Brexit: We expect sterling gains to stall

With the headwinds facing the UK economy set to remain in place, the chances of a rate hike from the Bank of England this year have faded considerably. We expect sterling gains to stall, and the risks are skewed to higher EUR/GBP in Q3 if a more eurosceptic candidate wins a Conservative Party leadership battle

Downside risks emerging for the economy and sterling

The European Union has decided to allow a further six-month extension to the Article 50 Brexit negotiating period, but big questions remain over whether this will be long enough. We looked at the political scenarios in an earlier piece, but the upshot is that this period may not be long enough to break the deadlock in the UK.

This means that the headwinds that have plagued the UK economy over recent months will continue to keep a lid on growth, given that firms are likely to use the extra time to continue 'no deal' preparations. For that reason, we no longer have a Bank of England rate hike pencilled in for 2019.

The extension is likely to be marginally more negative than positive for GBP. Not only is the Bank of England less likely to raise rates, the possibility of a Conservative leadership battle during the third quarter means there is a clear risk that:

- Little will change on the Brexit front before the new October deadline

- The perceived odds of a hard Brexit may marginally rise in response to future eurosceptic leadership candidates.

The latter should be negative for GBP in 3Q19. We've adjusted our EUR/GBP forecast accordingly (Figure 1) and expect EUR/GBP to test 0.88 in Q3.

Figure 1: Our new EUR/GBP forecast profile

Ongoing 'no deal' preparations set to keep a lid on economic growth

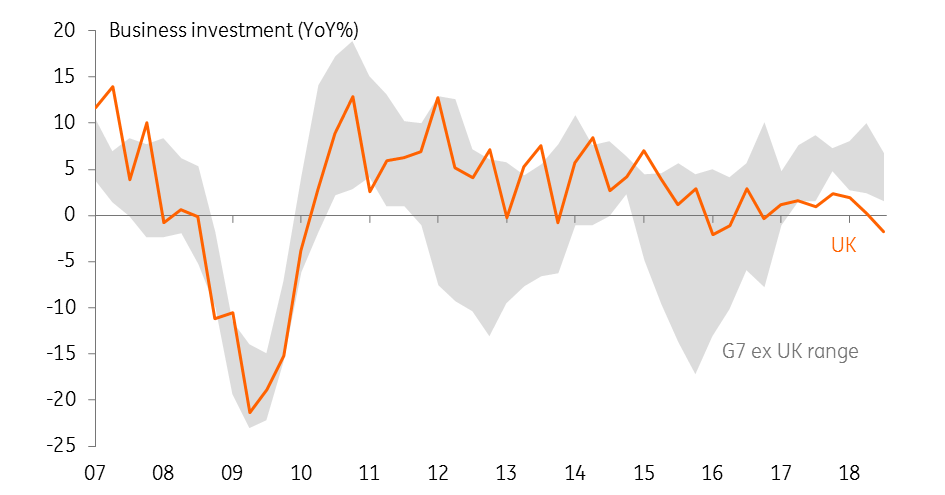

Growth has already been poor over recent months, and investment has been particularly disappointing. On a year-on-year basis, UK business investment was the worst among G7 economies in 2018.

In theory, the temporary removal of the 'no deal' risk could unlock a modest amount of pent-up hiring and shorter-term investment. But having come so close to the cliff-edge twice now, it’s much more likely that firms will use this extra time to continue preparations for a possible ‘no deal’ final outcome.

For many companies, this will be very costly. Some goods producers/suppliers may opt to maintain the stockpiles they have recently accumulated of components/finished goods etc, in which case they may need to renegotiate contracts on additional warehousing space – something which is already in very short supply in the UK.

Investment is likely to stay depressed over the coming months

Many others may be forced to reduce their excess inventory, either because it is perishable, or because the cost of holding or financing higher levels of stock is too steep. In other words, they may have to start the process all over again in a few months.

Those are just a few specific examples, but they highlight why investment is likely to stay depressed over the coming months. Admittedly the overall economy may get a mild boost from consumer activity, given that real wage growth has recently improved. The short-term reduction in uncertainty, perhaps coupled with some better weather over the next few weeks (a warm Easter would be a big boost for retailers), could see some shoppers lift spending on bigger-ticket items.

