China: recovery derailed by real estate crisis

The economy has recovered slightly due to more flexible Covid measures. But the real estate crisis will put pressure on economic growth if home sales do not pick up. Infrastructure stimulus has yet to impact growth as local government spending has been split between finishing uncompleted homes and infrastructure investment

China finally show signs of a slight recovery

More flexible Covid measures have resulted in shorter quarantine periods and more localised lockdowns, which have had less impact on the labour force than the measures imposed a few months back. Consumers have shown a willingness to buy electric vehicles with government subsidies, and are also eating out more. But they are still reluctant to buy luxury items. Overall, retail sales grew 5.4% year-on-year in August after 2.7% growth in July.

Industrial production also picked up to 4.2% YoY in August from 3.8% in July as more flexible Covid measures enabled more people to go to work.

As such, the People's Bank of China did not cut interest rates in September.

China retail sales show recovery

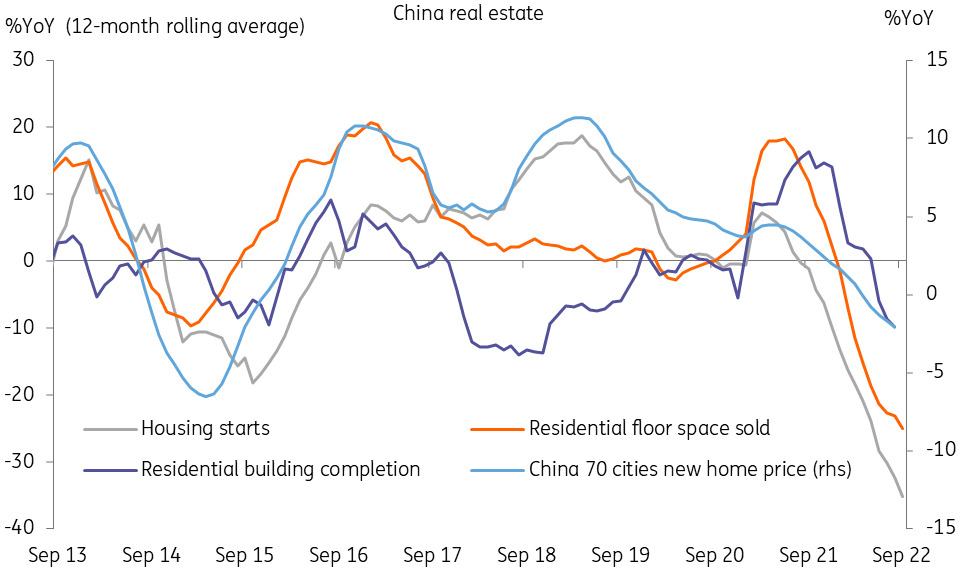

Real estate crisis

In the real estate market, some local governments have been pairing with property developers to finish uncompleted projects. But an improvement in market sentiment will only happen if some of the larger projects are finished to a high standard. Home buying activity should then pick up.

The market is now seeing genuine demand. The government is trying to fully unleash this demand by implementing policies such as cutting taxes for home upgrades. There are also policies for first-time buyers with lower mortgage rates. This fresh demand seems to be re-activating existing home sales, which were sluggish in the past due to a lot of new builds coming onto the market. This shift could reduce demand for new homes as buyers may worry that houses bought off-plan may not be completed. This, in turn, does not help housing starts. But at least some buyers are back in the market.

The long delay of fiscal stimulus

Facing both a Covid crisis and a real estate crisis, local governments with limited fiscal resources have had to prioritise what to deal with first. For most of them, the more urgent problem has been the stagnation in housing starts - and thus the drop in land auctions, which have traditionally provided local governments with the revenue they need to run their governments properly.

This explains the delay in infrastructure projects even as local government special bonds have been issued for this year. Even though the central government has called for an increase in infrastructure investment, only a few local governments have actually accelerated spending and they are mainly investing in existing projects, not new ones.

Double whammy is coming

External demand could be weaker in 2023. If the real estate crisis and decisions over Covid measures cannot be resolved (at least partially) China could face a tough year ahead, especially in manufacturing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 October 2022

ING’s October Monthly: bracing for a tough winter This bundle contains 14 Articles