Brazil: Heightened risk calls for a hawkish policy turn

Polls show that Presidential candidate Jair Bolsonaro has a clear edge in the first-round vote, but is considerably less competitive in the runoff. Given the unpredictable politics, central bank officials may opt to fine-tune the policy guidance, adding a hawkish bias, but refrain from a rate hike just yet

Bolsonaro’s stabbing, Lula’s exit and the latest polls

Two events marked Brazil’s election dynamics over the past week: last week’s (non-fatal) stabbing of frontrunner candidate Jair Bolsonaro and Tuesday’s official announcement that Fernando Haddad will replace Lula, whose candidacy was blocked by the courts, as the PT party’s candidate.

Polls released this week indicated that, since the attack, Bolsonaro's voter support increased slightly, perhaps due to voter sympathy and the greater media exposure. But its main effect was to galvanise and solidify the loyalty of his already-enthusiastic base, shielding the candidate from the negative campaign against him. This should, most likely, ensure that the candidate will maintain at least a 20% support-base, which should be sufficient to propel him to the second-round. This, ie, the fact that Bolsonaro will move on to the runoff, is among the greatest conviction calls among local political analysts.

With slightly more than three weeks until the first round, everything else about this race continues to be marked by worrying levels of uncertainty. Two key questions remain: who will get the other spot in the runoff and how competitive Bolsonaro would be in the runoff.

Polls show that left-leaning voters have been especially inclined to shift their support, and this trend should continue as a greater share of Lula’s supporters should now flock to his hand-picked successor. In any case, given that Haddad was already rising in the polls, the odds now seem to be in his favour, and he should rise quickly from his current fifth-place in the polls.

Also according to polls released this week, Ciro Gomes has, surprisingly, gained some traction with the electorate, mostly to the detriment of Marina Silva, who has seen her chances diminish materially. In fact, Gomes’s rise to the second place, sometimes credited to his blunt manner, somewhat akin to Bolsonaro’s, and the speed of Silva’s fall, to third, is among the most surprising elements of the recent polls.

