiwan is part of China, and this is a foundation stone for China’s Taiwan policy.

The US administration could end up in a pickle if it uses the Taiwan card to get more chips for negotiation as we think China is very unlikely to give any concessions on trade if the US continues to send military forces around Taiwan.

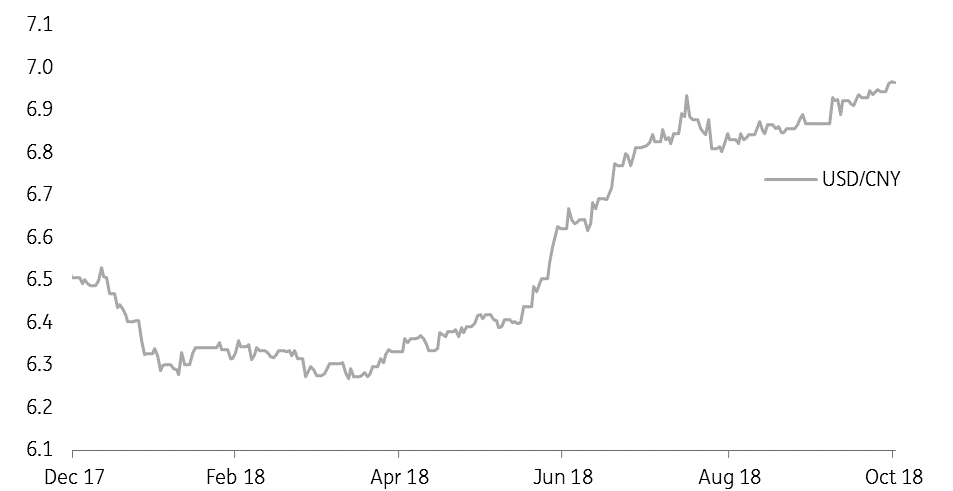

After the yuan cross the 7.0 handle it will continue to depreciate slowly

USDCNH crossing the 7.0 handle is a high probability

If the outcome of Xi-Trump meeting yields no improvement, then we see the yuan edging lower and USDCNY crossing the seven handle won't be a surprise. Recently, the central bank has allowed the USDCNH to test the 7.0 mark. This would increase market expectation that USDCNH could cross 7.0 anytime soon.

After crossing 7.0, the yuan would continue to depreciate slowly. The yuan has slowed down in its depreciation speed. The fastest depreciation happened in June (3.28%) followed by July (2.96%), and has moderated since then to around 1.43% in October. But crossing the 7.0 mark doesn't imply a fast depreciation will follow.

The claim that if the yuan passes the 7.0 handle, then there will be massive capital outflows doesn't add up because if that were the case, then the regulator could tighten capital outflows as the yuan continues to weaken.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 November 2018

Good MornING Asia - 5 November 2018 This bundle contains 3 Articles