Bank Pulse: ECB findings show banks should take more action on climate risk disclosures

European banks still have big steps to take before they live up to the European Central Bank’s supervisory expectations on climate-related and environmental risks disclosures. Bridging the gap will help banks readying for the comprehensive regulatory disclosure tasks at hand

It is no secret that the European Central Bank (ECB) sees climate change and environmental degradation as one of the main challenges the banking sector will face in the years to come. This has led the central bank to increasingly emphasise the importance for banks to effectively manage climate-related and environmental risks, and to become more transparent on these risks in their disclosures. Last week, the ECB concluded once again that banks still have some work cut out for them to bring their disclosures in line with the supervisory expectations.

The ECB’s guide on climate-related and environmental risks

The ECB’s guide on climate-related and environmental risks of November 2020 is a key element of the central bank’s ongoing supervisory dialogue with banks on climate risks. While the guide is not binding, it does describe how the ECB expects banks to consider climate-related and environmental risks within their business strategy, governance and risk management frameworks. It also explains how credit institutions should become more transparent via their climate-related and environmental disclosures. Moreover, the ECB does intent to ultimately integrate climate risks into its Supervisory Review and Evaluation Process (SREP).

The ECB’s supervisory expectations

The ECB’s guide covers 13 different supervisory expectations on how banks should address climate-related and environmental risks within their business model and strategy, governance and risk appetite, risk management and disclosures.

Business models and strategy

- 1. Business environment

- 2. Business strategy

Governance and risk appetite

- 3. Management

- 4. Risk appetite

- 5. Organisational structure

- 6. Reporting

Risk management

- 7. Risk management framework

- 8. Credit risk management

- 9. Operational risk management

- 10. Market risk management

- 11. Scenario analysis and stress testing

- 12. Liquidity risk management

Disclosures

- 13. Disclosure policies and procedures

More work to do to meet the supervisory expectations on climate risks

On 14 March 2022, the ECB published its second report on the climate-related and environmental risk disclosures of European banks. The report offers insight into the progress made by banks in terms of offering transparency on their climate-related and environmental risk profiles, since the first review of November 2020.

Identifying the gaps versus the ECB’s guide

The supervisory assessment of 14 March 2022 is based on the publicly available disclosures (eg annual reports, non-financial reports, sustainability reports and Pillar 3 reports for 2020) of 109 significant institutions (SIs) under European banking supervision. The main purpose is to identify key gaps in climate-related and environmental risk disclosures in light of the ECB’s climate-related and environmental risks guide. Meanwhile, the central bank also assessed the substantiation of disclosures (i.e the extent to which institutions report the methodologies, definitions and criteria underlying the disclosed figures), and tried to identify practices that could be affected by upcoming regulatory changes.

The report follows the ECB’s supervisory review on the state of climate and environmental risk management in the banking sector of November 2021. Based upon a self-assessment by 112 significant institutions, the ECB back then evaluated the steps taken by European banks to manage climate and environmental risks with reference to the ECB’s guide. While banks already made good progress, the ECB concluded European banks still had a long way to go to fully align their practices with the ECB’s supervisory expectations.

