China cuts rates via a new tool

China has cut the one-year loan prime rate, which we think was a result of the very weak August activity data, especially fixed asset investments and industrial production. Another cut is expected in October unless we see a very encouraging outcome from the trade talks, which is unlikely. We don't expect this cut to move the yuan

China cuts loan prime rate

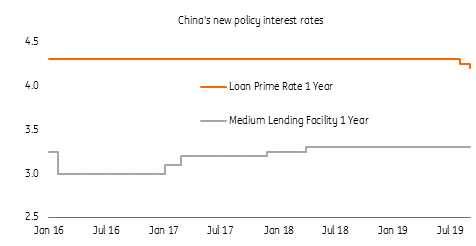

The People's Bank of China cut the one-year loan prime rate (LPR) by five basis points to 4.2% while keeping the five-year LPR rate unchanged at 4.85%. The LPR is the new reference rate for banks and other financial assets, which can quote an interest rate linked to the LPR.

The last time the PBoC cut the one-year LPR was on 20 August, from 4.31% to 4.25%.

Here's how the interest rate works:

- the change in the LPR is an average of quotations from some banks;

- each rate change is a multiple of 5 bps;

- the LPR is linked to the medium lending facility (MLF) interest rate, i.e., LPR is +/- MLF;

- the MLF has not changed since 16 March 2018, when it rose 5 bps from 3.25% to 3.3%.

Why now?

We believe that the decision to cut the rate came from very weak August data released a few days ago. Industrial production grew just 4.4% year-on-year, the lowest level since February 2002, while fixed asset investments grew 5.5%, down from 5.7% previously, even with support from infrastructure stimulus.

A 5 bps cut in the one-year LPR will guide interest rates lower in bank loans and other financial assets, including local government special bonds which are used to fund infrastructure projects. This means that production costs and investment costs will be lowered slightly.

As the trade war is expected to continue for some time, this rate cut is clearly necessary.

Impact on the economy

A 5 bps cut in the LPR alone won't be enough to soothe the market or counter weak growth right now. This cut, together with last month's move, will be too small (in total 10 bps) to have an obvious impact on economic growth. But we shouldn't forget that the PBoC also cut reserve requirement ratios on 16 September, and there will be more targeted RRR cuts on 15 October and 15 November. Together, these should be able to suppress overall interest costs in the economy.

We want to emphasise the benefits of fiscal stimulus and monetary easing working together. This PBoC rate cut, along with RRR cuts and the issuance of local government special bonds to finance infrastructure projects, should create synergies, which may be magnified in the fourth quarter.

We expect another cut in October unless September data is very encouraging, which we think is unlikely. With more rate cuts, the Chinese economy should grow at 6% in 2019.

Rate cut doesn't necessarily mean a weaker yuan

Impact on the yuan

A rate cut doesn't necessarily mean a weaker yuan. There is very little arbitrage opportunity given that China's capital account is not fully open. Put simply, the theory that lower interest rates weaken the currency doesn't apply in China.

USD/CNY peaked at 7.1054 on Thursday then closed at 7.0965. After the rate cut today, the USD/CNY moved to 7.0903. That is, the yuan actually strengthened rather than weakened.

We expect a weaker yuan if the trade talks go poorly. Our USD/CNY forecast is 7.20 by the end of 2019.

MLF and LPR

Download

Download article

23 September 2019

Good MornING Asia - 23 September 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).