China: Fiscal stimulus is tiny, expect more to come

China's State Council has unveiled a number of measures to boost growth. But don't celebrate too soon. Most of the fiscal spending has been planned and is already in the pipeline. A loosening of monetary policy is a more obvious benefit to the economy in the short-term

Fiscal stimulus is small

While the State Council has announced CNY2628 billion (USD386 billion) in fiscal stimulus, only a small portion of this is new i.e. real stimulus, rather than just planned spending. Of the CNY65 billion (USD9.6 billion) announced to foster R&D, only a fraction is new. The good news, however, is that the government wants to spend money earlier than planned.

According to our estimate, China's nominal GDP in 2018 could reach CNY86514 billion (USD12.7 trillion). That means the fiscal spending laid out by the State Council is around 3% of GDP. But spending could be higher than that if the government were to bring forward some of its infrastructure projects and other plans.

We expect more aggressive fiscal spending will be announced later if and when the trade war escalates and believe this year's stimulus could be around 4.5% GDP.

Monetary policy is more punctual

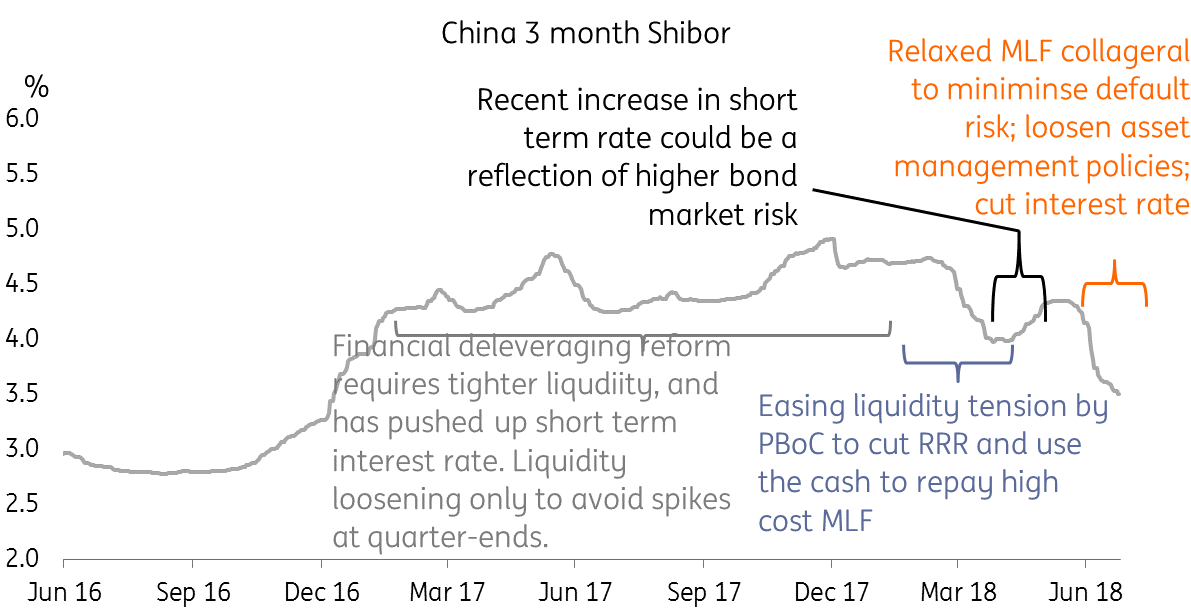

The People's Bank of China, China's Banking and Insurance Regulatory Commission and China's Securities Regulatory Commission have relaxed asset management policies. This is important to give breathing room to the corporate debt market. Tight asset management policies released at the end of April this year have squeezed corporate credit as well as increased the number of corporate defaults and pushed up short-end interest rates.

Now, the policies have been relaxed. Though this will slow the progress of shrinking shadow banking activities, it gives breathing room to corporates and the financial system, which is necessary when the government foresees an economic downturn from a trade war. The relaxation could help increase liquidity further (note that the central bank has already injected more liquidity into the system), credit risk could come down and default cases are likely to shrink.

The PBoC has also silently cut interest rates, which have guided short-end rates lower.

We expect even more fiscal stimulus

The stimulatory effect of monetary policy is short-term. But China needs long-term stimulus in the event of a trade war, as this could have a more protracted, damaging impact on the economy.

Stimulus in the areas of R&D and technology infrastructure should have a larger marginal impact on longer-term growth than putting money into transportation infrastructure, which is near the standard or even at a higher standard than developed economies.

We expect the next round of fiscal stimulus to benefit exports directly, and at the same time expand R&D investment pools, even if that means piling up government debt. At such an unusual time, the Chinese government will likely apply unusual measures to shield itself from an economic slowdown sparked by a trade war.

We still expect USDCNY to reach 7.0 by end of 2018

Download

Download article

25 July 2018

Good MornING Asia - 25 July 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).