EUR/RON

EUR/RON was fairly stable on Friday with clustered trading around 4.6700, supporting the suspicions about official offers on above-average turnover. Late buying interest pushed the currency pair towards 4.6750 in after hours. The National Bank of Romania might offer support to the Romanian leu for some time, but it is likely to allow a gradual depreciation if the emerging market backdrop remains negative. With negative sentiment prevailing on global markets today, we expect pretty much the same scenario and EUR/RON trading within 4.6650-4.6800 range.

In the US there are a number of Federal Reserve officials scheduled to speak this coming week, and we will be looking to see whether the risks appear skewed to the upside or the downside in terms of Fed policy. For now, we think the risks are balanced, given some uncertainty is likely following the mid-term elections. In the Eurozone, the minutes of the European Central Bank's September meeting should shed some light on the ECB’s current thoughts on their path.

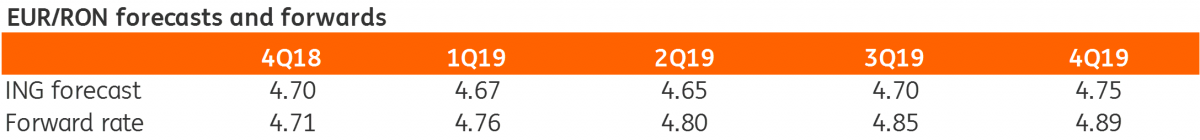

In Romania, we expect September CPI to decline by 0.4 percentage points to 4.7% year on year as the statistical base impact (last year saw an excise duty hike for fuel) more than offsets the recent increase in oil prices. This is in line with the latest National Bank of Romania forecast from August. With external backdrop not helping at all, we expect EUR/RON to trade with an upward bias, but it is hard to call the timing when the NBR will shift its comfort range higher. The possible range for the week: 4.6600-4.6800.

Government bonds

ROMGBs sold-off on Friday with July-2027 yields closing c.15bps higher given the negative global sentiment and the expected supply on the primary market in the fourth quarter with an indicative announcement at RON13-15bn. MinFin auctions RON600m in June-2023 bonds today. Despite good buying interest on this segment of the yield curve recently, the external backdrop is not supportive at all. Hence, we could see an average yield near Friday’s closing bid of 4.60% with the tail for the auction depending on the MinFin appetite to adjust the issuance relative to the demand. Given the context, the probability of partial allocation is fairly high.

Money Market

The overnight implied yields continued to trade just below the central bank's key rate level on Friday. Given the current liquidity backdrop, the NBR announced that it is not organising open market operations today. The central bank's Monthly Bulletin showed that September daily average liquidity deficit for the banking system decreased by RON0.9bn to RON3.9bn.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more