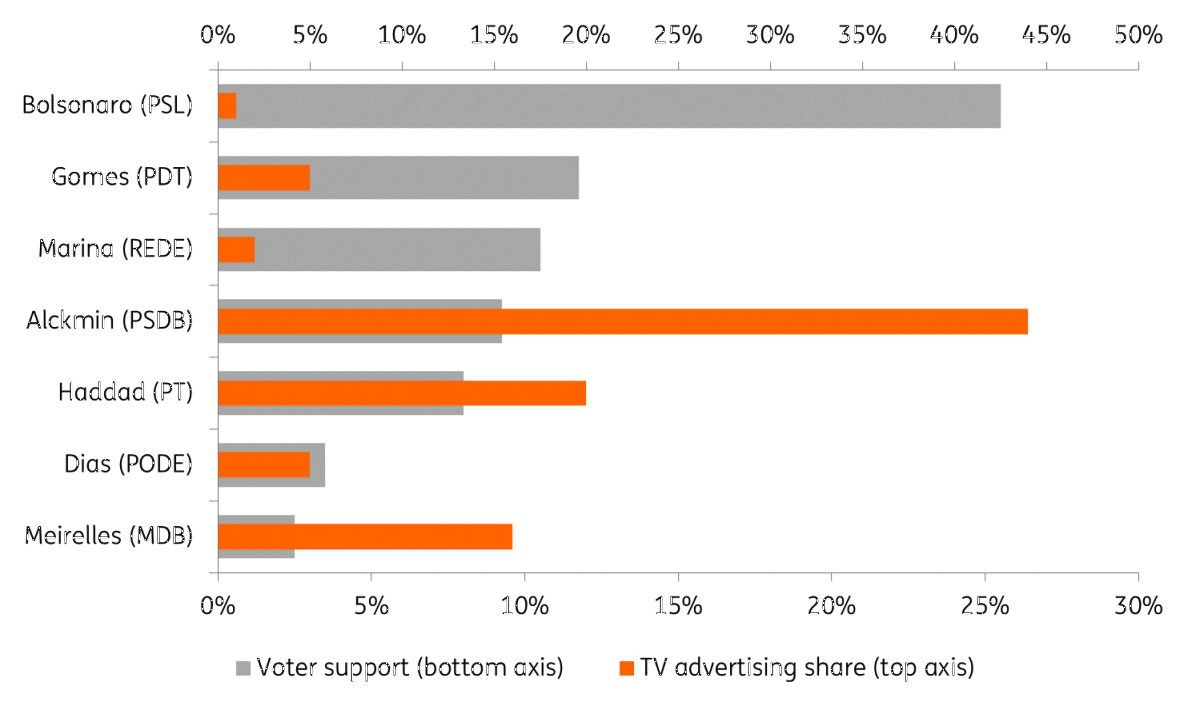

Lastly, the local consensus is that recent events have been particularly detrimental to the candidacy of the market-favourite candidate, Geraldo Alckmin, who remains broadly stable in fourth place. In particular, the expected surge in the polls, due to his greater TV campaign airtime (as seen in the chart above), appears to have become harder to envisage now. This reflects the fact that the success of his campaign strategy is increasingly in doubt, as it relied heavily on the use of attack-ads to take away voters from Bolsonaro, while polls indicate that these (targeted) voters have become even more committed to Bolsonaro.

In the nearer-term, investors are likely to pay particular attention to the following developments: monitoring Haddad’s rise as Lula’s supporters get to know him; monitoring Bolsonaro’s health, his rejection rate and his performance against leftist candidates in second-round simulations; and, lastly, watching whether Alckmin or Gomes gain traction with the electorate and threaten Haddad’s position as the most-likely runner-up in the October 7 first-round vote.

Overall, recent polls have been received with great caution by investors. Monday’s Datafolha poll triggered a considerable sell-off in local markets, as it confirmed that Alckmin continues to fail to gain traction while Bolsonaro, who most investors consider to be a second-best option, appeared to be a weak contender against the left in runoff simulations.

Tuesday’s Ibope poll did not alter that assessment for Alckmin, but it gave a slightly improved edge to Bolsonaro. In any case, both polls still indicate that Bolsonaro continues to have the highest rejection rate among all the candidates, suggesting that he is likely to struggle to maintain his advantage after the first round. This difficulty could increase if the candidate fails to make a full recovery relatively soon, a risk that should be considered in light of the emergency procedure he underwent yesterday. In principle, this increases greatly the likelihood of a left-leaning victory in the October 28 runoff.

Monetary policy at an inflection point

The highly unpredictable political and fiscal outlook, and its potentially temporary impact on the Brazilian Real, complicate the central bank’s decision in next week’s (Sep 19) monetary policy meeting.

The negative impact the BRL weakness will have in the bank’s inflation forecasts, which should increase towards 5% in some scenarios, ie, materially above the 4.25% target for 2019, would be sufficient to justify an increase in the SELIC rate (6.5%). But the possibility that the BRL may be overshooting, and that it could rally in the post-election period, depending on the policy signals adopted by the President-elect, could give policymakers pause.

A decision to delay a rate hike would also be consistent with recent inflation and economic activity data, in addition to the substantial slack in labor markets. On the inflation side, the latest inflation prints have surprised to the downside, while inflation expectations have remained persistently low (and fully-anchored), as seen in central bank surveys (chart below). Activity data continues meanwhile to disappoint, with the latest figures trending at sub-1% YoY levels, confirming a clear loss in momentum and adding downside risk to the GDP growth outlook.

We do not discard a rate hike however. A hike could also be justified as a means to reduce BRL vulnerabilities, by improving the carry and increasing the financial cost of short-BRL positions. But recent central bank behavior, in particular the bank’s apparent reluctance to intervene in the FX market, suggests that policymakers are relatively comfortable with the FX performance. As a result, officials do not seem inclined to implement changes in the policy rate, at least for now, strictly as an effort to anchor FX dynamics.

Overall, we suspect authorities will prefer to alter the guidance from neutral to hawkish, instead of opting for an outright rate hike at this meeting. Given the low inflation and still substantial ammunition to intervene in the FX market, if necessary, authorities can wait until after the elections, when a better assessment of the political and fiscal outlooks will be possible. We would consider this an appropriate response given that the fiscal outlook remains the most crucial ingredient in the assessment of next-year’s monetary policy path.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).