China’s growth rate likely to contract this quarter given latest activity data

Each activity data point for April released today was worse than expected, and only fixed asset investments were still in positive growth. This confirms our GDP forecast of a contraction in the second quarter of this year; we can blame anti-Covid lockdowns. So what about potential export order losses? And how will the yuan react this year?

China retail sales: -11%YoY

Our negative GDP forecast for this year is confirmed by the numbers

Let's look at how bad the Chinese economy was in April. Retail sales dived deeper to -11.1%YoY growth after a -3.5%YoY contraction in the previous month. Industrial production turned to -2.9%YoY growth from 5.0%YoY growth in March. Fixed asset investments, which performed the best among the three activity data points, recorded 6.8%YoY YTD growth after 9.3%YoY YTD growth. The jobless rate jumped to 6.1% from 5.8% in March.

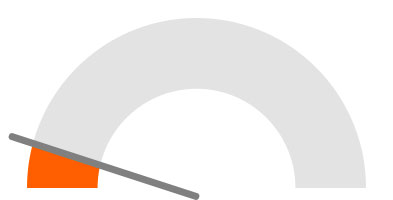

The overview of the data paints a gloomy picture of the economy. Our GDP forecast of -1% YoY for the second quarter is confirmed by this activity data.

The main reason is the long lockdown in Shanghai. This hurt retail sales the most, and also those factories that do not have "closed-loop operation"; if they don't have domitories for workers, they struggle to operate. Moreover, logistics were heavily disrupted as the movement in and out of Shanghai is difficult, and most logistics were used for transporting daily necessities and medical resources.

Forecasting GDP contraction in 2Q22

Infrastructure investment is the only growth engine remaining during lockdown

From the details of fixed asset investments, we see that construction grew 8.6%YoY YTD, higher than the headline of 6.8%YoY. And investments from Sate Owned Enterprises grew 9.1%YoY YTD, higher than private investments growth of 5.3%YoY YTD.

This implies infrastructure investments are still in progress. And this has been the only factor supporting economic growth for China during lockdown as many infrastructure projects are not in Shanghai and are, therefore, not as affected as retail sales and industrial production.

We believe that even when lockdowns end, infrastructure investments will continue to be the main growth engine this year to give extra strength to the economy, which will create more jobs for consumers.

Worry of losing export orders may not be valid

There are some discussions in the media that lockdowns in China have led to the loss of export orders to other South East Asian economies. I believe this is temporary as it is not easy to change the whole production chain, which is almost like a loop, getting orders from Chinese firms, then producing part of the goods in ASEAN and then going back to China to finish the rest of the production for shipments.

There are some goods that could eventually be produced outside China, even those export orders given to Chinese companies. These would be less capital intensive. And China will then focus on more capital and technology-intensive products and services.

But this is a process that won't happen overnight; it takes time. That said, China's lockdown policies are speeding things up.

For now, we do not expect China's export growth to fall tremendously for too long.

China industrial production and its relationship with PMI

We may not see export orders falling quickly in the coming months as China still has the capacity to produce, both outside Shanghai and indeed in the city when lockdowns finally end.

When will lockdowns end

This is a question asked by everyone with exposure to China. Shanghai city claims that it aims to end the lockdown by 20th May. Even if this happens, it won't be equitable to everyone with all companies going back to normal. There'll still be social distancing measures.

This makes us believe that the whole of 2Q22 activity will be in contraction compared to the same period last year, which results in our GDP forecast of -1%YoY for 2Q22.

Our concern is whether China will have lockdowns elsewhere, for instance in Bejing. The key question for us is how long future lockdowns will be. Any city that has to endure a 1-month lockdown will have its GDP in contraction on a yearly basis for that month. A 2-month lockdown may have a longer impact of more than 2 months as the jobless rate will increase, and people need time to find another job but at the same time firms are not ready to hire.

This is not our base case though. But we will keep this risk in mind.

Our base case is no more 1-month lockdowns in any China city after the second quarter of this year. This assumption implies a GDP growth rate of 4.3%YoY for 3Q22, with a jump in retail sales, faster delivery time for corporates and exporters, and significant support from infrastructure investments, and 3.6% for 2022.

USDCNY forecasts

The current forecast of USDCNY to get to 6.4 by the end of 2022 is too strong. We believe that the end of lockdowns will bring some appreciation pressure to the yuan. But given the current, level, that could be 6.7 by the end of 2022. We also expect that if Shanghai cannot end the lockdown as committed by end of 20th May, then USDCNY can go beyond the 7.0 handle, and could then be range-bound between 7.0 to 7.2.

We revise the USDCNY forecast to 7.0, 6.8, and 6.7 for 2Q, 3Q and 4Q, respectively.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).