Brexit battle continues as talks enter round two

As negotiations start again, disagreements persist in Brussels whilst public optimism fades and the economy continues to slow

Battling on all fronts

Brexit Secretary David Davis stayed in Brussels for just three hours on Monday, but he will return on Thursday to get an update on progress and to schedule details for the next round of discussions.

This comes as Conservative ministerial infighting continues, with briefing and counter-briefing commonplace given Theresa May’s weak position as Prime Minister. Debate continues about how long she can stay on with the October Conservative party conference (1-4 October) seen as a key event that could determine her future.

Meanwhile, the threat of an imminent Bank of England rate hike has receded thanks to a surprise dip in inflation and subdued activity data. Economic figures increasingly suggest the UK economy is losing steam.

The latest from the negotiations

- Exit bill debate

The issue of the “divorce” bill has continued to be the source of big disagreements in the second round of Brexit talks.The UK continues to disagree with the EU’s €100bn estimate, with Foreign Secretary Boris Johnson saying recently the EU can “go whistle” over the exit bill. The UK’s rebate, agreed by Thatcher in the 1980s on the basis the UK accounts for a small share of agriculture subsidies, is also reportedly a source of controversy in the talks. - Post-Brexit financial contributions

The UK government’s recent acceptance that it could continue contributing to the EU budget to maintain market access after Brexit has reportedly helped calm the debate on the exit bill this week. But the EU is pushing for more clarity here, something that the UK appears to want to tie into any agreement on exit costs. - Citizen rights

Following talks in June, the EU said that the UK’s proposals didn’t go far enough. There has apparently been some progress this week, specifically on the issue of family reunions, but the Financial Times has reported that there are still “substantial differences” left to be resolved.

Labour continues to lead polls as public Brexit optimism fades

Surprise dip in inflation makes a rate hike less likely

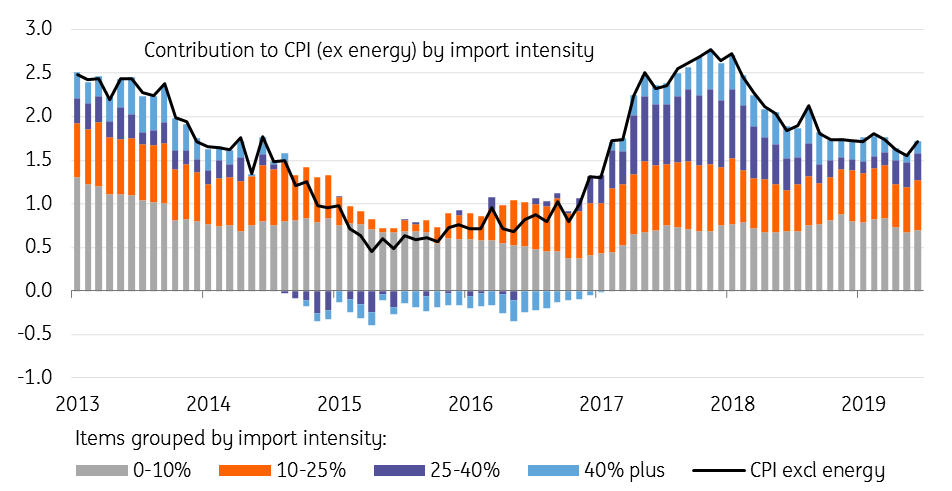

This week’s inflation data, which saw headline CPI dip back to 2.6%, casts further doubt over recent hawkish Bank of England comments.

Admittedly, a fair chunk of the recent fall is down to lower oil prices, and as the effect of the weaker pound continues to filter through, we expect inflation to stay in the 2.5-3.0% area for the rest of 2017. Whilst some hawkish voters have said they have “limited tolerance” to above-target inflation, the outlook for wage growth and investment remains subdued. Governor Carney has said these need to recover if the Bank is to hike rates, and elevated political uncertainty, higher import costs, and faltering consumer demand suggest businesses will remain cautious.

We still think a 2017 rate hike looks unlikely.

Weaker pound will continue pushing up inflation

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more