Car market outlook: Recovery to resume in 2022

We believe that auto volumes will grow in 2022 as the industry gradually works through supply chain headwinds and ramps up production as much as possible to reduce backlogs, satisfy pent-up demand and rebuild inventories. Electrification should gear up and the related challenges are an important driver, shaping strategies and directing investment

Recovery did materialise in 2021, but to a lesser extent than expected

With incessant negative headlines about the auto sector over recent months, it is easy to forget that the industry still experienced a modest recovery last year after a traumatic 2020. At the start of 2021, we anticipated growth in light vehicle sales of 7-9% during the year, based on various industry forecasts. While this headline pace of growth was clearly out of reach due to semiconductor shortages, it's important to remember that auto sales have indeed rebounded from the initial Covid-19 impact, with some of this recovery materialising already in the latter part of 2020 and in the first half of last year. However, sales volumes in 2021 have remained just over 10% below the 2019 levels.

Magnitude of logistical headwinds surprised nearly everyone in the sector

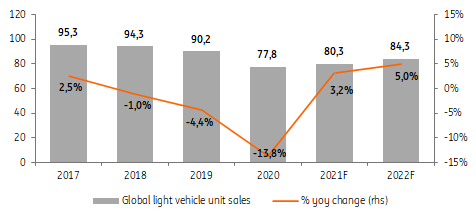

We are joining the majority of industry players in acknowledging that the magnitude and the length of the supply chain headwinds in 2021 surprised us, even relative to our assessment at the mid-point of the year. The logistical issues, mostly related to the delays and lack of supply of semiconductors used by the auto sector, lead us to cut our target range for global light vehicle sales in 2021 to 3% to 4%. As can be seen from the chart below, we now expect global light vehicle sales of approximately 80.3m units in FY 2021, using a growth rate of 3.2% YoY (here we use Moody’s global sales estimate of 77.8m units for FY20 as our base). Importantly, we expect production volumes in 2021 to end up growing below the rate of improvement in sales, creating a further need to replenish or beef up inventories next year.

We expect growth for the auto sector in 2022 although limitations remain

With the above backdrop in mind, we think that 2022 has a propensity to be a healthier recovery year than 2021, assuming that semiconductor shortages start to subside. At this point, having seen various curveballs during the course of last year, we err on the side of caution and assume that various logistical issues will continue to restrain production at least during the first half of 2022 and, more likely, to a lesser extent, throughout the whole of the year.

However, we anticipate that order books are well filled, consumer demand will remain solid and production volumes will spring up as soon as supply bottlenecks start clearing up. Therefore, we expect global vehicle sales to grow in a range of 4% to 6%, with production growth exceeding these rates by some 2 to 3 percentage points in order to catch up from lost volumes during interruptions in 2021. Clearly, this reasonably favourable scenario is predicated on a gradual improvement in semiconductor supplies - the main factor constraining volume expansion.

Global light vehicle unit sales (in m units)

Electrification to gear up further after new regulatory and strategic initiatives

We note that in 2021 the electrification trend gathered momentum across major geographies and industry players in the auto sector. We believe that this trend will continue to move from strength to strength in 2022. In 2021, the EU presented its target to shift to full electric vehicles by 2035, the Biden administration set its 50% EV goal for 2030, and a range of other countries pledged to make a shift before 2040 at the climate summit COP26.

On the corporate side, in 2021, virtually all major players either reaffirmed or announced strategic plans for a future shift to electric vehicles over the coming decade or so. For example, recently, the world’s largest carmaker, Toyota, also announced a significant investment programme aiming to reach 3.5 million battery electric vehicle sales by the end of the decade. This was somewhat less ambitious than the targets set by VW, but still a significant move in guidance. We note that major existing carmakers are significantly upping the ante in the area of electrification to retake the initiative or fend off competition from the pure-play electric car makers like Tesla, looming new entrants like Rivian and Lucid, and Chinese brands like BYD, Nio and XPeng.

