Canada remains on the right track

Growth expectations swung wildly in recent months, but the composition of today's 1Q GDP report means we shouldn't be too disappointed by the downside miss. The vaccination programme is going well, the labour market is strong, fiscal support and rising commodity prices are more the helpful. The Bank of Canada remains on track to raise rates next year

| 5.6% |

1Q annualised GDP growth |

Expectations got too carried away

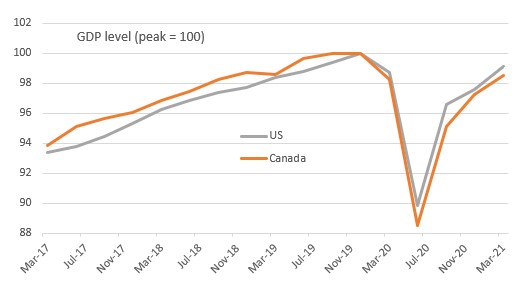

The Canadian economy has surprised almost everyone with its resilience as predictions swung from a contraction in output in the first quarter just a few months ago to the likelihood of very robust growth. In the end expectations got a little too carried away with the 5.6% outcome coming in below the consensus prediction of 6.8% growth (the range was 6.3% to 7.4% according to Bloomberg). Nonetheless, given where Canada has come from this is a great story.

Canada real GDP levels versus the US

A good mix of growth

The details show consumer spending rose at an annualised 3.4% rate, investment was up 17%, led by a 43% increase in residential structures, government was up 6.2% and net trade made a positive contribution to the tune of 0.5 percentage points. Inventories subtracted 1.4 percentage points from headline growth so on balance the mix of growth drivers looks good.

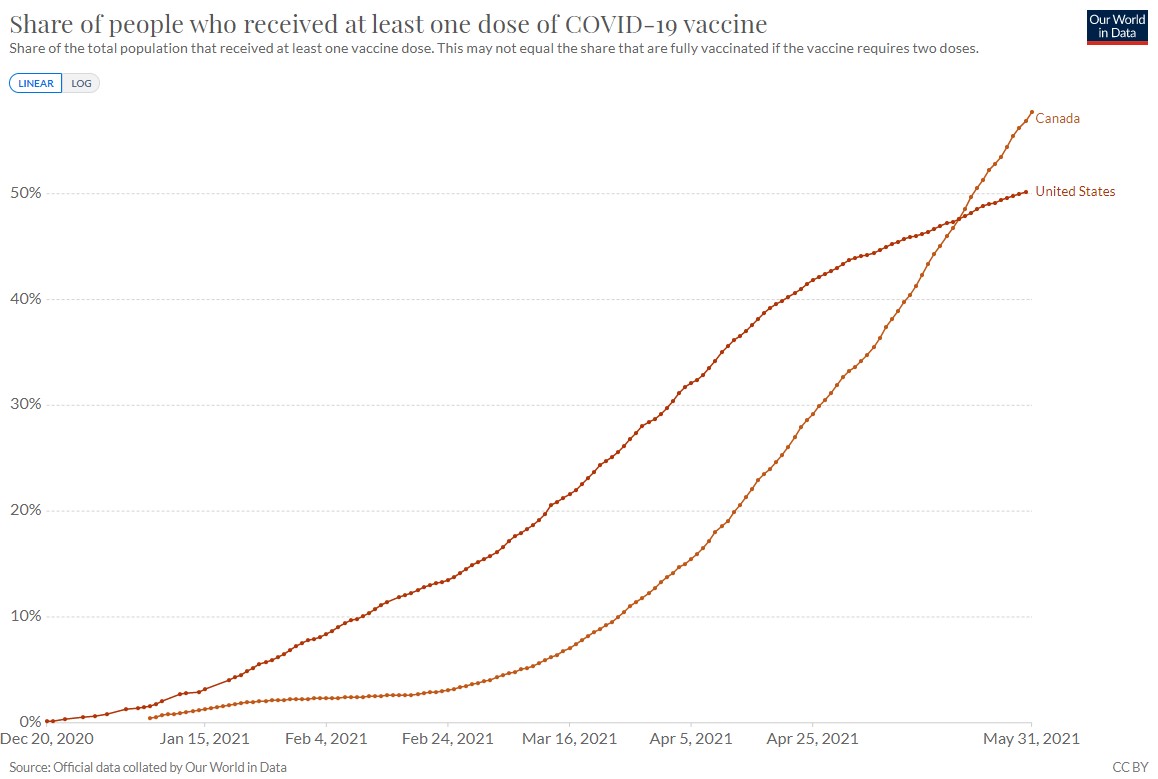

Canada vaccination program has rocketed to overtake the US - proportion of population having received at least one vaccination does

Outlook supports 2022 BoC rate hike story

This leaves GDP output 1.5 percentage points below the pre-pandemic peak and we strongly suspect that this current quarter (2Q21) will see all of that lost output returned. Canada's vaccination programme, after a slow start, is progressing superbly (a higher percentage of people vaccinated than in the US now) and with ongoing stimulus coming and the commodities rebound set to drive investment forward we are optimistic.

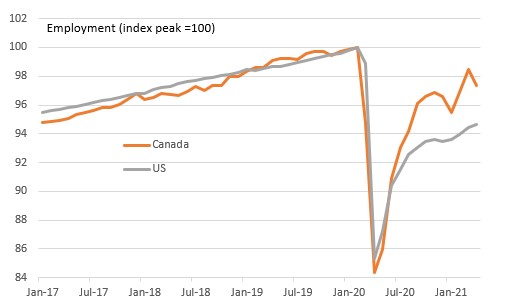

Note too that the Canadian jobs market has bounced back more strongly than in the US with employment just 2.4ppt below its pre-pandemic peak versus 5.4ppt in the case of the US. With inflation moving above target the Bank of Canada remains on track to taper its weekly QE asset purchases for a third time in July and hike rates in 2H22.

Canada employment levels versus the US

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more