Figure 2: UK business investment was the worst in the G7 last year

Lack of Bank of England tightening removes potential positive GBP catalyst

Overall though, we expect growth to remain sluggish, and we think this means the chances of further Bank of England tightening this year have now receded. We had previously pencilled in a rate rise in November if parliament had aprroved a deal in March or April. The BoE has kept the door ajar to a further rate rise, and a fall in uncertainty coupled with rising wage growth and skill shortages in the jobs market could see policymakers follow through.

We no longer expect a rate rise in 2019

But with the chances of a near-term resolution to the Brexit impasse looking fairly slim, we think the window for this to happen this year has more-or-less evaporated. We therefore no longer expect a rate rise in 2019, particularly given the backdrop of global central banks turning more dovish. However, we still think the Bank of England may be minded to move interest rates closer to their neutral rate (1.5-2%) over the next few years if Brexit uncertainty fades and some of the recent gloom in the global economic outlook disappears.

The fact that the six-month extension is unlikely to be long enough to give the BoE a window to hike rates means GBP will miss out on the potential positive catalyst, in turn lacking more meaningful upside this year.

Markets are currently pricing less than 5bp of rates hikes by the end of the year, and close to 15bp hikes by the end of 2020. Though the pricing is already subdued (mainly for this year), suggesting that this shouldn't be an outright negative for GBP, the ongoing Brexit uncertainty will likely prevent markets from pricing in more meaningful tightening.

Possible Conservative Party leadership battle a short-term negative for GBP

Following the extension of Article 50 by six months, we see risks to EUR/GBP modestly on the upside:

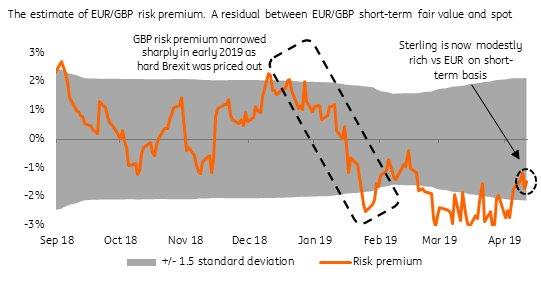

- EUR/GBP is modestly undervalued based on our short term financial fair value model.

- With markets meaningfully pricing out the risk of a hard Brexit earlier this year (evident in Figure 3 where EUR/GBP turns from over- to under-valued based on our short term model), the non-negligible risk of a leadership contest in the Conservative Party in Q3, ahead of the party conference in late-September, and the rise of eurosceptic candidates, such as Boris Johnson, could bring some modest risk premia back into sterling and lead to some light sterling weakness.

However, given the clear preference of most British MPs is to avoid 'no deal', we still suspect that such a scenario is unlikely. But in the meantime, the balance of risks may nonetheless increase (from the current low perceived probability priced by the market) and hence weigh on GBP somewhat.

Figure 3: Our estimate of EUR/GBP risk premium

Sterling profile: Downside risk in Q3

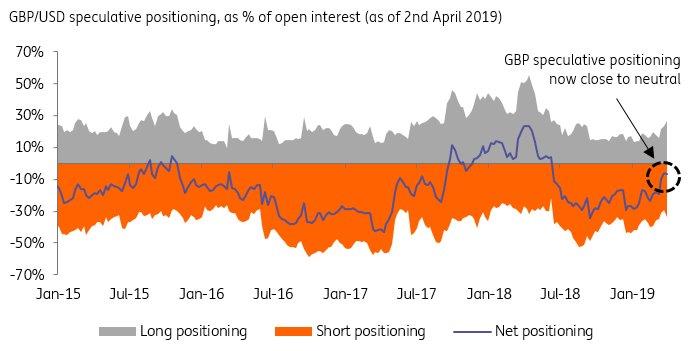

All this means that EUR/GBP is likely to test the 0.88 level in the third quarter in response to the negative headline news stemming from a possible Conservative leadership battle and concerns about a eurosceptic prime minister. Here, the partial clean-up of GBP short positioning (and some built-up of new speculative longs) can also add to the reversal as GBP positioning is no longer meaningfully skewed one way (as per Figure 4)

However, as Parliament is likely to try to avert 'no deal', perhaps easing some of the initial fears about a new eurosceptic leader, we expect GBP to recover some of its loses in Q4.

As we noted in more detail in our other piece, the fourth quarter is likely to be accompanied by another extension to the Article 50 period (beyond October), or less likely, a decision by the UK Parliament to revoke Article 50 altogether. This means that EUR/GBP should not move below the 0.8500 level persistently this year.

Figure 4: GBP speculative positioning

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more