China: State sees headwinds

China’s government has provided a set of targets for 2019, and it appears the government is relying a lot more on fiscal stimulus rather than monetary easing. A repeat of previous guidance on the exchange rate mechanism may mean the yuan will continue to follow the dollar index

China’s ‘Two sessions’ – the annual meetings of the national legislature and top political advisors- haven’t been as exciting as last year when the government was celebrating the 40th anniversary of its reform and opening up policy. While we’ve had a new set of targets, they’re almost as expected and details are missing when it comes to reforms.

The GDP growth target is now set at 6.0% to 6.5% for 2019, lowered from ‘around 6.5%’ in 2018. This lower growth target was expected by the market, and therefore didn’t create many ripples.

While the tax cut may save jobs, it doesn't necessarily mean the private sector will boost economic activity in general

The more surprising policy was an aggressive fiscal stimulus. Tax and fee cuts amount to CNY 2 trillion, including a 3% cut in value-added tax for manufacturing industries. This policy will give some breathing room to private companies by lowering expenses, which should help keep businesses and jobs alive. Without it, we would have seen more private firms closing down, which would result in job losses and a fall in consumption.

However, even with a smaller cost burden, private firms will still be keeping a watchful eye on the uncertainties surrounding the trade war/ truce, and may be reluctant to boost capital spending. So while the tax cut may save jobs and means the private sector won’t slow further, it doesn’t necessarily mean the private sector will boost economic activity in general.

With the fiscal stimulus, manufacturing PMI will rise

To generate growth, the state is looking at infrastructure investment. This is the responsibility of local governments and will be financed through local government special bonds, which is corporate debt totalling CNY 2 trillion, and therefore means local governments won’t be loading up on debt themselves.

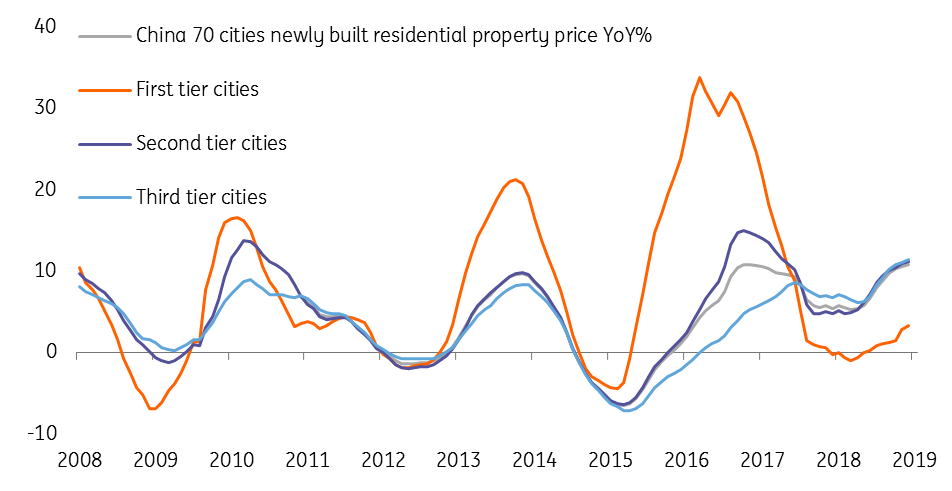

Altogether, the fiscal stimulus is worth CNY 4 trillion, which is line with our previous estimates. This means the state believes the economy is weakening, and the stimulus amount is aimed at preventing growth from dropping below 6%. There has been no specific focus on tightening measures in the housing market, which suggests the government recognises the importance of this sector to the construction industry.

The housing market can be a rescue to construction

Meanwhile, the government is maintaining a prudent stance when it comes to monetary policy. After 5 March, the date when this stance was announced, the central bank kept the daily injection of liquidity very moderate. We expected the medium lending facility (MLF) to be replaced completely by the targeted MLF (TMLF), which lends money via banks to small private firms at a lower interest rate. But this didn’t happen. It seems to us that the central bank is refraining from pumping too much liquidity into the market. So a repeat of the high loan growth we saw in January looks unlikely.

On the yuan, the state repeated its rhetoric from 2016 when USD/CNY started to follow the dollar index closely. Re-using identical phrases for the yuan suggests a similar USD/CNY move this year. Our forecast for USD/CNY and USD/CNH is 6.75. The yuan will likely gain some support from capital inflows into Chinese asset markets due to the inclusion of these assets in global indices.

The largest political event of the year provided some clues about China’s growth trajectory and the risks it faces in 2019. But there were no hints about any progress on the trade war, which is still a big risk to China and the rest of the world. Even if there is a truce, the market will ask how long this is likely to last, and how quickly all of the affected businesses can recover. Sizeable fiscal stimulus from the Chinese government offers part of the answer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

March Monthly UpdateDownload

Download article

8 March 2019

March Economic Update: In like a lion, out like a lamb? This bundle contains 9 Articles