Can the SEC’s climate disclosure mandate rule the roost?

The historical climate disclosure rule, albeit less stringent than peers’, will enhance data comparability and allow investors to better evaluate company climate risks and opportunities. The rule faces US election and legal risks, but we advocate preparedness and embrace of change over avoidance

In March 2022, when the Securities and Exchange Commission (SEC) first released its draft rule on mandating climate-related data disclosure, we wrote in our analysis that the rule could be ‘game-changing’ for corporates and investors. Now, after two years, and having received tens of thousands of public comments, the SEC has published and adopted the final rule. It’s arguably not comprehensive enough, and even then, will need to survive potential policy legal disruption as we head into a turbulent US election cycle. But, our central assessment views it as an overdue enhancement of climate data consistency, and a meaningful excuse for corporates to embrace its many positives.

Watered-down final rule can still have significant impact

- Scope 3 emissions off the hook; Scope 1-2 emissions required in a limited manner

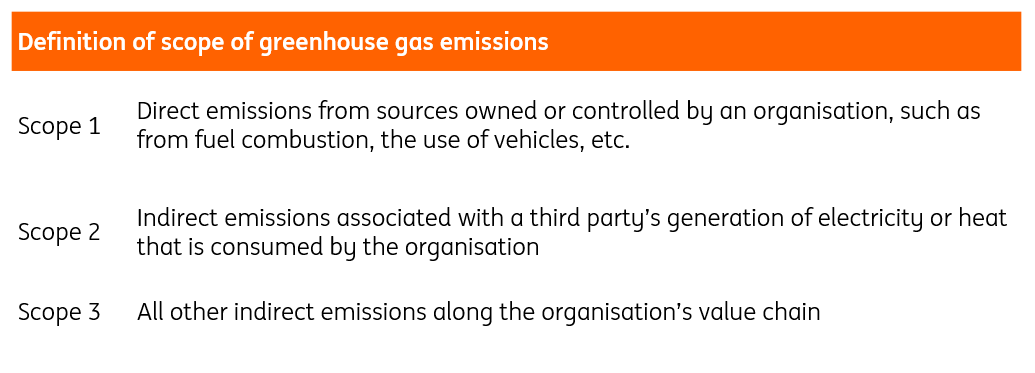

The final rule shows that the SEC would like to give as much flexibility as possible regarding implementation. As expected, the requirement of Scope 3 (see table below for definition) emissions data reporting, which was included in the draft proposal, has now been dropped due to overwhelming concerns about the associated cost and administrative burden. This is a valid concern, as the SEC estimates that the first-year cost of compliance would likely be $640,000 for large companies and $490,000 for small companies. Nevertheless, this means that the SEC rule will be more relaxed than the Corporate Sustainability Reporting Directive (CSRD) in the EU and the climate disclosure laws in California, both of which mandate Scope 3 emissions data disclosure.

Different scopes of emissions

Moreover, the SEC has narrowed down the requirement for Scope 1 and 2 emissions disclosure to only large accelerated filers and accelerated filers. And this reporting will only be mandated if such a registered company deems the information material to investors. This marks another major retreat from the March 2022 proposal, where all public companies would have been required to report Scope 1-2 emissions.

Climate reporting gap between the US and other developed economies

Percentage of listed companies that reported emissions in the respective MSCI indexes

- Climate risks take centre stage

The SEC’s rule requires listed companies to report on material climate risks that can impact their business strategy, operations, and financial condition. Additionally, when relevant, companies will need to disclose climate transition plans, scenario analysis, internal carbon prices, board oversight, qualitative and quantitative description of material expenditures for climate adaptation, etc. This indicates increasing market awareness that managing climate-related physical and transition risks has become impactful to business performance and investor decisions.

Furthermore, as more extreme weather events continue to affect infrastructure, housing, labour safety, availability of resources, and insurance practices, the SEC is requiring companies to disclose costs related to severe weather events and other natural conditions like hurricanes, flooding, and wildfires. To report on climate risks robustly, companies will need to perform adequate climate stress tests, establish relevant contingency plans, and align long-term business strategies.

- Disclosure will be phased in, but it needs to be assured

To ensure orderly implementation and manage the cost of compliance, the rule will be implemented in phases based on both a registered company’s type and the category of disclosure requirement.

For Scope 1-2 emissions data, large accelerated filers will be required to include it in their filings start fiscal year 2026, with the first level of assurance to be required starting fiscal year 2029. Accelerated filers’ disclosure will be mandatory beginning fiscal year 2028, with assurance (no step-up) needed starting fiscal year 2031.

For other reporting categories, initial implementation time can vary between fiscal years 2025 and 2027.

- More transparency and comparability

Despite compromises, the adoption of the SEC rule is a historic moment for the US, where for the first time, standardized, material climate data will be officially required in relevant listed companies’ filings. Today, there is a reporting gap between US listed companies and those in other developed markets. According to MSCI, 73% of listed companies in developed markets outside the US report Scope 1-2 emissions, whereas only 45% of US listed companies do so. The adopted SEC rule will greatly enhance the transparency and comparability of climate data across companies in the US. The SEC’s climate disclosure rule would bring greater consistency to voluntary climate reporting efforts, thereby reducing information asymmetry across companies.

