United States

Bundles5 November 2018

Good MornING Asia - 5 November 2018

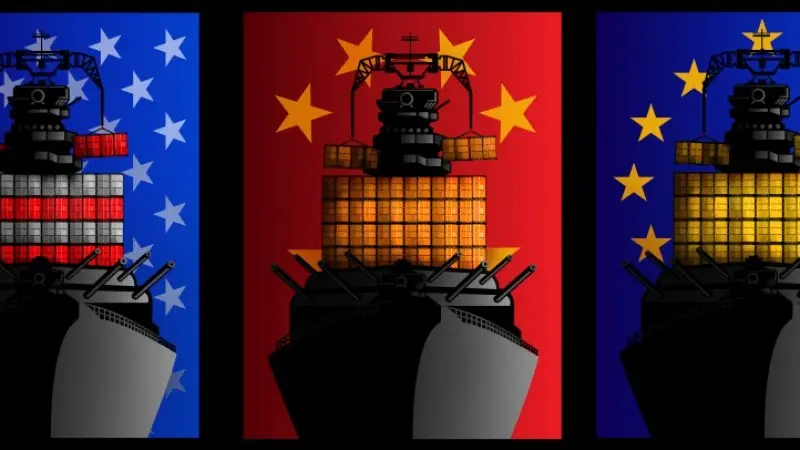

Last week's trade inspired optimism in Asia looks short-lived as softer US stocks set the tone for the start of the week in Asia. US sanctions on Iranian oil exports are centre-stage today, with considerable speculation about which countries will manage to get exemptions, and on what the impact on benchmark crude prices will be