Bank of Canada sits tight, but expect more tapering

Canada's central bank kept rates unchanged as weaker activity readings, the election and Covid-19 creates uncertainty. However, with inflation pressures on the rise, the case for tapering remains strong and we expect more tapering in October. The undervalued CAD may struggle to recover before the vote but should show idiosyncratic strength in October

| 0.25% |

Overnight rate |

Cautious optimism from BoC ...

The Bank of Canada has not changed monetary policy with the overnight rate held at the effective lower bound of ¼ percent and weekly QE asset purchases remaining at $2bn per week. A move was hardly likely given the recent shock GDP contraction, and the Bank wants to avoid any possibility of being seen to influence or to be taking a view on the 20 September 20 federal election.

The commentary remains cautiously optimistic, though. The negative GDP was caused primarily by supply chain disruptions hitting exports, but the underlying story remains good. Indeed the BoC “continues to expect the economy to strengthen in the second half of 2021, although the fourth wave of COVID-19 infections and ongoing supply bottlenecks could weigh on the recovery.”

In terms of elevated inflation readings, they are sticking to the “transitory” line for now but acknowledge that “their persistence and magnitude are uncertain and will be monitored closely”.

Canada GDP surprisingly fell in 2Q

More tapering next month with rate hikes in 2022

The case for further QE tapering is strong despite the Covid-19 uncertainty.

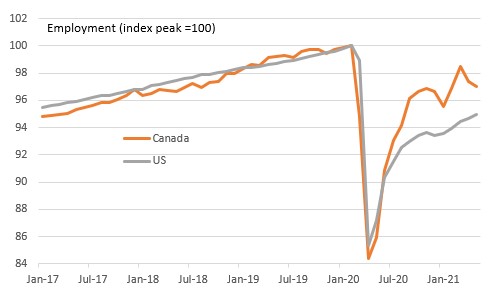

As elsewhere, supply chain issues, higher energy costs and re-opening frictions mean inflation is likely to stay elevated for quite some time. With employment levels just 1% lower than February 2020, wage and inflation expectations may push higher, which means annual CPI rates could linger at around 4% for a while, double the BoC’s target.

Vaccination rates are also looking strong, with 67.6% of the population fully vaccinated and an additional 6.3% partially, hopefully limiting the upside for hospitalisations. Consequently, we are hopeful that this will allow the economy to remain largely open even if case numbers continue to rise.

The economy is also receiving ongoing fiscal support with stimulus checks still being paid while 10-year bond yields have fallen 35bp since May, which also provides the stimulus. In an environment where inflation is already above target, and Canada’s booming housing market (prices are up around 25% since the start of the pandemic) is leading to fears surrounding financial stability, there is still a strong case for dialling back the stimulus again on October 27th. We favour QE being reduced to $1bn per week at that policy meeting and expect the BoC to start raising interest rates late next year with two rate hikes pencilled in before the end of 2022.

CAD: Most negatives in the price, BoC to come as a support again in October

Although the move was extremely contained, the Canadian dollar had a mildly positive reaction to today's BoC rate announcement. This is no surprise as the Bank delivered exactly what market consensus was expecting - a pause in tapering while keeping forward guidance unchanged.

We expect the BoC to step in with another reduction in weekly asset purchases by CAD 1bn in October, which should ultimately offer fresh support to the loonie. Until then, CAD’s recovery will depend on: a) Friday’s jobs data for August; b) the outcome of the Federal election; c) external factors (risk sentiment and oil prices).

We think that August jobs data will not disappoint, which should encourage markets to price in more BoC tapering and offer some respite to CAD, but political uncertainty is set to remain a potential drag as we head into the 20 September election. The polls-imply a probability of a Liberal Party majority government moved from 60% before snap elections were announced to just 2%, according to 338canada.com, as PM Trudeau saw a sharp drop in his approval rating in the past few weeks. According to the latest polls, it now appears marginally more likely (according to the latest polls) that the opposition party (Conservatives) may secure the most votes and possibly form a new coalition government.

For now, markets are concerned about the political picture in Canada, which may stall as parties could struggle to secure coalition deals for some time after the vote.

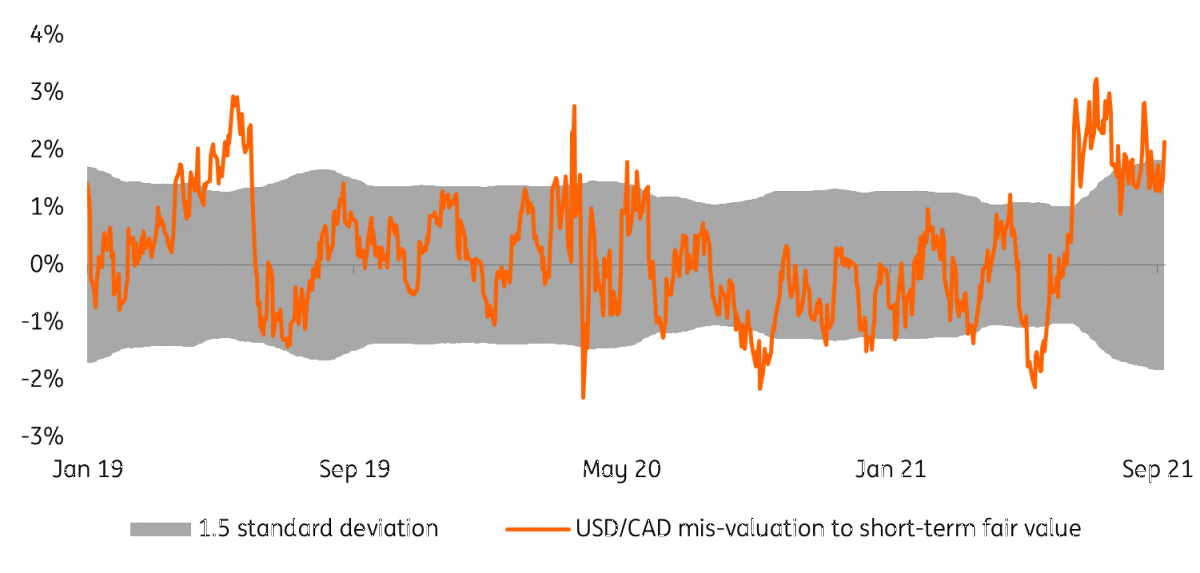

CAD is cheap according to our short-term fair value model

Political uncertainty was one of the factors contributing to CAD’s underperformance lately, and may well limit any ability of the loonie to stage a solid recovery if other factors improve. At the same time, we also note that CAD is trading quite cheaply according to our short term fair value model, which shows a 2.1% overvaluation in USD/CAD (chart above). This mis-valuation appears quite overstretched as it falls above the 1.5 standard-deviation band.

This suggests that most of the negatives are in the price and a dissipation in political risk combined with the Bank of Canada stepping in with more tapering in October may see some idiosyncratic CAD strength emerge. As discussed in the latest edition of FX Talking, we expect USD/CAD to consistently trade below 1.25 in 4Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more