Canada growth preview: Oil to weigh on October figure

A weak third quarter and continued problems in Canada’s oil industry leave the near-term growth outlook shaky, but we don't expect a material turn for the worse. We still expect positive growth in October and a robust manufacturing sector should help keep growth on track

The pace of Canadian growth unexpectedly slowed in September and brought a pretty disappointing end to the third quarter, as the economy grew only 2.0%. Things look slightly better for October though; we’re forecasting +0.1% month-on-month. This should see an annual figure of 2.1%, which supports our view that Canada will undergo a mild slowdown next year.

Medium-term growth outlook lowered in response to oil industry issues

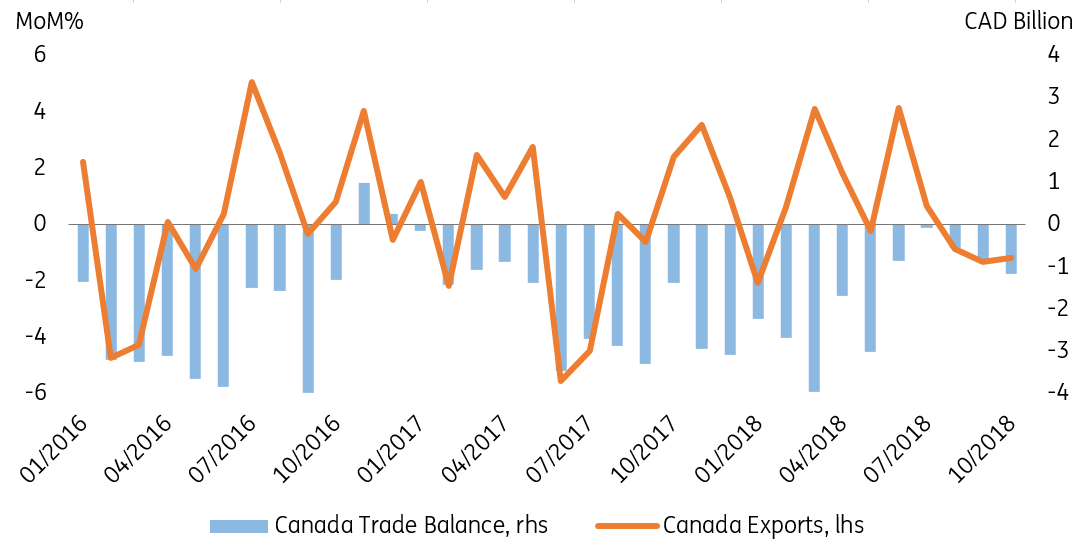

Though our October forecast is still for decent growth, it could be better if it weren’t for transportation constraints and inventory build-ups in Canada’s oil industry weighing on both oil extraction and exports. A glimpse of this can be seen in Canada’s trade data: The trade deficit widened to CAD1.17 billion in October - largely driven by a 1.2% fall in exports.

Widening of trade deficit is fuelled by a fall in exports

Until planned projects get underway, we see this theme sticking around for some time. Alberta has recently curbed oil production to support the price of Western Canada Select (WCS), which has been trading at a deep discount to other benchmark oil prices. While the cuts have helped reduce the discount, the production cuts mean we’ve lowered our growth outlook in the medium term.

The manufacturing sector should help keep growth numbers healthy

Going forward, Canada’s robust manufacturing sector should prop up growth. The manufacturing PMI ticked up to 54.9 in November (from 53.9 the previous month), which is likely a lagged effect of a United-States-Mexico-Canada-Agreement sentiment boost. This reassures us that, despite the materially weaker outlook for the energy sector, manufacturing should remain strong in response to solid levels of both domestic and foreign demand.

The central bank still has the green light to hike

Our 2018 growth estimate has been revised down to 2.5% due to a worse-than-expected third quarter, but don’t let that take the shine off things. This print is still solid, and with the central bank’s three main core inflation measures still averaging 1.9% in November, the Bank of Canada will likely carry on tightening policy rates throughout next year (here’s four reasons why they’ll keep hiking in 2019).

| 2.5% |

2018 GrowthRevised Lower |

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).