CE4 1Q GDP: Not as bad as feared

The first readings of first quarter GDP across the CE4 regions were generally not as bad as feared. Polish, Hungarian and Romanian releases were all slightly better than expected, while Czech data was pretty much in line with consensus. Second quarter data will, of course, be worse as the full force of lockdowns are felt

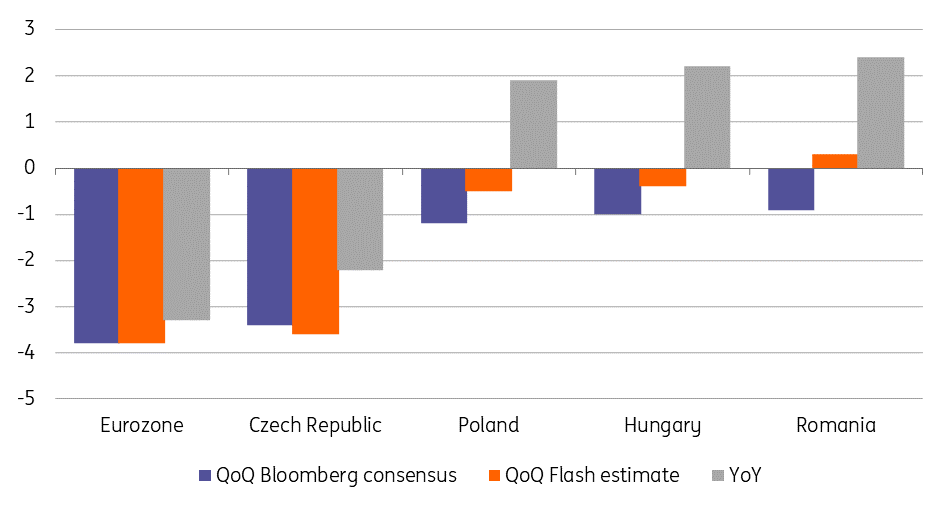

CE4 GDP developments in 1Q20: Mostly better than expected

Eurozone sets the tone

Today’s release of CE4 1Q20 GDP data follows on from the flash eurozone release on 30 April, which saw the single market contract 3.8% quarter-on-quarter. Revisions to this data will be published very shortly. As Bert Colijn noted at the time of the first release, 1Q marks the start of the lockdown recession and 2Q will be worse given that lockdowns typically hit for only two weeks of the first quarter compared to at least six for the second quarter.

Encouragingly, however, our eurozone team’s analysis of Google COVID-19 Community Mobility Reports suggests we are starting to move away from the worst of the lockdown. The latest Google data suggests German activity has recovered to 84% of levels seen in January – which will be welcome for CE4 supply chains.

Poland: Slightly better than expected and large fiscal support will soften the future blow

1Q20 GDP contracted 0.5% QoQ (non annualised), while year-over-year growth remained positive at 1.9%. The data was slightly above consensus expectations at -1.2% QoQ and +1.5 to +1.8% in YoY terms. The onset of the Covid-19 slowdown has not hit the economy too hard so far, but the impact of the lockdown on 1Q20 was limited in Poland as the first restrictions came into force in the second half of March.

Poland stays above average in the Central Europe league, both in terms of QoQ and YoY growth, above Czech, which recorded negative YoY growth, but slightly lower than Hungary as well as Romania, where YoY growth stayed more positive than in Poland. The lockdown measures imposed in Poland were less severe than in the eurozone’s southern states, which is why Polish GDP contracted by 0.5% QoQ only - less severe than the eurozone average (-3.8% QoQ flash) and less severe than Czech and Slovakia, which strongly rely on the automotive sector.

We do not have details of 1Q GDP, but we point out that the positive contribution of the construction sector was even higher than in 4Q19. Also, the manufacturing contribution was still positive although halved compared to 4Q19. Sectors most affected by the lockdown were retail sales while other market services slowed, but probably less than retail sales was suggesting.

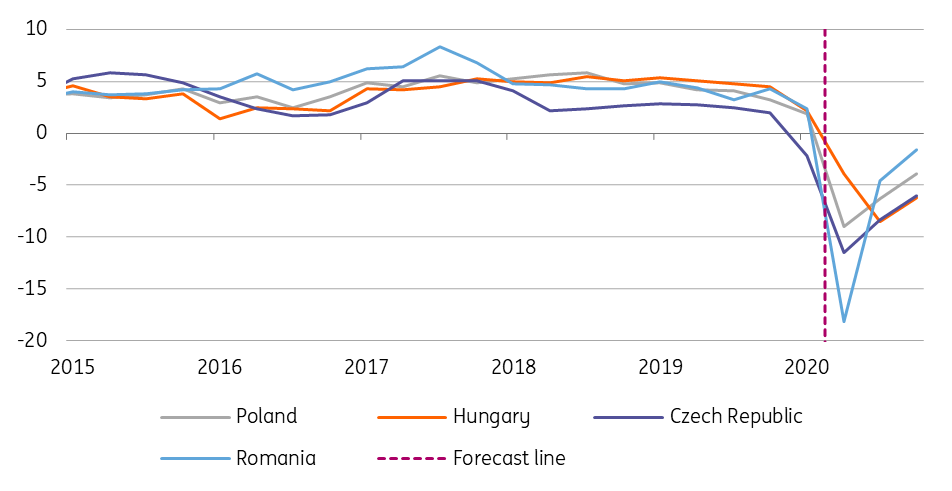

Polish 2Q20 will be much worse with GDP dropping by about 9%, both in QoQ and YoY terms. The impact of Covid-19 will be most severe in 2Q20, but contrary to the eurozone, manufacturing has been excluded from the lockdown and only some sectors were closed due to the lack of external demand.

