China: Rough seas in 2019

The Chinese economy is set to slow down in 2019. The most likely scenario is an escalation of the US-China trade conflict, hurting exporters, manufacturing and logistics services. Pressure from trade and investment partners will also intensify

Escalation of the trade dispute is the key risk to China in 2019

2019 will be a difficult year for China in terms of economic growth and the increasingly tricky political relationships with its trading partners.

An escalation in trade tensions is the key risk to China in 2019 – and this seems like the most probable scenario. This will hurt exporters, manufacturing and logistics services, therefore slowing economic growth directly.

Indirectly, the bilateral trade conflict between China and the US has resulted in multilateral trade and investment disputes. This is exacerbated by international voices blaming the Belt and Road Initiative as a debt pile-up exercise for poorer economies. It has become more difficult to maintain existing relationships with trade and investment partners. The recent APEC meeting showed these economies having difficulties positioning themselves between China and the US.

Sizeable fiscal stimulus and looser monetary policy will see only a moderate slowdown next year

Having said that, we are not too worried about the economic growth rate. We expect GDP growth to slow to 6.3% in 2019 from 6.6% in 2018.

This moderate slowdown in growth reflects our projection of fiscal stimulus worth between CNY 9-10 trillion from late 2018 to 2020, averaging about CNY 4 trillion each year. The size of this stimulus is comparable with that of 2009-2011’s CNY 4 trillion, taking into account that nominal GDP has grown by 2.3 times between 2009 and 2018 to CNY88.6 trillion (rolling four quarters to 3Q18).

Manufacturing PMI approaching 50 and below

GDP won't rise proportionally to the fiscal money spent

This fiscal boost will take the form of tax cuts (salary tax cuts and more export tax rebates), creation of capital pools for advanced technology R&D, the creation of liquidty pools for small private companies, and infrastructure projects. We’d emphasise that fiscal spending on infrastructure projects may not reflect the same scale of increase in fixed-asset investments. This is because some of the money will be used for repayment of debt from local government financial vehicles (LGFVs) that finance infrastructure investments. Put simply, fiscal money spent will not result in a proportional increase in GDP. This also reflects the fact that the debt problem in China has yet to be solved.

Moderately loose monetary policy to support small private firms

We expect monetary policy to provide support to the economy, mainly to small private firms. Liquidity injections via cuts in the reserve requirement ratio (RRR) are necessary to keep private firms running. Again, some of this money will be used for debt repayments. To lower the interest burden when risk premiums should be rising, we expect the central bank (PBoC) to also cut its seven-day reverse repo policy rate twice (in 1Q19 and 3Q19).

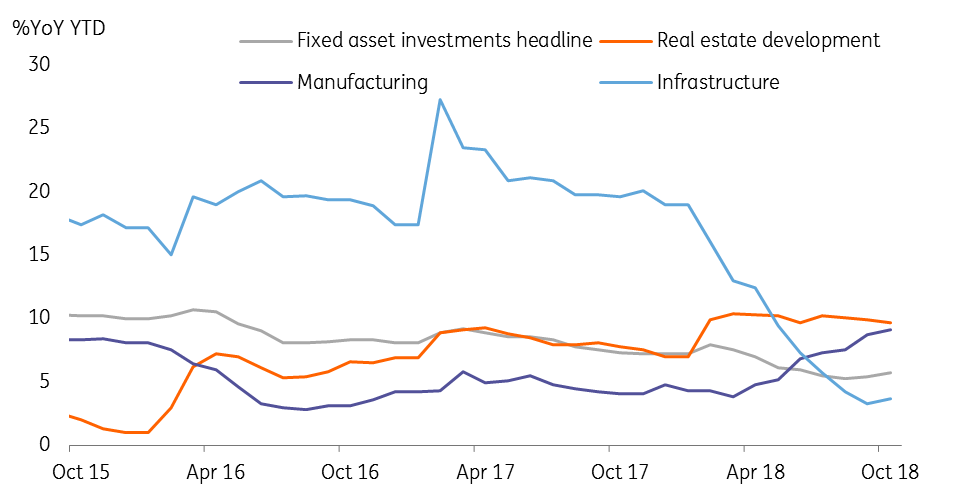

Infrastructure investments have increased in Oct18

Housing market restrictions will be relaxed to support growth

Restrictions on the housing market could be relaxed, as the government won’t want another drag on the economy during the ongoing trade dispute, and the housing market could support construction activity.

USD/CNH crossing the 7.0 handle is a high probability scenario

We forecast the USD/CNY and USD/CNH will reach 7.30 by the end of 2019 from 7.00 by the end of 2018, as the trade conflict escalates.

Unlikely scenario: Resolution to trade conflict, what would happen?

In the unlikely event that China and the US agree to withdraw tariffs altogether, the Chinese government would focus again on reducing the economy’s debt pile. This could prove just as difficult as facing a trade war. The deleveraging reform has been shelved since the middle of 2018 because the government has had to focus on combating the trade dispute. Within these few months, debt has piled up quickly within local governments, and LGFVs have made a comeback. It would take another few years (just like 2016 to mid- 2018) to reduce debts of LGFVs, not to mention state-owned and privately-owned enterprices that receive liquidity for survival. In this scenario, GDP growth would be around 6.5%, depending on how fast the government wants to clean up debts. If the trade conflict were to end, the yuan would likely appreciate against the dollar to 6.50 by the end of 2019.

Download

Download article

3 December 2018

Good MornING Asia - 3 December 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).