China: shrinking shadow banking

Data for May shows that China has controlled the growth of shadow banking, and we expect financial deleveraging to continue for the rest of the year. Even as credit growth slows and liquidity tightens, we think a cut in banks' reserve requirements will likely be delayed until the second half

| -51% |

China credit growthMonthly change in May |

China central bank staring at financial deleveraging

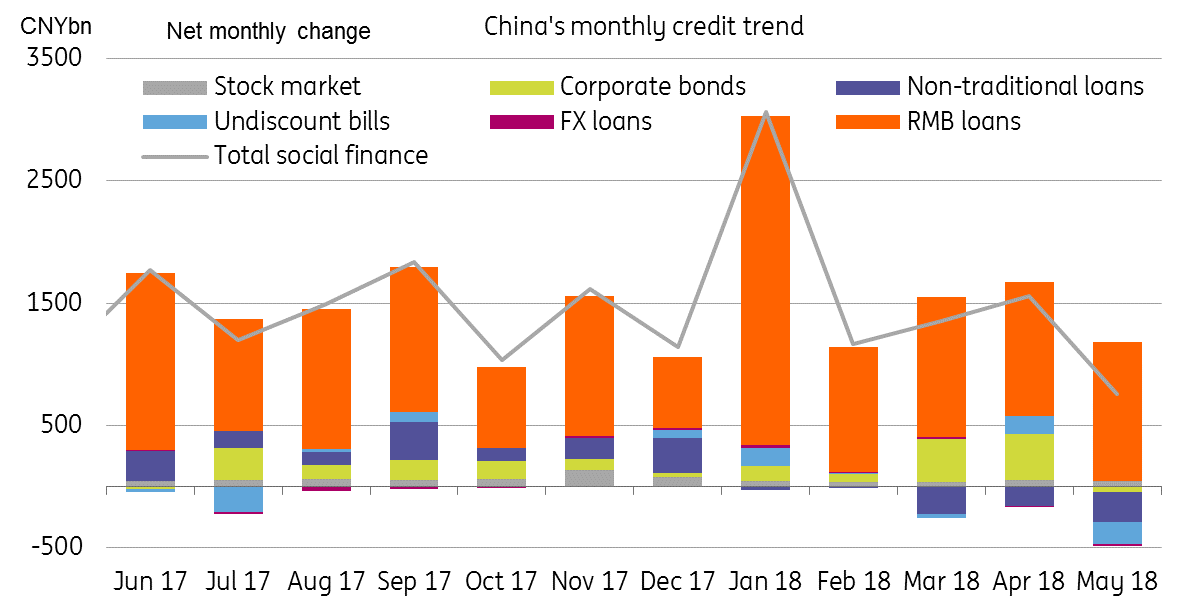

Total credit, which is called aggregate financing, was cut in half in May (from CNY1560 billion in April to CNY761 billion in May) due to a fall in every non-loan item. Yuan loans grew by CNY1150 billion in May, slower than 1180 billion in April.

This was a result of the central bank’s recent policies to reduce issuance and rollover issuance of wealth management products. The shrinkage has induced isolated bond defaults, making for a quiet month in the onshore debt market in terms of new issuance.

The data confirms our view that there will not be a cut in the reserve requirement ratio (RRR) in June after the central bank (PBoC) expanded collateral for its Medium-Term Lending Facility (MLF)- which allows banks to borrow from the central bank. This is because cutting the RRR (even if cash released is used to repay existing and expensive MLF) would send a signal to the market that the central bank has finished its financial deleveraging. In fact, financial deleveraging in China still has a long way to go. The central bank has yet to issue more regulations to prevent leveraging in grey areas.

Tighter credit is the theme in 2H18

We expect the central bank to keep deleveraging until the leverage of the whole economy is under 200% of GDP. Our estimate of China's total leverage is 234% of GDP. Though leverage is coming down in corporate credits, debts are piling up in local and central governments.

We also expect more policies to be imposed on non-financial institutions which hold assets of financial institutions. That would create a new tide of liquidity tightness, and is likely to push up financial costs in the onshore market.

Deleveraging measures will surely reduce credit growth. The PBoC will manage liquidity risks through daily open market operations and MLF operations. We think the central bank will only cut the RRR when it sees interest rates rising to such a level that they could induce a credit crunch. Otherwise, a cut in the RRR is not imminent.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).