Between doomsaying and reality: There’s still no rush for Chinese cars in Germany

Despite efforts by Chinese car manufacturers to take market share in Germany, they are still a long way from overtaking local producers. But with the end of the e-car subsidy, a wider choice of Chinese brands, and the aggressive pricing of models, China's market share could increase significantly over the coming years

In the last quarter of 2023, the Chinese car manufacturer BYD sold more electric cars worldwide than any other manufacturer for the first time, even overtaking electric car pioneer Tesla from the US. According to the China Association of Automobile Manufacturers, China exported an impressive five million cars last year, probably overtaking Japan as the world's largest car exporter. The final figures are expected at the end of January.

In Europe, Chinese car manufacturers went on the offensive with roadshows, test drives, new models and low prices. The fear that Chinese electric vehicles could take market share from European producers triggered an intense debate last year over whether to impose additional tariffs. In October last year, the EU Commission launched a formal investigation into whether Chinese companies are benefiting from illegal subsidies. This is scheduled to run for 13 months. Currently, three major Chinese car manufacturers are under scrutiny, according to Reuters.

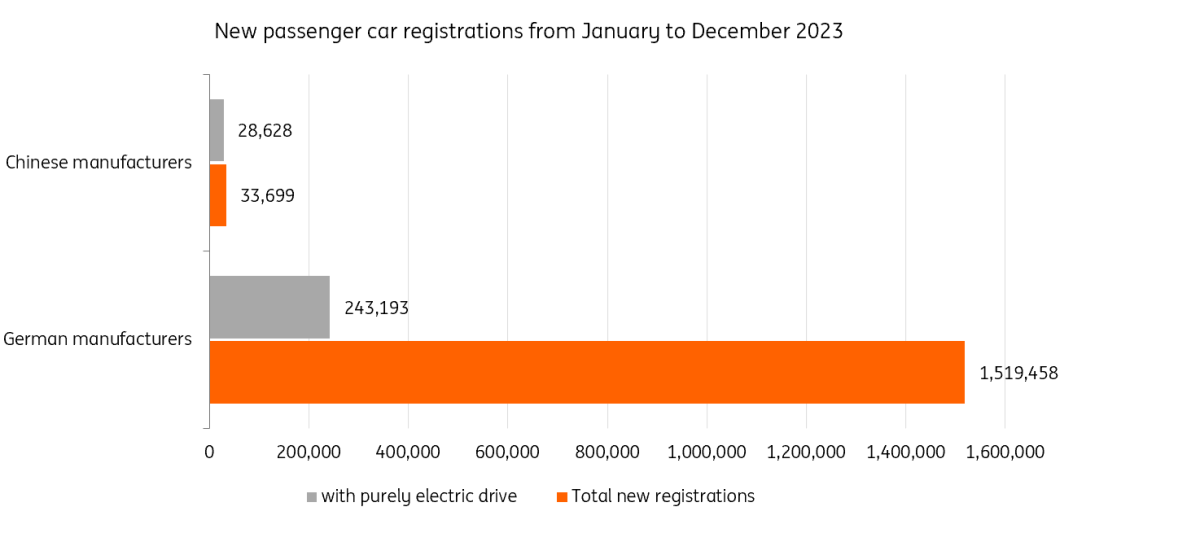

In terms of the German market, we checked the data and found that Chinese car manufacturers are still a long way from overtaking German manufacturers. This is shown by the new car registration figures from the Federal Motor Transport Authority (KBA) for 2023. A total of 2.84 million new cars were registered in Germany between January and December, an increase of 7.3% compared to the previous year. 33,699 of these vehicles come from China, which corresponds to a meagre 1.2% of all new registrations in 2023. German manufacturers*, on the other hand, have a share of 53.4%.

Newly registered passenger cars from Chinese manufacturers are almost exclusively electric cars

Interestingly, registered passenger cars from China were almost exclusively electric cars. 85% of new registrations of Chinese cars were pure electric; in 2022, this was only 40.7%. And compared to 2022, the overall number of newly registered passenger cars from Chinese manufacturers increased by 47.6%. Maybe one reason for this increase is the wider choice of Chinese brands. While there were just three Chinese suppliers on the German market in 2022, there are now models from seven different suppliers to choose from (Aiways, BYD, GWM, Lynk & Co, Maxus, MG Roewe, Nio). Despite the increase, Chinese cars accounted for only 5.5% of all new registrations of electric vehicles, compared with 46% by German manufacturers.

New passenger car registrations from January to December 2023

The end of the e-car subsidy (environmental bonus) could play into the hands of Chinese manufacturers

German subsidies for electric cars expired on 18 December 2023, which could help Chinese manufacturers significantly increase their market share this year. This is because the models are priced on average 24% below the base price of electric models from German manufacturers (without consideration of discount promotions). Only the Chinese brand Nio offered its models in the significantly higher price segment but has now also adjusted its list prices significantly downwards. Some manufacturers are granting discounts until 31 March, 2024. But Chinese suppliers such as Nio are also among them. BYD has even permanently reduced the list price of some models.

The pricing by Chinese manufacturers prompted accusations from the European Union last year that the Chinese government was keeping prices artificially low through very large state subsidies. The ongoing investigation into these subsidies could ultimately result in higher tariffs on Chinese vehicles, which already face a 10% import charge by the EU.

The risk of Chinese car manufacturers taking over the German automotive market is more doomsaying than reality right now. But Chinese manufacturers could become a serious threat over the coming years, at least in the lower price segments.

*Audi, BMW, MAN, Mercedes, Mini, Opel, Porsche, Smart, VW

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more