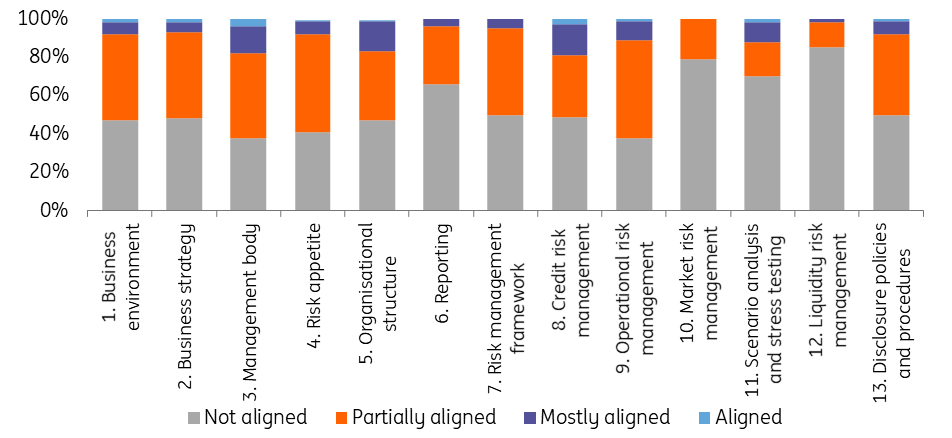

Institution's alignment with the 13 supervisory expectations of the ECB's guide

Banks are improving on the climate-related disclosures

In light of the outcome of last year’s supervisory review, it may not come as a surprise that the ECB also in its most recent report came to the conclusion that virtually none of the banks disclose all the basic information on climate-related and environmental risks in line with all of the ECB’s expectations. In fact, for 45% of the banks the ECB believes disclosures to be insufficient from both a content and substantiation perspective.

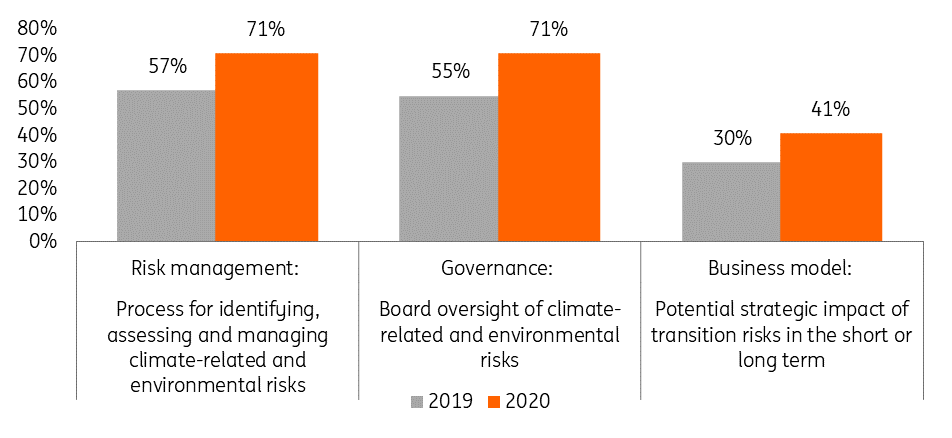

That said, the central bank did see some improvement in the disclosures. For instance, 71% of the credit institutions did describe the processes in place for identifying, assessing and managing climate-related and environmental risks. This compares with 57% in November 2020 when the ECB published its first report on climate-related and environmental disclosures for the year 2019. Also, 71% of the assessed banks now explain how their board oversees climate-related and environmental risks, compared to 55% in 2019. Besides, 41% of the banks do describe the impact of transition risk on their strategy, compared to 30% in 2019. This percentage is made up of banks that disclose the strategic impact of both physical risk and transition risk (31%) and banks that only disclose the impact of transition risk (10%). It excludes the 2% of banks that refer to physical risks alone.

The progress made by institutions on describing selected indicators in their public disclosures

Expectation 13 on disclosure policies and procedures

Transparency of climate-related and environmental risk disclosures

13. For the purpose of their regulatory disclosures, institutions are expected to publish meaningful information and key metrics on climate-related and environmental risks that they deem to be material, with due regard to the European Commission’s guidelines on non-financial reporting: Supplement on reporting climate-related information.

13.1 Institutions are expected to specify in their disclosure policies key considerations that inform their assessment of the materiality of climate-related and environmental risks, as well as the frequency and means of disclosures.

13.2 In case an institution deems climate-related risks to be immaterial, the institution is expected to document this judgement with the available qualitative and quantitative information underpinning its assessment.

13.3 When institutions disclose figures, metrics and targets as material, they are expected to disclose or reference the methodologies, definitions and criteria associated with them.

Content of climate-related and environmental risk disclosures

13.4 Institutions are expected to disclose climate-related risks that are material with due regard to the European Commission’s guidelines on non-financial reporting: Supplement on reporting climate-related information.

13.5 In particular, institutions are expected to disclose the institution’s financed Scope 3 GHG emissions* for the whole group.

