Canadian growth story: Cool, calm and unconcerned

Canadian growth appears to have slowed in the third quarter, but our forecast of 2.2% won't cause any headaches for the Bank of Canada. If anything, it still shows the economy is operating close to full capacity and gives the central bank a green light to carry on pushing rates higher

Canada’s growth story this year has been good, and the underlying strength is set to continue. On Friday, we'll get growth figures from September and, more importantly, the third quarter - we forecast a healthy 0.3% MoM and 2.2% QoQ (annualised) respectively.

| 2.2% |

Canada 3Q18 GDP ForecastQoQ%, Annualised |

Third quarter GDP, though still robust, is unlikely to be as shiny as the 2.9% posted in the second quarter. Our 2.2% prediction plays into the idea that the economy will undergo a modest slowdown, after having peaked mid-way through this year. And it’s likely the housing market will factor as one of the leading drags on growth.

Residential investment is subdued and will be for a while

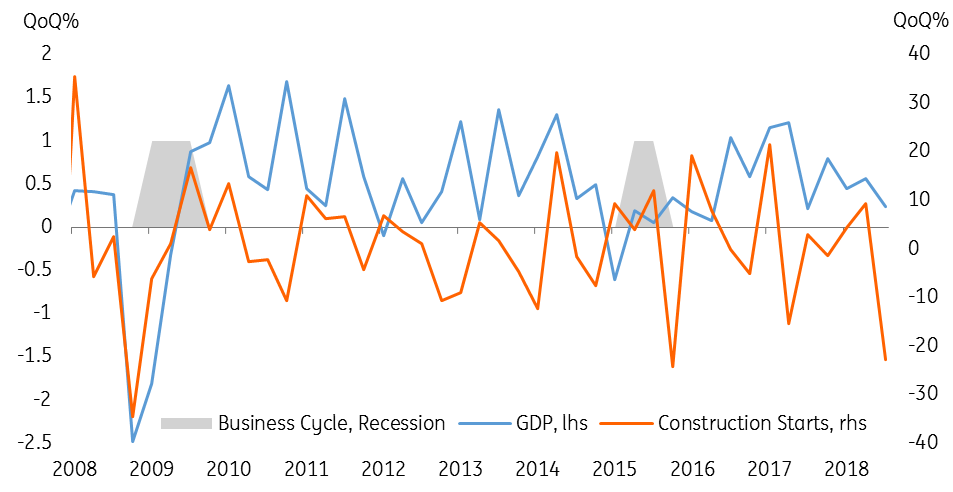

Dips in construction starts typically precede an economic slowdown, and from the chart above you can see that this appears to be taking place now (although of course the data is highly volatile). Either way, this isn't unexpected - the housing market is in a tricky situation. Excess supply (linked to affordability issues), higher borrowing cost and tighter mortgage rules are holding back residential investment, and this lower trajectory will probably persist for some time.

Is business confidence lower than it should be? And, if so, why?

Manufacturing also has a bit of a question mark over it. The good news is that new orders are continuing to perform well, but at the same time, business confidence remains a little subdued relative to the past couple of years. It's possible businesses are still wary about trade risks. After all, the United-States-Mexico-Canada-Agreement (USMCA) hasn’t actually been ratified yet, and the ongoing US-China trade spat will undoubtedly spill over to weigh on the sentiment of Canadian firms too.

New orders outperform business confidence

The manufacturing sector dims our concerns

That said, we see no alarming bells ringing – yet. In the Bank of Canada’s (BoC) Business Outlook Survey, the attitude of firms was generally positive.

This is generally being played out in the data. Manufacturing sales rebounded 0.2% MoM in September, and although below their July peak, the sector shows few signs of weakness. This should give a boost to September growth figures, and we don’t see this strength fading anytime soon, given there are limited signs of the strong domestic and foreign demand (mainly from the US) dissipating immediately.

Growth gives BoC green light to pursue tightening

A solid September growth figure should help to bring annual 2018 growth to 2.5%. We expect this momentum to continue into 2019, where we expect 2.1% average growth. This supports the notion Canada’s economy is tracking close to potential and will give the BoC the green light to carry on pushing rates higher. See here for our 2019 guide to global central banks.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more