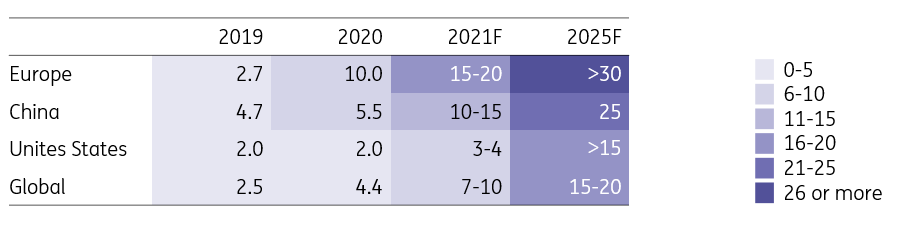

Share of Battery Electric and Plug-in Hybrid Electric Vehicles as % of Total Sales

Global EV share in sales expected to approach 10% in 2022

Over the first three quarters of 2021, the European share of EVs (BEVs + plug-in hybrids) in total new registrations rose to 17%, almost double the share from the same period in the prior year. This could exceed the 20% mark in 2022, in our view. Europe is currently running ahead of the curve, but China also enjoyed a strong increase in EV-share of new sales during 2021. With new government subsidies and more available models, we also expect the US to start catching up from 2022.

On a global scale, S&P expects electrified vehicles to represent 7-10% of total annual sales in 2022 and the figure may trend towards the upper end of this range. As EVs become more mainstream and the fleet expands, developing charging infrastructure is of crucial importance to facilitate growth. This, however, should not yet hamper sales in 2022, in our view.

Supply chains remain fragile in 2022

Whether our car production and delivery growth targets are achieved in 2022 will, of course, depend on the ability of manufacturers to physically produce the targeted volumes. Shortages of semiconductors keep weighing on production ambitions and workarounds and stocking (‘banking’) vehicles with missing functionalities is unlikely to be acceptable this year. Car manufacturer order portfolios remain well filled with demand from businesses, including leasing companies, which reportedly have substantial outstanding orders for new cars.

Delivery times have been extended during the last year and, as we have mentioned, the majority of carmakers have an order backlog which they need to fulfill and reduce. At the same time, semiconductor production remains tight and the pandemic could still lead to new supply hiccups in 2022. Consequently, semiconductor supply is likely to continue to be the main bottleneck for carmakers in 2022. Manufacturers have generally been prioritising the production of high-margin models and full EVs, which supported a greater proliferation of these vehicles during 2021. However, for perspective, full EVs also consume roughly double the amount of chips relative to the traditional combustion-engine cars.

Car makers move to secure chips and batteries by forming closer links with suppliers

Chip production capacity adapts slowly to changes in demand as expanding production or building greenfield facilities usually takes two to three years. For example, a production facility announced by TSMC in 2021 to be rolled out in Texas won’t be operational until 2024. This difficulty in ramping up supply, together with ongoing strong demand for digital vehicle features, suggests that chip shortages are likely to linger this year, at least to some extent.

Amid the ongoing uncertainty of input shortages, carmakers have been moving to set up partnerships with various suppliers. For example, Ford partnered with GlobalFoundries to secure future supplies. It is also possible that more carmakers start designing their own chips. This generally makes the ordering process easier, although final supplies remain dependent on a handful of large manufacturers like TSMC, Samsung and SMIC.

In addition to semiconductors, battery supplies are also becoming increasingly critical as demand soars. Many car makers have already started to set up joint ventures with battery manufacturers in order to secure future supplies. But the question for 2022 is whether supply will keep up with the fast-expanding demand. If it doesn't, metal prices such as aluminium could be set to increase.

Volkswagen aims to establish six European battery manufacturing sites by 2030, but its first gigafactory in cooperation with Northvolt is set to come online from 2023 while Automotive Cells Company (TotalEnergies, Stellantis and Mercedes-Benz) will also start in 2023. This means that the global auto sector will remain highly dependent on the Asian battery suppliers (like CATL and LG) for some time to come.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article