13.6 Institutions are expected to disclose the key performance indicators (KPIs) and key risk indicators (KRIs) used for the purposes of their strategy-setting and risk management, as well as their current performance against these metrics.

Other environmental risk disclosures

13.7 Institutions are expected to evaluate any further environmental risk-related information needed to comprehensively convey their risk profile.

*Scope 3 emissions refer to the GHG emissions of the counterparties of the bank. The direct GHG emissions of financial institutions are scope 1 emissions, while the GHG emissions linked to their energy consumption are scope 2 emissions.

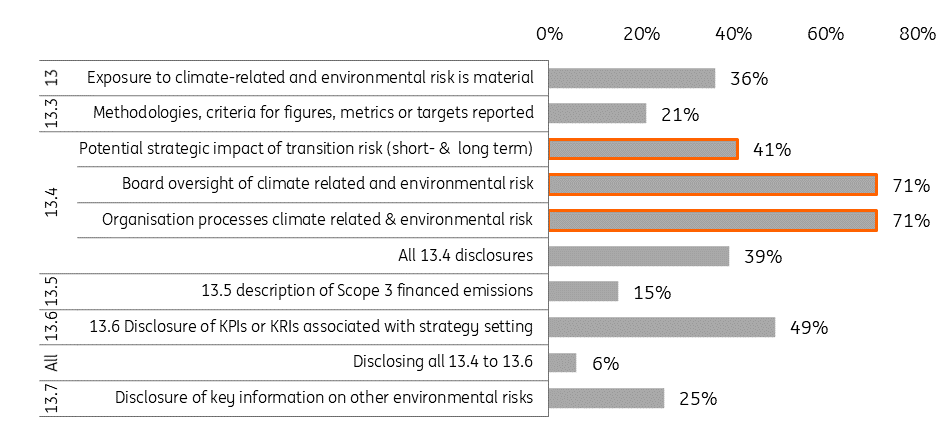

Alignment with ECB expectation 13 and related sub-expectations

Some gaps in light of future regulatory requirements

The ECB also found that only 15% of the banks disclose Scope 3 financed emissions, even though almost three-quarters of the banks provide information on Scope 1, 2 and 3 emissions. Stepping up on these disclosures will be crucial for banks, considering the fact that part of the banks (those with traded securities) are required to disclose Scope 3 financed emissions in light of the EBA ITS on Pillar 3 disclosures on ESG risk. The same holds when it comes to disclosures on the energy efficiency of real estate collateral, where the EBA ITS require banks to provide information on the collateral distribution by EPC label and energy consumption. The ECB concludes that 80% of the banks do not yet provide this type of information. Importantly, the ECB also found that little over 25% of the banks made some qualitative reference to the EU taxonomy in their disclosures, while only 7% provided quantitative information relating to the taxonomy.

Conclusion

The outcome of the ECB’s most recent review of the climate-related and environmental risks disclosures of European banks confirm that transparency on these risks will remain an important topic within the central bank’s supervisory dialogue with banks. Further aligning their disclosures with the ECB’s expectations should also help banks prepare for the far-reaching regulatory (Environmental, Social, and Governance) ESG disclosure requirements, while at the same time offering market participants better possibilities to analyse the banks’ ESG risks and efforts.

What more to expect from the ECB this year on climate risks

In December 2021, the ECB set a number of supervisory priorities for 2022-24, to ensure that 1. banks emerge from the pandemic healthy, 2. structural weaknesses are addressed via effective digitalisation strategies and enhanced governance, and 3. emerging risks are tackled, such as risks arising from climate change and environmental degradation.

For the purpose of the latter the ECB will, further to the assessment published on 14 March, also conduct a thematic review of the preparedness of banks to manage climate-related and environmental risks in combination with on-site inspections in 2022. On top of this, the ECB will perform a bottom-up climate stress test in the second quarter of 2022. The central bank aims to gradually integrate climate-related and environmental risks into its SREP, which could ultimately impact the Pillar 2 capital requirements of European banks. The findings of the upcoming thematic review and climate stress test will for instance already qualitatively inform this year’s SREP.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more