In 2020 as a whole, we expect GDP to contract by 4.5% YoY. Poland has a very high fiscal support programme. Direct support in the programme is worth 6.5% of GDP and is the highest in Europe and the Central and Eastern European space. Still, we expect Polish GDP to contract, as two natural buffers which helped Poland previously avoid recession, are no longer working this time around. These are stable domestic and eurozone internal demand. The former helped Poland survive without recession after Lehman collapsed, the second had been very supportive during the trade wars.

Czech Republic: Bracing for a double digit decline in 2Q

Flash 1Q GDP contracted by 3.6% QoQ, based on today’s Czech Statistical Office release, which was very close to the market and the CNB estimate, of -3.3 and -3.4, respectively. The range of estimates was broad, however, from -7.6 to -1.5%, indicating huge uncertainty related to the negative impact of lockdowns on the Czech economy.

No details have yet been published by the statistical office, it was only noted that the economy was impacted by weaker foreign demand and lower investments, together with a slump in the manufacturing segment and services like travel, accommodation, restaurants. This is no surprise given the nature of the shock. Assuming a 3.6% QoQ fall, which was caused by lockdowns in the last two weeks of March, the Czech economy was performing at a 70% level in the second half of March, i.e. falling around 30% during this period.

Still, April was affected for almost the whole month and the recovery in May has also been relatively slow. Thus the QoQ fall in 2Q will most likely be in the double-digit range. Both we, and the CNB, expect a fall of around 9-10% QoQ in 2Q. For the whole year, we see GDP contracting around 7%, the CNB at -8%, but some market estimates see a 10% fall. All will be dependent on the recovery in the second half of the year, so all scenarios are still to some extent possible. However, what we would say is that today’s figure is more consistent with those forecasts calling for the Czech economy to fall by less than 10% this year.

Hungary: 2019 statistical revisions in play

Hungarian GDP dropped by 0.4% on a quarterly basis in 1Q20. This is not a horrible outcome since it is better than the market consensus (-1.0%). On the other hand, the year-on-year figure shows 2.2% growth, which roughly matches expectations. This signals a significant discrepancy which can be explained by a major revision for the 2019 growth path. The 2019 first quarter reading was moved up from 1.3% QoQ to 1.9% QoQ (translating to a lower YoY figure in 1Q20). The rest of the 2019 QoQ data was revised down by 0.2-0.3ppt, which supports the YoY figures for the rest of the year due to a lower base. This could help smooth the trajectory of the crisis. Against this backdrop, we have had to make changes to our YoY path for GDP growth. This revision also means a significant downward revision to our 2020 forecast, which reflects only a technical statistical change. Our 2020 GDP outlook now sits at -4.2%.

Regarding the details, according to the statement of the Central Statistical Office, services and industry contributed positively to GDP growth. As lockdowns started only at the end of March, this hardly comes as a surprise. An easing of the lockdown measures has started only in recent days, so we see 2Q20 as the low point, expecting a U-shape recovery.

Romania: Temporary expansion buoyed by government spending

Compared to the same quarter of 2019, the 1Q20 GDP advanced by 2.4%, versus the ING/Bloomberg forecast of 1.7%/1.9%. The breakdown of GDP is due 9 June, but even without it, we suspect that the main forecast distortion remained the soaring budget deficit which impacted public consumption. Even for 4Q19, but particularly for 1Q20, one difficult item to estimate has been the impact of the huge budgetary spending, which started in December last year and continued into 2020. The 1.7% of GDP budget deficit in the first quarter of this year was the highest ever. Hence, we expect public consumption to have remained the main growth driver in 1Q20.

Despite today’s positive surprise, the rest of the hard data we’ve been receiving so far has not made us more optimistic regarding this year’s growth prospects: starting with March, exports and imports have been contracting, wage advances have slowed down and could turn negative, retail sales are contracting as well, and industrial production has plunged. The so-called reopening of the economy is happening very gradually, strict social distancing remains in place, with even some restrictions on mobility outside cities. This will probably keep consumer morale depressed for a while. Therefore, we maintain our quarterly GDP forecasts for the rest of the year. Updating these forecasts with today’s results for the first quarter, we get -5.5% GDP growth in 2020.

CE4 YoY GDP trajectories with ING forecasts

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more