- What does this mean for investors and US companies?

With more standardised climate data, investors will be able to more accurately evaluate – and price – climate-related risks and opportunities of a company or issuance. It will also allow more trustworthy comparison of companies within a particular industry. The SEC’s climate disclosure rule therefore allows for more effective allocations of capital to companies with either higher climate credibility or larger progresses toward decarbonisation.

For US-listed companies, they will also have clear metrics as to how their climate performance compares with peers. The rule will also lead them to think more systematically: climate data and risk reporting is the result; behind it are thorough climate strategy settings, climate risk scenario stress-testing, as well as climate management. Moreover, the SEC rule can encourage more sustainable finance issuance. In an environment of climate data consistency, issuers would find it easier to show the sustainability credibility and avoid greenwashing allegations.

That said, many companies remain not fully prepared for the upcoming disclosure rules, and the clock is ticking. They need to adequately design and invest early in a data collection, processing, reporting, and verification ecosystem. This includes, among others, having a dedicated climate data reporting team that sets up official workflows and stay in timely coordination with various internal teams.

Looming election risks

Election results this year can change the outlook of the SEC’s climate disclosure rule. Now that the rule has been adopted, it has dodged the bullet of quickly being revoked under the Congressional Review Act in the scenario where Republicans won both houses of Congress and the White House. Now, any congressional repeal of the rule during the next presidential term would need supermajority approval from the Senate, which would be hard to achieve.

However, there can still be significant implementation hardship if the Republican party controls the White House and at least one house of Congress. For instance, Congress can pass additional legislation to limit the amount of funding the SEC receives and uses to enforce the climate disclosure rule. This could add challenges to the rule’s implementation.

Even more uncertainty from litigation risks

It is highly likely that the SEC’s climate disclosure rule will be subject to litigations soon after its adoption. In comparison, California’s now-signed-into-law regulations requiring large companies doing business in the state to start reporting climate data in 2026 are already facing litigations, most prominently from the US Chamber of Commerce. The direction of travel of these lawsuits will largely affect the perspectives of litigation risks of the SEC’s climate disclosure rule.

Another source of risk comes from the Supreme Court, which ruled in 2022 that the Environmental Protection Agency (EPA) does not have authority to regulate greenhouse gas emissions from power plants, based on the "major questions" legal doctrine that requires congressional approval for action on issues of broad societal impact. This sets a precedent that can be used to strike down the SEC’s climate disclosure rule.

But significant uncertainties remain, and it is hard to predict the outcome of the litigation risks facing the SEC rule. As we will argue below, one sensible route for companies to manage these risks is to get ahead of the curve in sustainability reporting.

Large US companies will soon have nowhere to hide in the global race to mandatory climate disclosure

Despite the SEC climate disclosure implementation risks, large US companies should not take these as an excuse to delay climate reporting action. This is because many jurisdictions have already set climate disclosure mandates that can affect large public companies globally.

In the EU, the CSRD requires certain non-EU companies with subsidiaries or branches in the EU to start reporting a series of climate data starting 2029 (financial year 2028). Large non-EU companies with securities listed on EU regulated markets are, similar to their EU counterparts, already in scope of the CSRD reporting requirements per 2025 (financial year 2024). California, the world’s fifth largest economy, will mandate climate data reporting from large US companies doing business in the state in phases starting 2026 (provided that the laws are not stranded by court). And both jurisdictions require Scope 3 emissions data, potentially holding large US companies to a higher standard than required by the SEC.

California's climate disclosure rules

Moreover, the International Sustainability Standards Board’s (ISSB’s) sustainability reporting standards, finalised by the International Financial Reporting Standards (IFRS) in June 2023, has received support from regulators and standard setters from more than 15 countries and groups. Some of them are actively planning to integrate the standards into their market policy, with Turkey being the first to have done so in January 2024. The ISSB’s standards will not necessarily affect the US unless it commits to it, but a substantial gap between climate reporting standards in the US and globally will become an issue, and ISSB-backing governments may similarly require foreign companies to comply to the standards.

In essence, large US companies doing business internationally can expect to have little choice in the medium term but to establish standardised reporting and assurance mechanisms to comply with other jurisdictions’ rules. Consequently, companies would benefit from getting ready, as opposed to finding themselves unprepared in the face of implementation timelines.

Conclusion

The SEC’s landmark climate disclosure rule brings the US one step closer to the sustainability reporting ecosystem in jurisdictions such as the EU. It is game-changing in a sense that companies and investors will have a larger and more consistent data pool to contextualise a company’s climate performance. Clearer reporting of climate risks and opportunities will make a better case for business or investment adjustments. And the sustainable finance market will become more defined to incentivise quality issuance. But the rule also means that companies will need to adapt swiftly to comply.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more