Canada on a charge

The positive data surprises just keep coming from Canada, likely prompting another interest rate hike this week

The surprises just keep coming

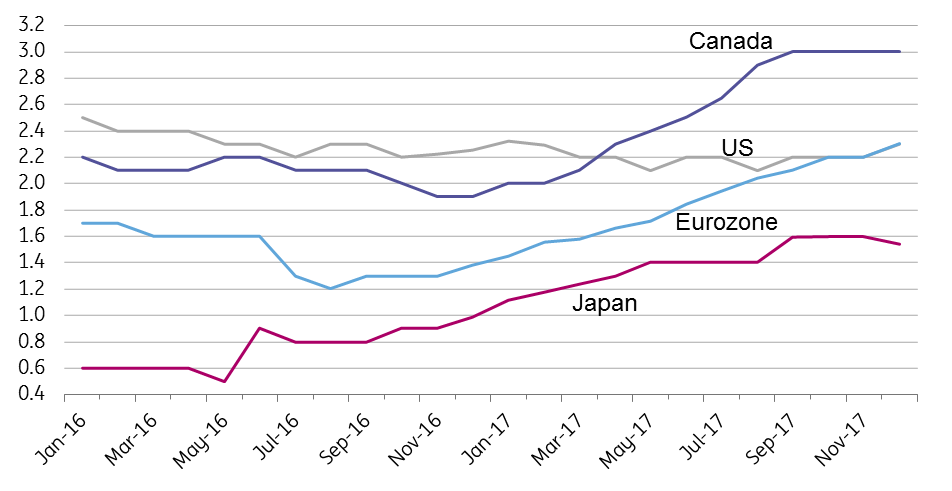

Growth expectations were revised up across the globe in 2017, but Canada was one of the star performers. Only the Netherlands and Spain are likely to have outpaced Canada’s 3% GDP growth amongst developed market economies. The speed of the turn-around in Canada also caught the Bank of Canada by surprise. Having suggested little prospect of any rate hike early in the summer, the central bank actually hiked rates at both the July and September policy meetings.

How Economists' 2017 GDP forecasts changed

December's jobs report changed everything

Following these moves, the Bank of Canada had thought there would be a moderation in growth rates and as recently as the December meeting, they were still only suggesting that “higher interest rates will likely be required over time”. However, there is little evidence of any real slowing in the pace of growth. In fact, the global backdrop has strengthened further, inflation has rebounded, retail sales have boomed and the labour market has gone from strength to strength.

It now suddenly looks as though the Bank of Canada will raise rates again this week, rather than wait until March. The big catalyst for the change in market expectations has been the strength in the December jobs report, released January 5. Canada saw nearly 80,000 jobs created in November. Expectations had been for a correction in December but instead, we got another 79,000 jobs. To put this in context, job creation had averaged just 26,000 in the first ten months of the year. As such, the Canadian unemployment rate has dropped from 6.9% at the end of 2016 to just 5.7% - the lowest rate since comparable records began back in 1976.

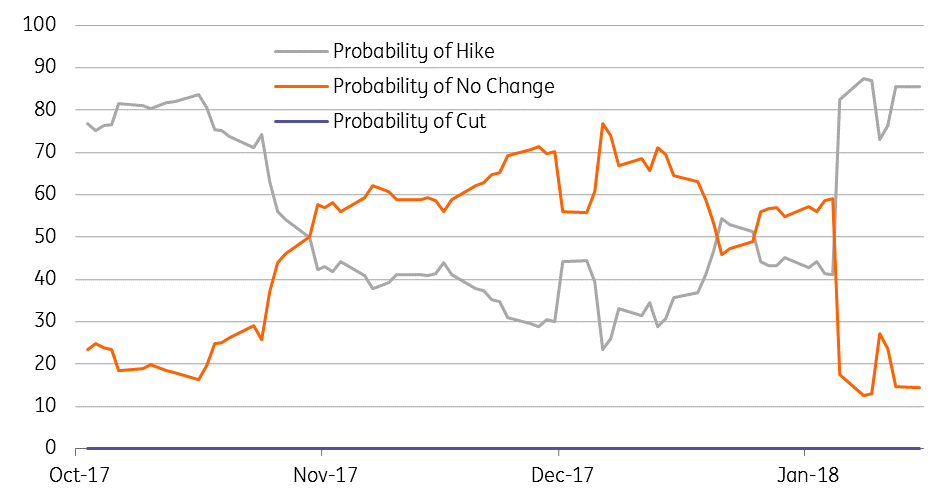

Implied market probability for a BoC rate hike this week...

Another 25bp move, but NAFTA risks remain

We are also seeing a recovery in wage growth, and with oil prices close to $70/bbl this is adding to nervousness that inflation pressures are building at a time when the economy is performing strongly. With financial markets pricing in an 80% chance of a hike and 23 out of 26 economists surveyed by Bloomberg also looking for an increase, it would be a major surprise for the Bank of Canada not to deliver.

However, concerns over the future of the NAFTA free trade agreement lead us to believe that the BoC will be somewhat cautious in their assessment for the economic outlook. With President Trump having threatened to rip up the longstanding trade deal and Mexican and Canadian officials sounding cautious on the prospect for compromise ahead of the sixth and penultimate round of talks, we expect little guidance from the BoC on future moves. After all, exports to the US account for 17% of Canada’s GDP so officials will be nervously waiting to see what happens. We still think there is scope for compromise on the future of NAFTA, but this is by no means the universal view. As such, we are currently only pencilling in one further rate rise this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more